Samsung 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

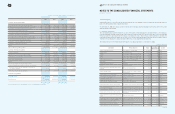

60 61 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

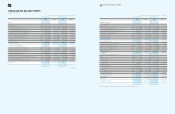

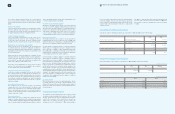

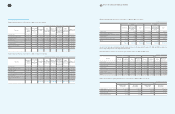

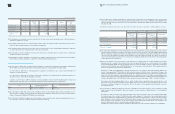

(1) Collection schedule of installment finance and general loans as of December 31, 2009, follows:

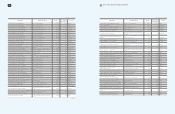

(2) Lease assets consist primarily of finance lease receivables and properties under operating leases.

Maturities of finance leases, as of December 31, 2009 and 2008, are as follows:

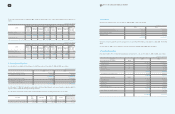

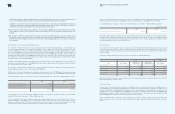

As of December 31, 2009 and 2008, properties under operating leases are classified as follows:

The minimum lease receipts relating to operating lease agreements as of December 31, 2009 and 2008, are as follows:

(In millions of Korean won)

Year Installment finance General loans

2010

₩

161,281

₩

175,470

2011 80,802 45,394

2012 54,458 33,637

2013 8,391 15,935

2014 3,690 4,717

Thereafter 176 617

₩

308,798

₩

275,770

(In millions of Korean won)

2009 2008

Minimum

Lease Payment Present Values Minimum

Lease Payment Present Values

Within one year

₩

129,454

₩

124,868

₩

29,973

₩

29,225

From one year to five years 191,725 163,656 438,904 385,848

Unguaranteed residual value 70,855 64,414 88,790 78,199

392,034

₩

352,938 557,667

₩

493,272

Present value adjustment (39,096) (64,395)

Finance lease receivables

₩

352,938

₩

493,272

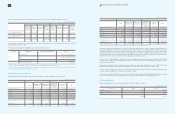

(In millions of Korean won)

2009 2008

Automobiles

₩

768,821

₩

993,712

Electronic system 3,997 6,410

772,818 1,000,122

Less: Accumulated depreciation 324,430 315,471

Accumulated impairment losses 2,852 2,641

Operating lease assets

₩

445,536

₩

682,010

(In millions of Korean won)

2009 2008

Within one year

₩

168,731

₩

242,325

From one year to five years 68,973 212,272

₩

237,704

₩

454,597

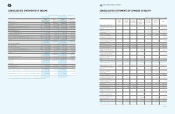

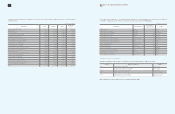

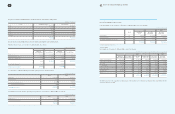

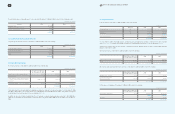

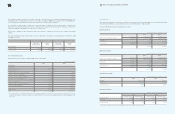

9. Long-Term Available-For-Sale Securities and Long-Term Held-To-Maturity Securities

(1) Long-Term Available-For-Sale Securities

Long-term available-for-sale securities as of December 31, 2009 and 2008, consist of the following:

1. Exclude equity-method investees.

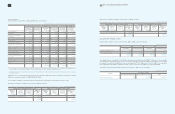

1) Listed equities

Listed equities as of December 31, 2009 and 2008, consist of the following:

The differences between the acquisition cost and fair value of the investment is recorded under accumulated other comprehensive income,

a separate component of equity.

(In millions of Korean won)

Detail

2009 2008

Acquisition

Cost

Recorded

Book Value

Recorded

Book Value

Listed equities 1(1)

₩

593,639

₩

2,234,339

₩

1,935,163

Non-listed equities 1(2) 411,661 644,468 679,602

Government and public bonds and others 31,706 31,706 3,497

₩

1,037,006

₩

2,910,513

₩

2,618,262

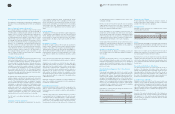

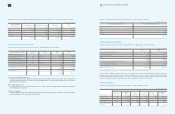

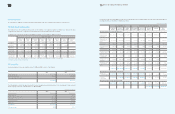

(In millions of Korean won, except for the number of shares and percentage)

2009 2008

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition

Cost

Market Value

of Investee

Recorded

Book Value

Recorded

Book Value

Samsung Heavy Industries 40,675,641 17.6

₩

258,299

₩

984,350

₩

984,350

₩

919,269

Samsung Fine Chemicals 2,969,730 11.5 61,374 139,726 139,726 114,186

Hotel Shilla 2,529,580 6.4 18,604 52,109 52,109 32,505

Cheil Worldwide 259,949 5.7 25,737 81,884 81,884 50,690

Samsung Fire & Marine Insurance 2,298,377 4.9 90,443 458,526 458,526 433,244

Samsung Securities 3,143,194 4.7 57,347 198,650 198,650 194,878

Cheil Industries 2,449,713 4.9 18,339 138,409 138,409 98,478

Others 63,496 180,685 180,685 91,913

₩

593,639

₩

2,234,339

₩

2,234,339

₩

1,935,163