Royal Caribbean Cruise Lines 2014 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 73

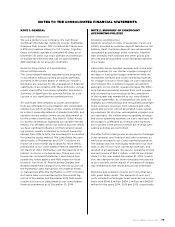

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. GENERAL

Description of Business

We are a global cruise company. We own Royal

Caribbean International, Celebrity Cruises, Pullmantur,

Azamara Club Cruises, CDF Croisières de France and

a 50% joint venture interest in TUI Cruises. Together,

these six brands operate a combined 43 ships as of

December 31, 2014. Our ships operate on a selection

of worldwide itineraries that call on approximately

480 destinations on all seven continents.

Basis for Preparation of Consolidated

Financial Statements

The consolidated financial statements are prepared

in accordance with accounting principles generally

accepted in the United States of America (“GAAP”).

Estimates are required for the preparation of financial

statements in accordance with these principles. Actual

results could differ from these estimates. See Note 2.

Summary of Significant Accounting Policies for a dis-

cussion of our significant accounting policies.

All significant intercompany accounts and transac-

tions are eliminated in consolidation. We consolidate

entities over which we have control, usually evidenced

by a direct ownership interest of greater than 50%, and

variable interest entities where we are determined to

be the primary beneficiary. See Note 6. Other Assets

for further information regarding our variable interest

entities. For affiliates we do not control but over which

we have significant influence on financial and operat-

ing policies, usually evidenced by a direct ownership

interest from 20% to 50%, the investment is accounted

for using the equity method. We consolidate the oper-

ating results of Pullmantur and CDF Croisières de

France on a two-month lag to allow for more timely

preparation of our consolidated financial statements.

On March 31, 2014, Pullmantur sold the majority of its

interest in its non-core businesses. These non-core

businesses included Pullmantur’s land-based tour

operations, travel agency and 49% interest in its air

business. See Note 16. Restructuring Charges and

Related Impairment Charges for further discussion on

the Pullmantur sales transaction. No material events

or transactions affecting Pullmantur or CDF Croisières

de France have occurred during the two-month lag

period of November and December 2014 that would

require disclosure or adjustment to our consolidated

financial statements as of December 31, 2014.

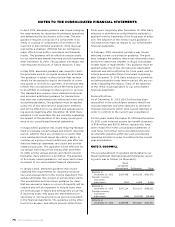

NOTE 2. SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Revenues and Expenses

Deposits received on sales of passenger cruises are

initially recorded as customer deposit liabilities on our

balance sheet. Customer deposits are subsequently

recognized as passenger ticket revenues, together

with revenues from onboard and other goods and

services and all associated cruise operating expenses

of a voyage.

Historically, we recognized revenues and cruise oper-

ating expenses for our shorter voyages (voyages of

ten days or less) upon voyage completion while we

recognized revenues and cruise operating expenses

for voyages in excess of ten days on a pro-rata basis.

We followed this completed voyage recognition

approach on our shorter voyages because the differ-

ence between prorating revenue from such voyages

and recognizing such revenue at the completion

of the voyage was immaterial to our consolidated

financial statements. As of September 30, 2014, we

changed our methodology and recognized passenger

ticket revenues, revenues from onboard and other

goods and services and all associated cruise operat-

ing expenses for all of our uncompleted voyages on a

pro-rata basis. We believe that recognizing revenues

and cruise operating expenses on a pro-rata basis for

all voyages is preferable as revenues and expenses

are recorded in the period in which the revenue gen-

erating activities are performed.

The effect of this change was an increase to Passenger

ticket revenues and Onboard and other revenues, as

well as an increase to our Cruise operating expenses.

The change was not individually material to our reve-

nues or any of our cruise operating expenses, and

resulted in an aggregate increase to operating income

and net income of $53.2 million, or $0.24 per diluted

share, for the year ended December 31, 2014. In addi-

tion, the change has not been retrospectively applied

to prior periods, as the impact of prorating all voyages

was immaterial to the respective periods presented.

Revenues and expenses include port costs that vary

with guest head counts. The amounts of such port

costs included in Passenger ticket revenues on a gross

basis were $546.6 million, $494.2 million and $459.8

million for the years 2014, 2013 and 2012, respectively.