Samsung 2009 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

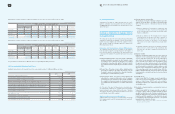

78 79 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

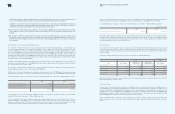

25. Treasury Stock

As of December 31, 2009, the Company holds 19,027,950 common shares and 2,979,693 preferred shares as treasury stocks.

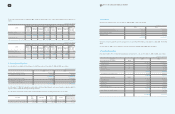

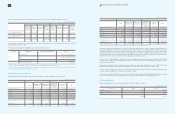

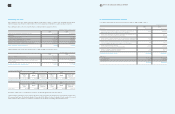

26. Stock-Based Compensation

The Company has a stock option plan that provides for the granting of stock purchase options to employees or directors who have

contributed or are expected to contribute to the management and technological innovation of the Company.

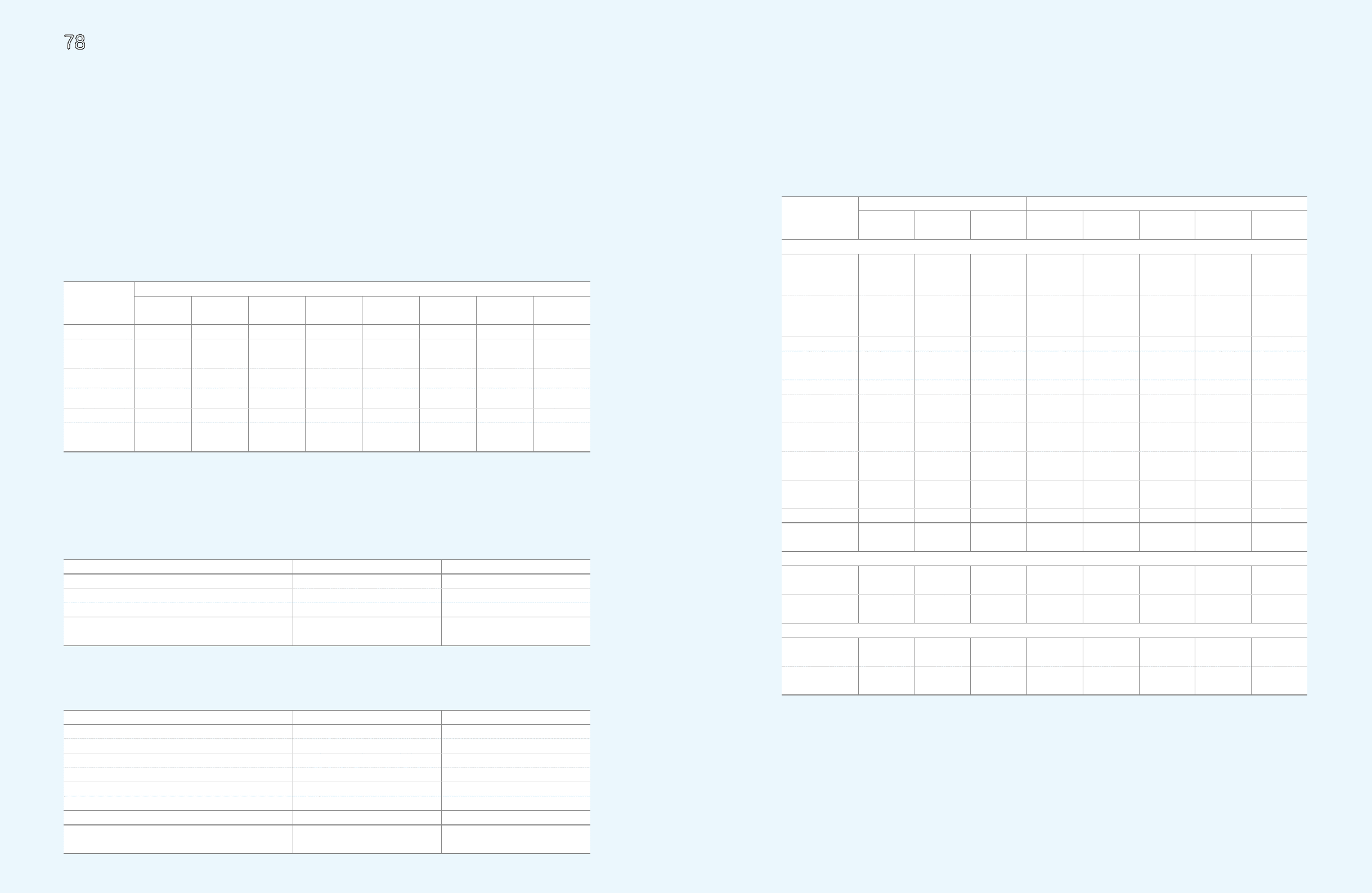

A summary of the terms and the number of outstanding stock options as of December 31, 2009 is as follows:

1. The exercise price can be adjusted in the case of the issuance of new shares, stock dividends, stock splits, or stock mergers.

2. All options currently in issue are fully vested.

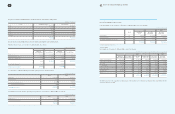

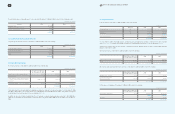

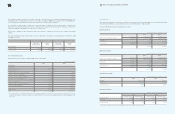

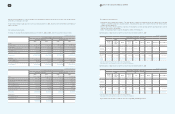

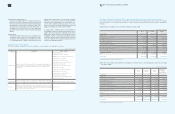

27. Income Tax

Income tax expense for the years ended December 31, 2009 and 2008, consists of the following:

The following table reconciles the expected amount of income tax expense based on statutory rates to the actual amount of taxes recorded

by the Company for the years ended December 31, 2009 and 2008:

Date of the Grant

March 16,

2000

March 9,

2001

February 28,

2002

March 25,

2002

March 7,

2003

April 16,

2004

October 15,

2004

December 20,

2005

Total grants 1,500,000 3,099,500 988,000 121,000 368,100 590,000 10,000 10,000

Forfeitures and

exercises

prior to 2009

128,540

849,745

393,768

1,779,917

53,859

508,384

12,942

51,168

37,744

164,914

53,061

12,068

-

10,000

-

-

Exercised

during 2009 467,208 476,406 150,253 24,036 56,607 60,969 - -

Outstanding

stock options 54,507 449,409 275,504 32,854 108,835 463,902 - 10,000

Exercise price 1272,700 197,100 329,200 342,800 288,800 580,300 460,500 606,700

Exercise period

from the date

of the grant 2

2003.3.17~

2010.3.16

2004.3.10~

2011.3.9

2004.3.1~

2012.2.29

2004.3.26~

2012.3.25

2005.3.8~

2013.3.7

2006.4.17~

2014.4.16

2006.10.16~

2008.10.15

2007.12.21~

2015.12.20

2009 2008

Current income taxes

₩

2,070,999

₩

1,198,146

Deferred income taxes 261,136 (507,963)

Items charged directly to equity 2,994 (2,622)

₩

2,335,129

₩

687,561

2009 2008

Income before tax

₩

12,565,050

₩

6,577,775

Statutory tax rate 31.7% 32.9%

Expected taxes at statutory rate 3,982,749 2,161,473

Tax credit (801,854) (1,084,311)

Changes in tax rates (67,790) (34,444)

Others, net (777,976) (355,157)

Actual taxes

₩

2,335,129

₩

687,561

Effective tax rate 18.6% 10.5%

(In millions of Korean won)

(In millions of Korean won)

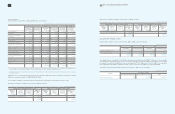

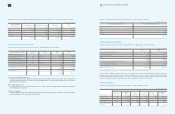

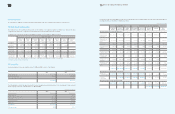

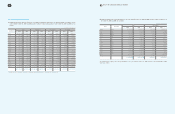

Deferred income tax assets and liabilities from tax effect of temporary differences including available tax credit carryforwards and undisposed

accumulated deficit as of December 31, 2009, are as follows:

(In millions of Korea won)

Temporary Differences Deferred Income Tax Asset (Liabilities)

Beginning

Balance

Increase

(Decrease)

Ending

Balance

Beginning

Balance

Increase

(Decrease)

Ending

Balance Current Non-

Current

Deferred tax arising from temporary differences

Special reserves

appropriated for

tax purposes

₩ (

1,282,294)

₩

637,483

₩

(644,811)

₩

(296,129)

₩

140,085

₩

(156,044)

₩

(156,044)

₩

-

Equity-method

investments and

others

(5,222,534) (3,809,948) (9,032,482) (596,130) (350,286) (946,416) - (946,416)

Depreciation (58,463) 32,049 (26,414) (54,503) 1,004 (53,499) 22,373 (75,872)

Capitalized interest

Expense (44,027) 2,365 (41,662) (9,685) (699) (10,384) (682) (9,702)

Accrued income (223,605) 184,037 (39,568) (54,064) 44,488 (9,576) (9,576) -

Allowance(technical

expense, others) 3,326,258 552,867 3,879,125 846,053 123,636 969,689 161,835 807,854

Deferred foreign

exchange gains 28,402 (27,195) 1,207 7,520 (7,011) 509 (1,519) 2,028

Foreign currency

translation 486,833 (361,269) 125,564 115,933 (86,868) 29,065 29,065 -

Impairment losses

on investments 516,958 (45,036) 471,922 113,823 (373) 113,450 105,882 7,568

Others 1,850,816 710,125 2,560,941 522,253 190,382 712,635 638,739 73,896

₩

(621,656)

₩

(2,124,522)

₩

(2,746,178)

₩

595,071

₩

54,358

₩

649,429

₩

790,073

₩

(140,644)

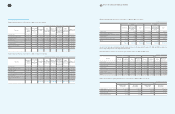

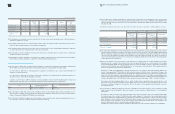

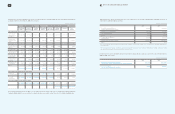

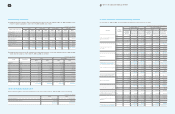

Deferred tax assets arising from the carryforwards

Undisposed

accumulated deficit

₩

2,453,416

₩

(899,119)

₩

1,554,297

₩

178,951

₩

(139,040) 39,911 20,003 19,908

Tax credit

carryforwards

₩

1,342,115

₩

168,034

₩

1,510,149

₩

933,544

₩

122,990 1,056,534 1,005,604 50,930

Deferred tax relating to items charged to equity

₩

(5,177,894)

₩

374,515

₩

(4,803,379)

₩

(682,172)

₩

42,261 (639,911) (179,467) (460,444)

₩

1,105,963

₩

1,636,213

₩

(530,250)