Royal Caribbean Cruise Lines 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 97

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

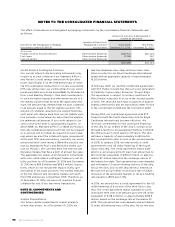

prior to the ship delivery, interest on the loan will

accrue either (1) at a fixed rate of 2.53% (inclusive of

the applicable margin) or (2) at a floating rate equal

to LIBOR plus 1.20%. In connection with this credit

agreement, we amended the €892.2 million credit

agreement, originally entered into in 2013 to finance

the ship, reducing the maximum facility amount to

approximately €713.8 million. Both of the facilities are

100% guaranteed by COFACE.

As of December 31, 2014, the aggregate cost of our

ships on order, not including those subject to closing

conditions, was approximately $5.0 billion, of which

we had deposited $394.4 million as of such date.

Approximately 28.8% of the aggregate cost was

exposed to fluctuations in the Euro exchange rate

at December 31, 2014. (See Note 14. Fair Value Meas-

urements and Derivative Instruments).

Litigation

A class action complaint was filed in June 2011 against

Royal Caribbean Cruises Ltd. in the United States

District Court for the Southern District of Florida on

behalf of a purported class of stateroom attendants

employed onboard Royal Caribbean International

cruise vessels. The complaint alleged that the state-

room attendants were required to pay other crew

members to help with their duties and that certain

stateroom attendants were required to work back of

house assignments without the ability to earn gratu-

ities, in each case in violation of the U.S. Seaman’s

Wage Act. In May 2012, the district court granted our

motion to dismiss the complaint on the basis that the

applicable collective bargaining agreement requires

any such claims to be arbitrated. The United States

Court of Appeals, 11th Circuit, affirmed the district

court’s dismissal and denied the plaintiffs’ petition for

re-hearing and re-hearing en banc. In October 2014,

the United States Supreme Court denied the plaintiffs’

request to review the order compelling arbitration.

Subsequently, approximately 575 crew members sub-

mitted demands for arbitration. The demands make

substantially the same allegations as in the federal

court complaint and are similarly seeking damages,

wage penalties and interest in an indeterminate

amount. Unlike the federal court complaint, the

demands for arbitration are being brought individually

by each of the crew members and not on behalf of a

purported class of stateroom attendants. At this time,

we are unable to estimate the possible impact of this

matter on us. However, we believe the underlying

claims made against us are without merit, and we

intend to vigorously defend ourselves against them.

We are routinely involved in other claims typical

within the cruise vacation industry. The majority of

these claims are covered by insurance. We believe the

outcome of such claims, net of expected insurance

recoveries, will not have a material adverse impact on

our financial condition or results of operations and

cash flows.

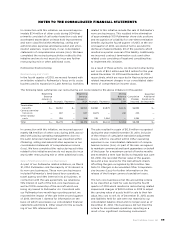

Operating Leases

In July 2002, we entered into an operating lease

denominated in British pound sterling for the Brilliance

of the Seas. In December 2014, we terminated the

leasing of Brilliance of the Seas and, as part of the

agreement, purchased the ship for a net settlement

purchase price of approximately £175.4 million or

$275.4 million. Refer to Note 5. Property and Equip-

ment for further discussion on the transaction. Prior

to the purchase, the lease payments varied based on

sterling LIBOR and were included in Other operating

expenses in our consolidated statements of compre-

hensive income (loss). Brilliance of the Seas lease

expense amounts were approximately £11.7 million,

£12.3 million and £14.6 million, or approximately $19.3

million, $19.1 million and $23.3 million for the years

ended December 31, 2014, 2013 and 2012, respectively.

We are obligated under other noncancelable operat-

ing leases primarily for offices, warehouses and motor

vehicles. As of December 31, 2014, future minimum

lease payments under noncancelable operating leases

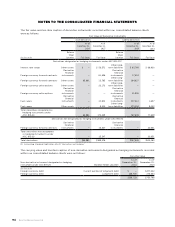

were as follows (in thousands):

Year

Thereafter

Total expense for all operating leases amounted to

$52.0 million, $57.5 million and $61.6 million for the

years 2014, 2013 and 2012, respectively.

Other

Some of the contracts that we enter into include

indemnification provisions that obligate us to make

payments to the counterparty if certain events occur.

These contingencies generally relate to changes in

taxes, increased lender capital costs and other similar

costs. The indemnification clauses are often standard

contractual terms and are entered into in the normal

course of business. There are no stated or notional

amounts included in the indemnification clauses and

we are not able to estimate the maximum potential

amount of future payments, if any, under these

indemnification clauses. We have not been required

to make any payments under such indemnification

clauses in the past and, under current circumstances,

we do not believe an indemnification in any material

amount is probable.