Samsung 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

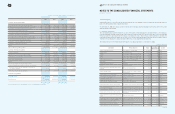

66 67 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. Others include amounts from changes in scope of consolidation and changes in foreign currency exchanges rates.

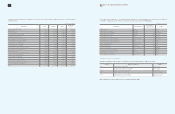

In accordance with the Asset Revaluation Law, on January 1, 1980, 1982, 1998 and April 1, 1999, SEC revalued a substantial portion of its

property, plant, equipment and investments in equity securities by

₩

3,051,612 million. The remaining revaluation increments amounting to

₩

1,208,872 million, net of revaluation tax, credits to deferred foreign currency translation losses and others, were credited to capital surplus,

a component of equity. Also, in accordance with the Asset Revaluation Law, on October 1, 2000, Samsung Gwangju Electronics, an SEC

subsidiary, revalued a portion of its property, plant and equipment by

₩

63,326 million. The remaining revaluation increments amounting to

₩

62,145 million, net of revaluation tax, were credited to capital surplus, a component of equity.

As of December 31, 2009 and 2008, a certain portion of overseas subsidiaries' property, plant and equipment amounting to

₩

5,518 million

equivalent to US$ 4,726 thousand and

₩

5,766 million equivalent to US$ 4,585 thousand, respectively is pledged as collaterals for various

loans from financial institutions.

Property, plant, equipment are insured against fire and other casualty losses, and business interruption losses of up to

₩

92,254,561 million

(2008:

₩

85,564,185 million) and

₩

22,234,148 million (2008:

₩

22,764,493 million), respectively as of December 31, 2009.

The value of land owned by the SEC and its domestic subsidiaries based on the posted price issued by the Korean tax authority amounted

to

₩

4,782,545 million (2008:

₩

4,675,376 million) as of December 31, 2009.

As of December 31, 2009 and 2008, Samsung Card, an SEC subsidiary, recorded

₩

449,226 million (2008:

₩

690,187 million) of operating

lease assets, cancellation lease assets and prepaid finance lease assets acquired through the lease financing business (Note 8).

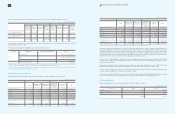

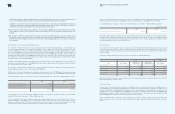

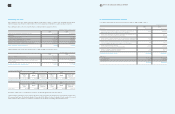

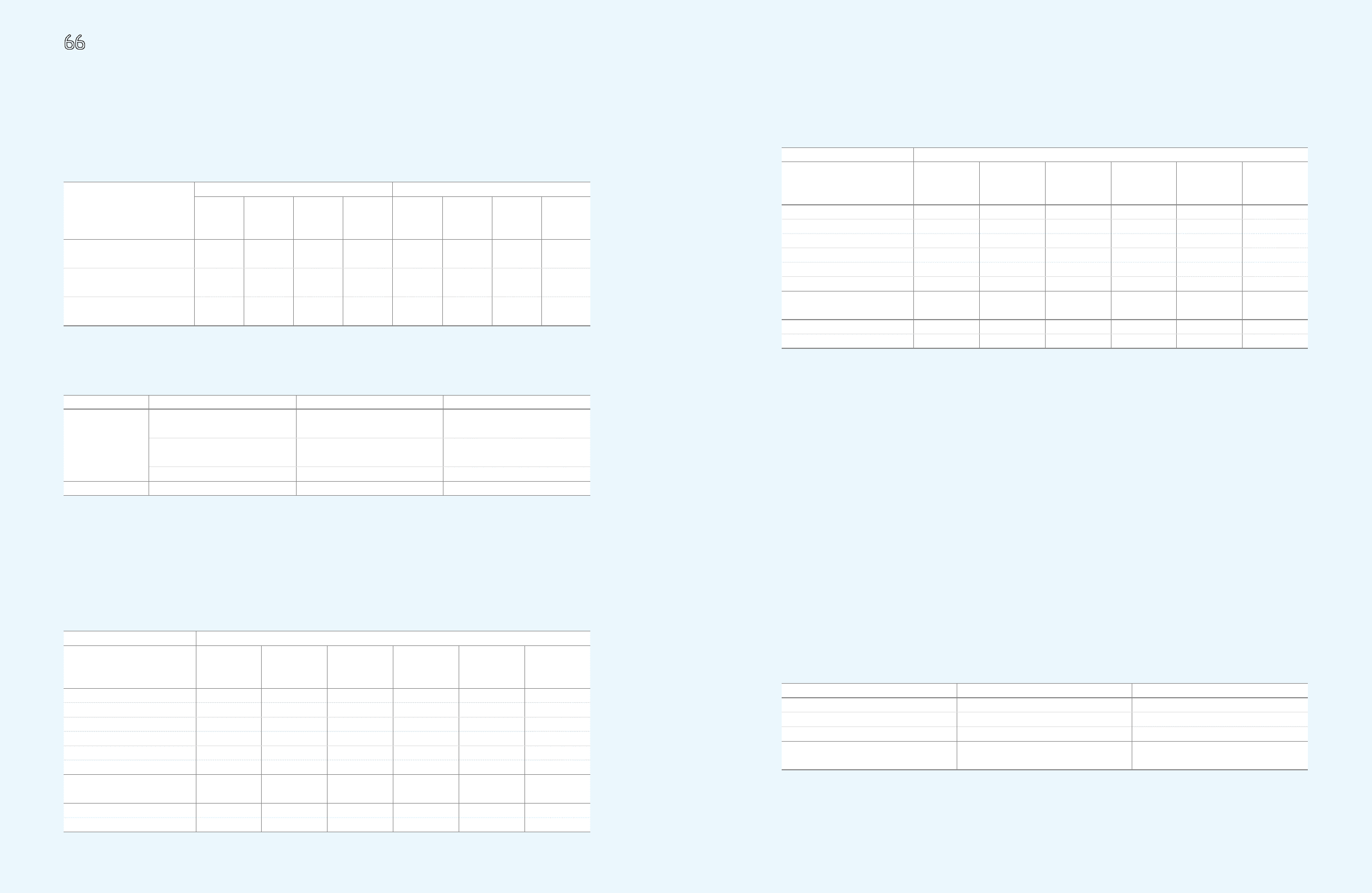

12. Intangible Assets

Changes in intangible assets for the years ended December 31, 2009 and 2008, are as follows:

Location 2009 2008

Goodwill

₩

67,402

₩

9,885

Intellectual property rights 453,573 405,848

Others 370,293 371,516

₩

891,268

₩

787,249

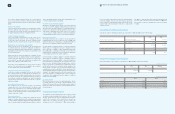

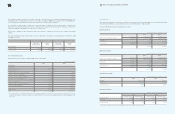

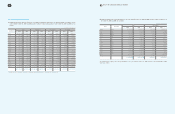

Share of equity-method investees’ other comprehensive income or loss as of December 31, 2009 and 2008, are as follows:

As of December 31, 2009, share of equity-method investees’ other comprehensive income and loss included the tax effect of

₩

73,920

million and

₩

615 million, respectively.

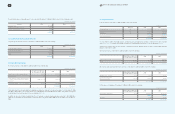

The Company has not applied the equity method of accounting on following investees:

1. Investments are excluded from the application of equity method of accounting because the Company does not have the ability to exercise significant

influence over the operating and financial policies, in accordance with the Monopoly Regulations and Fair Trade Law.

2. These investments are excluded from the application of equity-method of accounting because their total assets at the prior fiscal year end were less than

₩

10,000 million and movement in their net assets is immaterial.

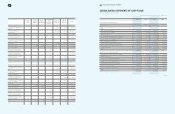

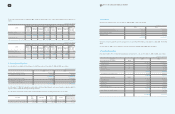

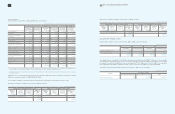

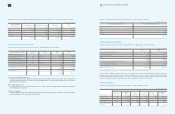

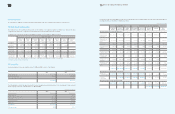

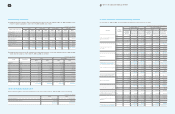

11. Property, Plant and Equipment

Changes in property, plant and equipment for the years ended December 31, 2009 and 2008, consist of the following:

(In millions of Korean won)

2009 2008

Balance at

January 1,

2009

Valuation

Amount

Included in

Earnings

Balance at

December

31, 2009

Balance at

January 1,

2008

Valuation

Amount

Included in

Earnings

Balance at

December

31, 2008

Share of equity-method investees’

other comprehensive income

₩

257,328

₩

104,588

₩

-

₩

361,916

₩

251,591

₩

5,737

₩

-

₩

257,328

Share of equity-method investees’

other comprehensive loss (13,441) 4,152 - (9,289) (8,017) (6,003) (579) (13,441)

₩

243,887

₩

108,740 -

₩

352,627

₩

243,574

₩

(266)

₩

(579)

₩

243,887

Location Subsidiaries Percentage of Ownership (%) Reason

Korea

Samsung Everland 1 25.6 Absence of significant influence

Allat 130.0 Absence of significant influence

International Cyber Marketing 245.0 Limited assets

Asia Future Technology & Service 228.6 Limited assets

(In millions of Korean won)

2009

Land Buildings and

Structures

Machinery and

Equipment

Construction-

In-Progress/

Machinery-In-

Transit

Tools and

Vehicles Total

Balance at January 1, 2009

₩

3,212,092

₩

9,031,893

₩

24,027,462

₩

5,035,038

₩

1,189,826

₩

42,496,311

Acquisition 15,147 161,443 582,713 6,985,199 437,695 8,182,197

Transfer 99,835 1,358,145 7,094,380 (8,697,452) 145,092 -

Disposal (7,164) (41,984) (176,696) - (63,677) (289,521)

Depreciation (745,727) (9,499,813) - (665,803) (10,911,343)

Others 1 (13,562) 102,615 276,466 1,283 (28,459) 338,343

Balance at December 31, 2009

₩

3,306,348

₩

9,866,385

₩

22,304,512

₩

3,324,068

₩

1,014,674

₩

39,815,987

Acquisition cost 3,306,348 13,950,997 71,886,165 3,324,068 3,828,623 96,296,201

Accumulated depreciation - (4,084,612) (49,581,653) - (2,813,949) (56,480,214)

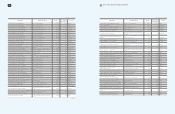

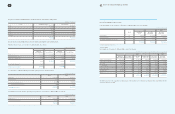

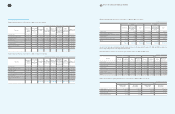

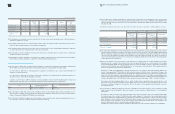

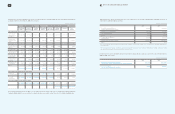

(In millions of Korean won)

(In millions of Korean won)

2008

Land Buildings and

Structures

Machinery and

Equipment

Construction-

In-Progress/

Machinery-In-

Transit

Tools and

Vehicles Total

Balance at January 1, 2008

₩

3,154,330

₩

7,800,158

₩

21,921,021

₩

3,354,428

₩

1,150,707

₩

37,380,644

Acquisition 22,094 265,853 1,062,701 12,269,006 455,975 14,075,629

Transfer 45,986 1,168,031 8,910,681 (10,297,439) 172,741 -

Disposal (58,705) (26,327) (95,609) - (65,249) (245,890)

Depreciation - (632,243) (8,616,476) - (606,810) (9,855,529)

Others 148,387 456,421 845,144 (290,957) 82,462 1,141,457

Balance at December 31, 2008

₩

3,212,092

₩

9,031,893

₩

24,027,462

₩

5,035,038

₩

1,189,826

₩

42,496,311

Acquisition cost 3,212,092 12,507,469 67,190,337 5,035,038 3,917,104 91,862,040

Accumulated depreciation - (3,475,576) (43,162,875) - (2,727,278) (49,365,729)