Samsung 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 57 NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

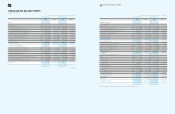

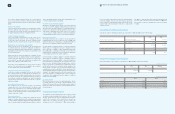

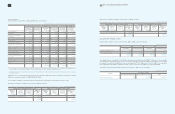

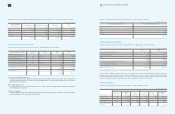

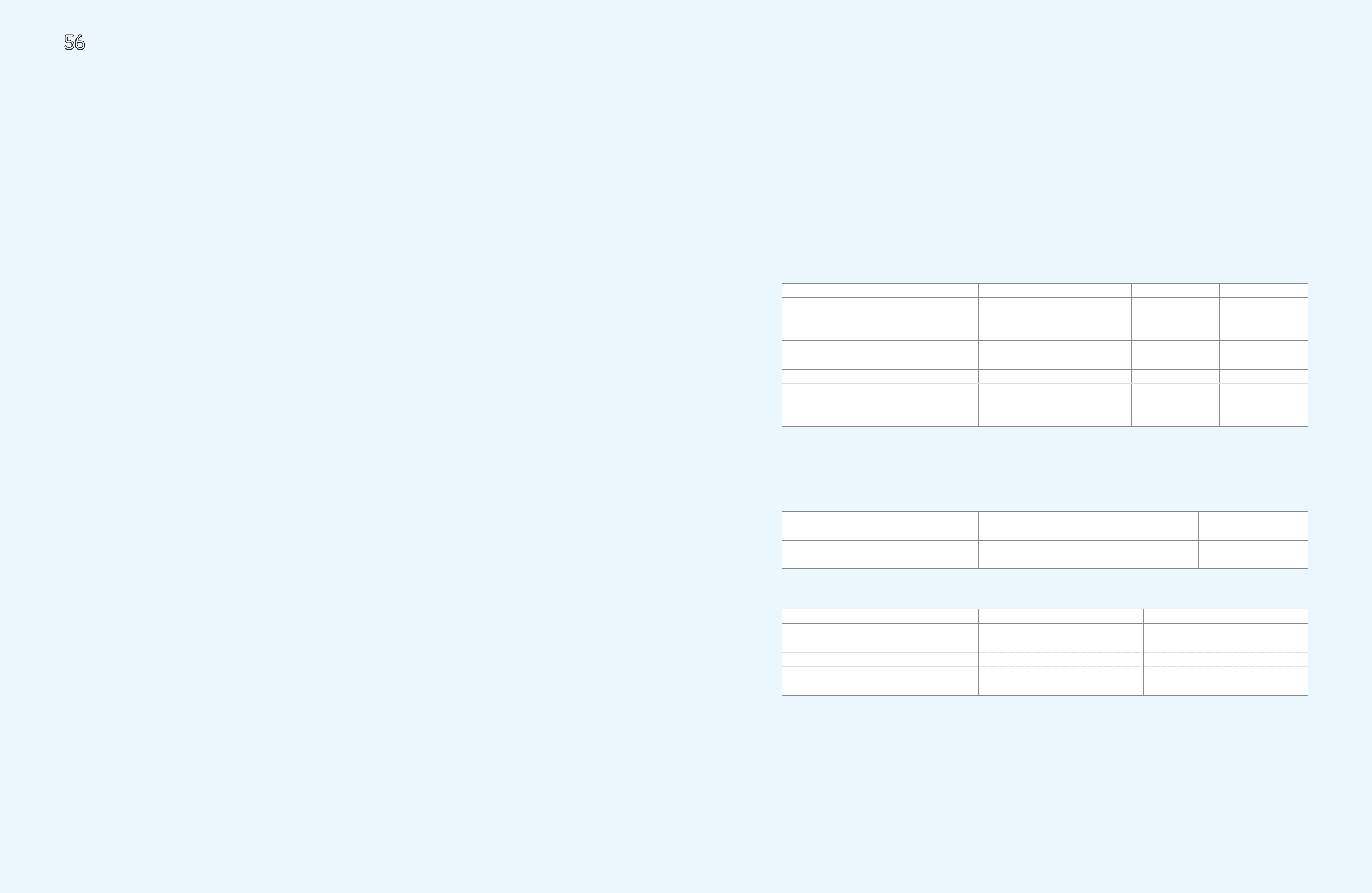

4. Cash Subject to Withdrawal Restrictions

Cash deposits subject to withdrawal restrictions as of December 31, 2009 and 2008, consist of the following:

5. Short-Term Available-For-Sale Securities

Short-term available-for-sale securities as of December 31, 2009 and 2008, consist of the following:

1. Beneficiary certificates as of December 31, 2009 and 2008, consist of the following

(In millions of Korean won)

2009 2008

Short-term financial instruments Government-sponsored

research and development projects

₩

54,336

₩

24,505

Other activities 15,731 36,228

₩

70,067

₩

60,733

Long-term deposits and other assets Special deposits

₩

51

₩

60

Other activities 8 9

₩

59

₩

69

(In millions of Korean won)

2009 2008 Maturity

Beneficiary certificates 1

₩

2,104,420

₩

982,067 Within 1 year

₩

2,104,420

₩

982,067

(In millions of Korean won)

2009 2008

Call loan

₩

8,670

₩

157

Certificates of deposit 118,689 231,561

Bonds 1,569,532 622,911

Time deposits 390,738 127,307

Others 16,791 131

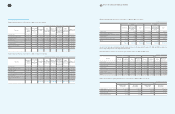

In accordance with the National Pension Act, a certain portion

of the accrued severance benefits is deposited with the National

Pension Fund and deducted from the accrued severance benefits

liability.

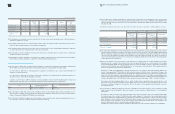

Revenue Recognition

Sales of products and merchandise are recognized upon delivery

when the significant risks and rewards of ownership of goods

are transferred to the buyer. Revenue from rendering services is

recognized using the percentage-of-completion method.

Foreign Currency Translation

Assets and liabilities denominated in foreign currencies are

translated into Korean won at the rate of exchange in effect as

of the balance sheet date. Gains and losses resulting from the

translation are reflected as either income or expense for the period.

Deferred Income Tax Assets and Liabilities

Deferred income tax assets and liabilities are recognized based

on estimated future tax consequences attributable to differences

between the financial statement carrying amounts of existing assets

and liabilities and their respective tax bases, and operating loss and

tax credit carryforwards.

Deferred income tax assets and liabilities are computed on such

temporary differences by applying statutory tax rates applicable to

the years when such differences are expected to be reversed. Tax

assets related to tax credits and exemptions are recognized to the

extent of the Company’s certain taxable income.

The balance sheet distinguishes the current and non-current

portions of the deferred tax assets and liabilities, whose balances

are offset against each other by tax jurisdiction.

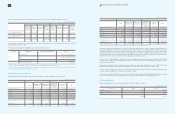

Long-Term Receivables and Payables

Long-term receivables and payables that have no stated interest

rate or whose interest rate are different from the market rate are

recorded at their present values using the market rate of discount.

The difference between the nominal value and present value of

the long-term receivables and payables are amortized using the

effective interest rate method with interest income or expense

adjusted accordingly.

Stock-Based Compensation

The Company uses the fair-value method in determining

compensation costs of stock options granted to its employees and

directors. The compensation cost is estimated using the Black-

Scholes option-pricing model and is accrued and charged to

expense over the vesting period, with a corresponding increase in a

separate component of equity.

Earnings Per Share

Basic earnings per share is calculated by dividing net income

available to common shareholders by the weighted-average number

of common shares outstanding during the year. Diluted earnings per

share is calculated using the weighted-average number of common

shares outstanding adjusted to include the potentially dilutive effect

of common equivalent shares outstanding.

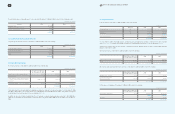

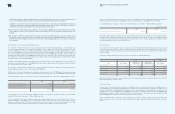

Provisions and Contingent Liabilities

When there is a probability that an outflow of economic benefits will

occur due to a present obligation resulting from a past event, and

whose amount is reasonably estimable, a corresponding amount of

provision is recognized in the financial statements. However, when

such outflow is dependent upon a future event, is not certain to

occur, or cannot be reliably estimated, a disclosure regarding the

contingent liability is made in the notes to the financial statements.

Derivative Instruments

All derivative instruments are accounted for at fair value with the

resulting valuation gain or loss recorded as an asset or liability. If the

derivative instrument is not designated as a hedging instrument, the

gain or loss is recognized in earnings in the period of change.

Fair value hedge accounting is applied to a derivative instrument

with the purpose of hedging the exposure to changes in the fair

value of an asset or a liability or a firm commitment (hedged item)

that is attributable to a particular risk. The gain or loss, both on the

hedging derivative instrument and on the hedged item attributable

to the hedged risk, is reflected in current operations.

Cash flow hedge accounting is applied to a derivative instrument

with the purpose of hedging the exposure to variability in expected

future cash flows of an asset or a liability or a forecasted transaction

that is attributable to a particular risk. The effective portion of the

gain or loss on a derivative instrument designated as a cash flow

hedge is recorded as a accumulated other comprehensive income

and the ineffective portion is recorded in current operations. The

effective portion of the gain or loss recorded as accumulated other

comprehensive income is reclassified to current operations in the

same period during which the hedged forecasted transaction affects

earnings. If the hedged transaction results in the acquisition of an

asset or the incurrence of a liability, the gain or loss recognized as

accumulated other comprehensive income is added to or deducted

from the asset or the liability.

Asset Impairment

When the book value of an asset is significantly greater than its

recoverable value due to obsolescence, physical damage, or the

decline in the fair value of the asset, the decline in value is deducted

from the book value and recognized as an asset impairment loss in

the current period.

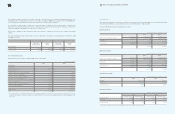

3. United States Dollar Amounts

The Company operates primarily in Korean won and its official

accounting records are maintained in Korean won. The U.S. dollar

amounts, provided herein, represent supplementary information

solely for the convenience of the reader. All won amounts are

expressed in U.S. dollars at the rate of ₩1,167 to US$1, the

exchange rate in effect on December 31, 2009. Such presentation

is not in accordance with generally accepted accounting principles

in either the Republic of Korea or the United States, and should

not be construed as a representation that the won amounts shown

could be readily converted, realized or settled in U.S. dollars at this

or at any other rate.

The 2008 U.S. dollar amounts, which were previously expressed at

₩1,257 to US$1, the rate in effect on December 31, 2008, have

been restated to reflect the exchange rate in effect on December

31, 2009.