Royal Caribbean Cruise Lines 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98 Royal Caribbean Cruises Ltd.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

If (i) any person other than A. Wilhelmsen AS and

Cruise Associates and their respective affiliates (the

“Applicable Group”) acquires ownership of more than

33% of our common stock and the Applicable Group

owns less of our common stock than such person, or

(ii) subject to certain exceptions, during any 24-month

period, a majority of the Board is no longer comprised

of individuals who were members of the Board on the

first day of such period, we may be obligated to pre-

pay indebtedness outstanding under the majority of

our credit facilities, which we may be unable to replace

on similar terms. Certain of our outstanding debt

securities also contain change of control provisions

that would be triggered by the acquisition of greater

than 50% of our common stock by a person other

than a member of the Applicable Group coupled with

a ratings downgrade. If this were to occur, it would

have an adverse impact on our liquidity and operations.

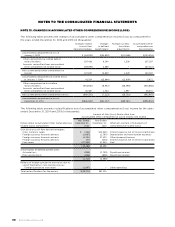

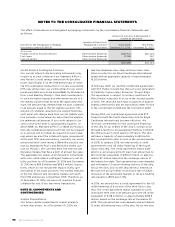

At December 31, 2014, we have future commitments

to pay for our usage of certain port facilities, marine

consumables, services and maintenance contracts as

follows (in thousands):

Year

Thereafter

NOTE 16. RESTRUCTURING AND RELATED

IMPAIRMENT CHARGES

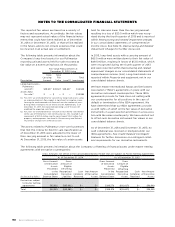

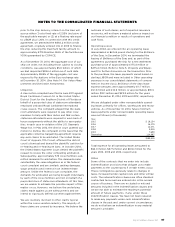

For the years ended December 31, 2014 and Decem-

ber 31, 2013, we incurred the following restructuring

and related impairment charges in connection with

our profitability initiatives (in thousands):

Restructuring exit costs

Impairment charges —

Restructuring and related

impairment charges

The following are the profitability initiatives:

Consolidation of Global Sales, Marketing, General

and Administrative Structure

One of our profitability initiatives relates to restructur-

ing and consolidation of our global sales, marketing

and general and administrative structure. Activities

related to this initiative include the consolidation of

most of our call centers located outside of the United

States and the establishment of brand dedicated

sales, marketing and revenue management teams in

key priority markets. This resulted in the elimination

of approximately 500 shore-side positions in 2013,

primarily from our international markets, resulting

in recognition of a liability for one-time termination

benefits during the year ended December 31, 2013.

Additionally, we incurred contract termination costs

and other related costs consisting of legal and con-

sulting fees to implement this initiative.

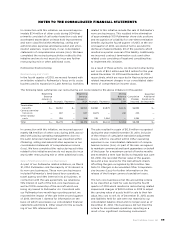

As a result of these actions, we incurred restructuring

exit costs of $1.1 million and $18.2 million for the years

ended December 31, 2014 and December 31, 2013,

respectively, which are reported in Restructuring and

related impairment charges in our consolidated state-

ments of comprehensive income (loss). The costs

incurred in 2014 are mainly related to discretionary

bonus payments paid to persons whose positions

were eliminated as part of our restructuring activities.

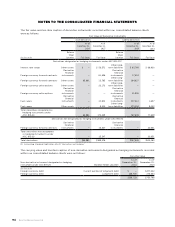

The following table summarizes our restructuring exit costs related to the above initiative (in thousands):

Beginning

Balance

January

Accruals Payments

Beginning

Balance

January

Accruals Payments

Ending

Balance

December

Cumulative

Charges

Incurred

Expected

Additional

Expensesto

beIncurred

Termination

benefits — —

Contract termina-

tion costs — () — —

Other related costs — —

Total — —