Samsung 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

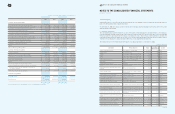

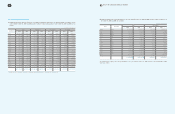

68 69 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

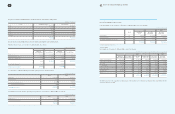

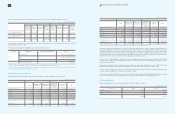

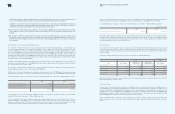

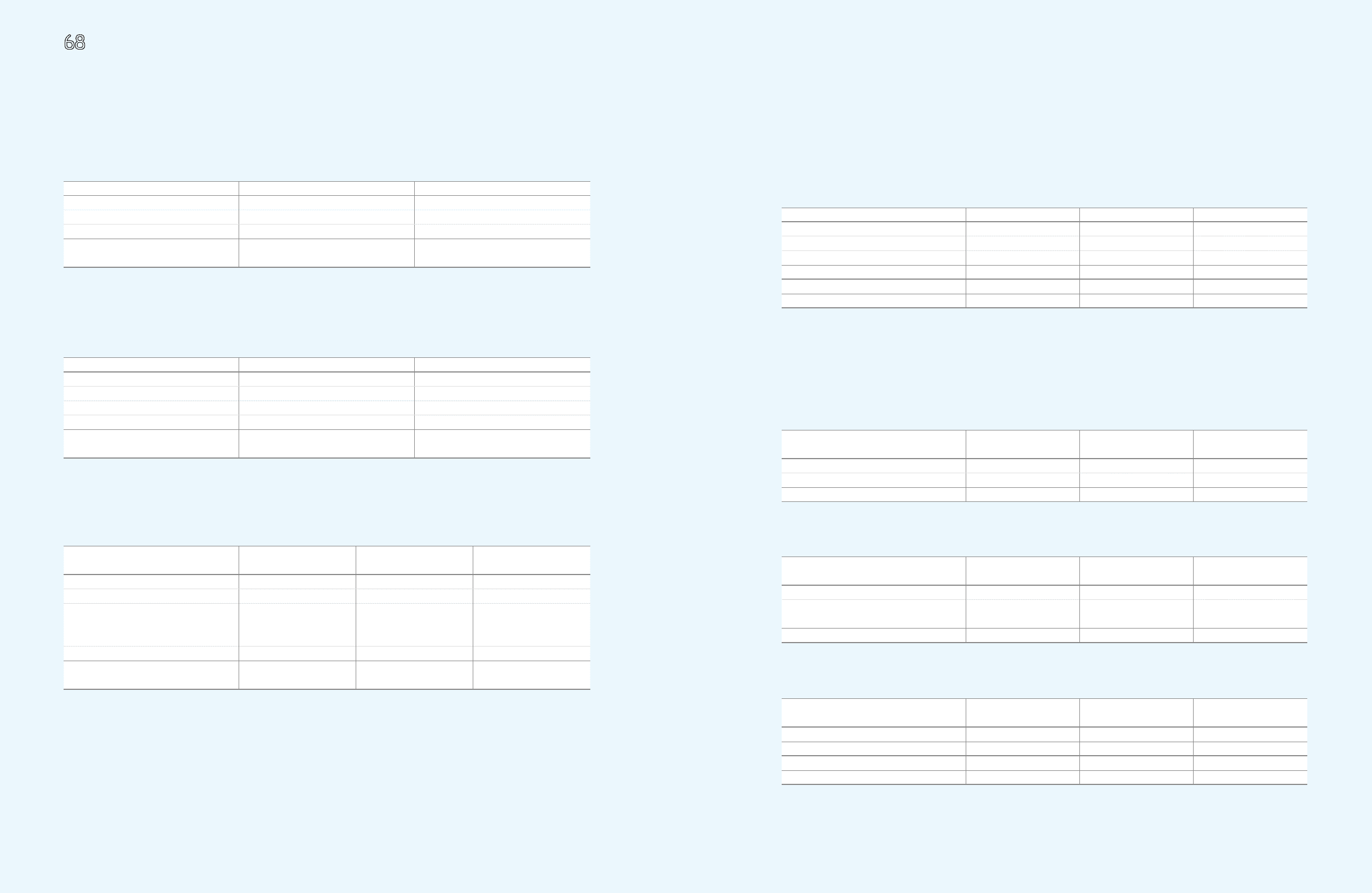

15. Long-Term Debts

Long-term debts as of December 31, 2009 and 2008 consist of the following:

As of December 31, 2009, certain bank deposits, and property, plant and equipment are pledged as collaterals for the above long-term

debts (Notes 4 and 11). In addition, SEC guarantees repayment of substantially all long-term debt of overseas subsidiaries (Note 19).

Included in the long-term debts are the borrowings of Samsung Card with an aggregate amount of

₩

867,119 million (2008:

₩

836,498

million) as of December 31, 2009.

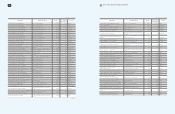

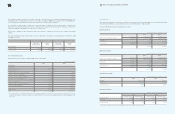

(A) Korean won loans as of December 31, 2009 and 2008, consist of the following:

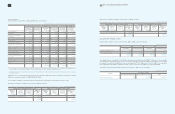

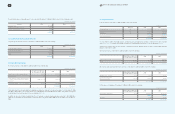

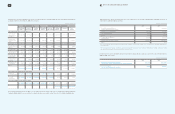

(B) Long-term debts denominated in foreign currencies as of December 31, 2009 and 2008, consist of the following:

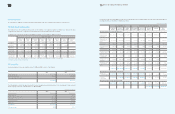

(C) Debentures outstanding as of December 31, 2009 and 2008, consist of the following:

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)

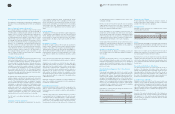

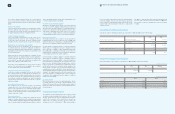

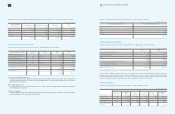

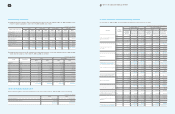

The amortization expense of intangible assets for the years ended December 31, 2009 and 2008, is allocated to the following accounts:

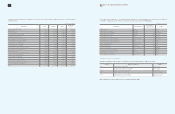

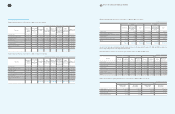

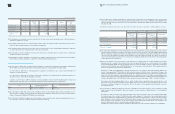

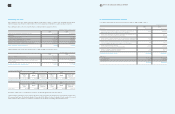

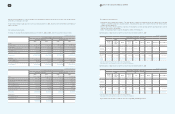

13. Long-Term Deposits and Other Assets

Long-term deposits and other assets as of December 31, 2009 and 2008, consist of the following:

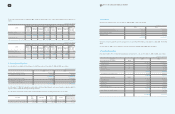

14. Short-Term Borrowings

Short-term borrowings as of December 31, 2009 and 2008 consist of the following:

Certain bank deposits and property, plant and equipment are pledged as collaterals for the above borrowings. As of December 31, 2009

and 2008 overdraft facilities of the Company amount to

₩

1,484,800 million and

₩

930,500 million. In addition, SEC guarantees repayment

of substantially all short-term borrowings of overseas subsidiaries (Note 19).

In addition, the above short-term borrowings include those of Samsung, a consumer financing subsidiary, amounting to

₩

586,000 million

(2008:

₩

1,779,762 million) and current maturities of long-term debts of

₩

2,894,277 million (2008:

₩

2,243,426 million) as of December 31,

2009.

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)

Account 2009 2008

Production costs

₩

43,113

₩

32,801

Selling and administrative expenses 124,003 123,661

Research and development expenses 80,987 83,200

₩

248,103

₩

239,662

2009 2008

Long-term guarantee deposits

₩

864,013

₩

895,245

Long-term trade receivables, net 92,980 27,600

Long-term prepaid expenses 2,440,595 368,875

Others 258,074 363,351

₩

3,655,662

₩

1,655,071

Annual Interest Rates (%)

as of December 31, 2009 2009 2008

General term loans from commercial banks 1.6~6.5

₩

578,500

₩

1,177,500

Notes discounted 3.1 90,000 674,762

Usance financing, including document against

acceptance loans incurred from intercompany

transactions

LIBOR + 1.2~1.7 3,534,129 3,065,346

Short-term borrowings of overseas subsidiaries 0.8~11.0 3,410,889 4,109,022

₩

7,613,518

₩

9,026,630

Reference 2009 2008

Korean won loans (A)

₩

932,132

₩

768,638

Foreign currency denominated loans (B) 1,132,941 1,346,158

Debentures (C) 4,398,174 5,916,532

6,463,247 8,031,328

Less: Current maturities (2,918,235) (2,257,371)

₩

3,545,012

₩

5,773,957

Annual Interest Rates (%)

as of December 31, 2009 2009 2008

Samsung Shinhan 4th Special Purpose Company -

₩

-

₩

97,002

Others 3.1~10.0 932,132 671,636

₩

932,132

₩

768,638

Annual Interest Rates (%)

as of December 31, 2009 2009 2008

Mitsubishi Tokyo and others 0.8~4.0 110,240 383,476

Foreign financial institutions

(Overseas subsidiaries) 0.9~15.0 1,022,701 962,682

₩

1,132,941

₩

1,346,158

Annual Interest Rates (%)

as of December 31, 2009 2009 2008

Non-guaranteed debentures 5.0~9.2

₩

4,400,000

₩

5,920,000

4,400,000 5,920,000

Discounts (1,826) (3,468)

₩

4,398,174

₩

5,916,532