Samsung 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

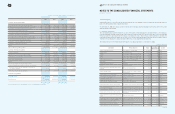

62 63 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

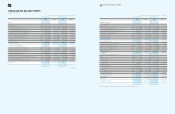

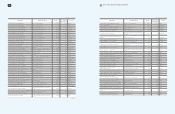

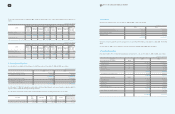

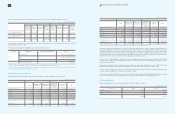

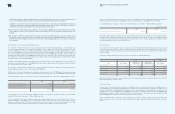

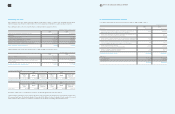

2) Non-listed equities

Non-listed equities as of December 31, 2009 and 2008, consist of the following:

1. As of December 31, 2009, these investments in affiliated companies were not valued using the equity method of accounting due to immateriality of their

total asset balances or the Company's inability to exercise significant influence over the operating and financial policies.

2. The differences between the acquisition cost and fair value of the investment is recorded under accumulated other comprehensive income, a separate

component of equity.

Impairment losses on cost-method investments resulting from the decline in realizable value below the acquisition cost amounted to

₩

3,040

million for the year ended December 31, 2009 (2008:

₩

2,885 million).

As of December 31, 2009, the Company’s investments in Pusan Newport are pledged as collateral against the investee's debt.

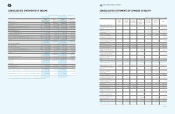

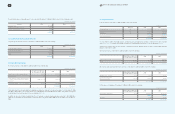

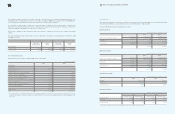

Gain and loss on valuation of available-for-sale securities for 2009 are as follows:

(In millions of Korean won, except for the number of shares and percentage)

2009 2008

Number of

Shares Owned

Percentage of

Ownership (%)

Acquisition

Cost

Net Book Value

of Investee

Recorded

Book Value

Recorded

Book Value

Allat Corporation 1 300,000 30.0

₩

1,500

₩

4,924

₩

5,173

₩

5,427

iMarketKorea 380,000 14.1 1,900 11,825 1,900 1,900

Kihyup Technology Banking

Corporation 1,000,000 17.2 5,000 6,612 5,000 5,000

Korea Digital Satellite Broadcasting 240,000 0.7 3,344 738 3,000 3,000

Pusan Newport 1,135,307 1.0 5,677 4,181 5,677 5,677

Renault Samsung Motors 2 17,512,000 19.9 87,560 147,714 147,714 119,432

Samsung Electronics Football

Club 1 400,000 100.0 2,000 1,990 2,000 2,000

Samsung Everland 1 641,123 25.6 64,112 547,405 256,452 256,452

Samsung General Chemicals 1,914,251 3.9 19,143 39,918 13,864 13,864

Samsung Life Insurance 131,588 0.7 92,112 47,194 92,112 92,112

Samsung Petrochemical 514,172 13.0 8,040 27,332 8,040 8,040

Samsung Venture Investment

Corporation 980,000 16.3 4,900 7,274 4,900 4,900

TU Media 3,015,195 5.6 15,076 1,496 15,076 15,076

Yong Pyong Resort 400,000 1.1 1,869 2,931 1,869 1,869

Others 99,428 62,751 81,691 144,853

₩

411,661

₩

914,285

₩

644,468

₩

679,602

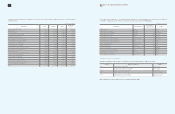

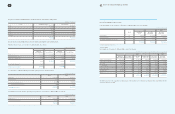

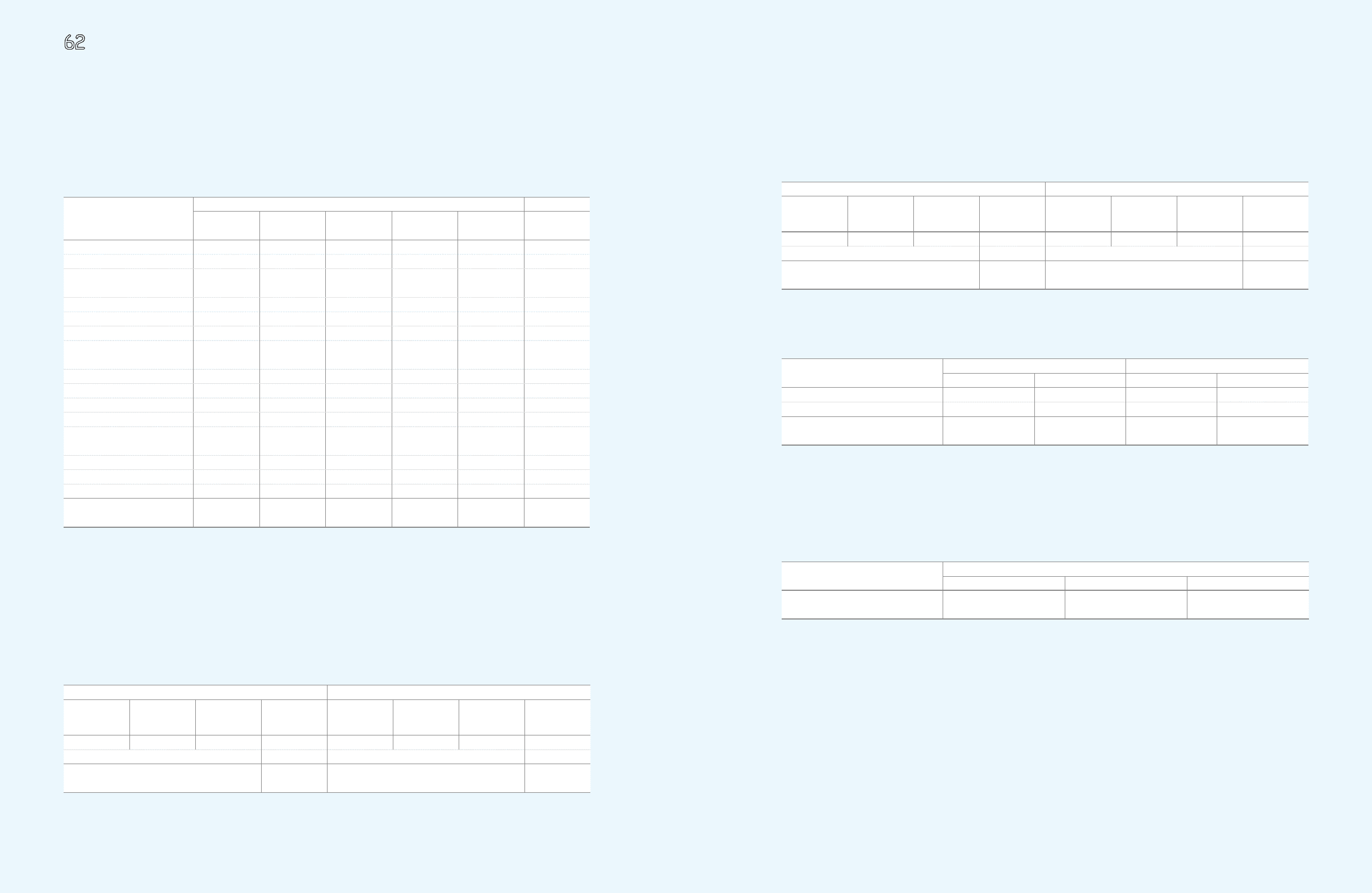

(In millions of Korean won)

Valuation Gain on Available-For-Sale Securities Valuation Loss on Available-For-Sale Securities

Balance at

January 1,

2009

Valuation

Amount

Included in

Earnings

Balance at

December 31,

2009

Balance at

January 1,

2009

Valuation

Amount

Included in

Earnings

Balance at

December 31,

2009

₩

1,441,907

₩

376,869

₩

33,006

₩

1,785,770

₩

(2,264)

₩

819

₩

(2)

₩

(1,443)

Deferred income tax and Minority interest (797,964) 942

₩

987,806

₩

(501)

Gain and loss on evaluation of available-for-sale securities for 2008 are as follows:

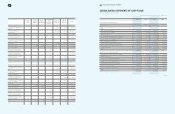

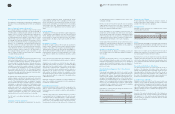

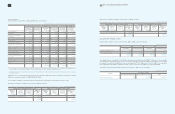

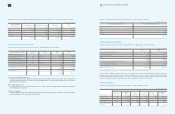

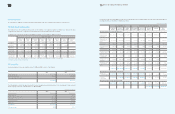

(2) Long-Term Held-To-Maturity Securities

Long-term held-to-maturity securities as of December 31, 2009 and 2008, consist of the following:

The subordinate bonds of SangRokSoo 1st Securitization Specialty were previously impaired by

₩

408,121 million prior to fiscal year 2009.

The realizable value subsequently dropped and a loss of

₩

2,083 million was recognized in 2009. The subordinate bonds of Badbank

Heemangmoah Securitization Specialty were also previously impaired by

₩

14,217 million prior to fiscal year 2009. As the subordinate

bonds of Badbank Heemang Moah Securitization Specialty recovered, a gain of

₩

11,424 million was recognized during 2009.

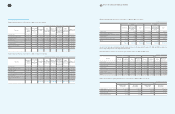

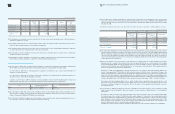

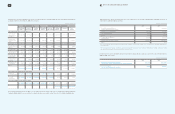

The maturities of long-term held-to-maturity securities as of December 31, 2009, consist of the following:

(In millions of Korean won)

Valuation Gain on Available-For-Sale Securities Valuation Loss on Available-For-Sale Securities

Balance at

January 1,

2008

Valuation

Amount

Included in

Earnings

Balance at

December 31,

2008

Balance at

January 1,

2008

Valuation

Amount

Included in

Earnings

Balance at

December 31,

2008

₩

2,519,181

₩

(1,077,274)

₩

-

₩

1,441,907

₩

(1,665)

₩

(599)

₩

-

₩

(2,264)

Deferred income tax and Minority interest (598,550) 542

₩

843,357

₩

(1,722)

(In millions of Korean won)

2009 2008

Face Value Recorded Book Value Face Value Recorded Book Value

Government and public bonds

₩

61

₩

61

₩

97

₩

97

ABS subordinated securities 727,868 314,872 756,701 334,363

₩

727,929

₩

314,933

₩

756,798

₩

334,460

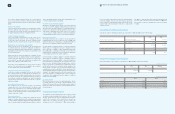

(In millions of Korean won)

Maturity Recorded book value

Government and public bonds ABS subordinated securities Total

From one year to five years

₩

61

₩

314,872

₩

314,933