Royal Caribbean Cruise Lines 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 99

In connection with this initiative, we incurred approx-

imately $7.4 million of other costs during 2014 that

primarily consisted of call center transition costs and

accelerated depreciation on lease hold improvements

and were classified within Marketing, selling and

administrative expenses and Depreciation and amor-

tization expenses, respectively, in our consolidated

statements of comprehensive income (loss). We have

completed the restructuring activities related to this

initiative and we do not expect to incur any further

restructuring exit or other additional costs.

Pullmantur Restructuring

Restructuring Exit Costs

In the fourth quarter of 2013, we moved forward with

an initiative related to Pullmantur’s focus on its cruise

business and its expansion in Latin America. Activities

related to this initiative include the sale of Pullmantur’s

non-core businesses. This resulted in the elimination

of approximately 100 Pullmantur shore-side positions

and recognition of a liability for one-time termination

benefits during the fourth quarter of 2013. In the sec-

ond quarter of 2014, we elected not to execute the

dismissal of approximately 30 of the positions which

resulted in a partial reversal of the liability. Additionally,

we incurred contract termination costs and other

related costs consisting of legal and consulting fees

to implement this initiative.

As a result of these actions, we incurred restructuring

exit costs of $3.2 million and $5.3 million for the year

ended December 31, 2014 and December 31, 2013,

respectively, which are reported in Restructuring and

related impairment charges in our consolidated state-

ments of comprehensive income (loss).

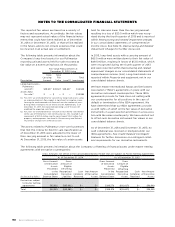

The following table summarizes our restructuring exit costs related to the above initiative (in thousands):

Beginning

Balance

January

Accruals Payments

Beginning

Balance

January

Accruals Payments

Ending

Balance

December

Cumulative

Charges

Incurred

Expected

Additional

Expensesto

beIncurred()

Termination

benefits — — —

Contract termina-

tion costs — — () — —

Other related

costs — — — —

Total — — —

In connection with this initiative, we incurred approxi-

mately $8.9 million of other costs during 2014, associ-

ated with placing operating management closer to

the Latin American market that was classified within

Marketing, selling and administrative expenses in our

consolidated statements of comprehensive income

(loss). We have completed the restructuring activities

related to this initiative and we do not expect to incur

any further restructuring exit or other additional costs.

Sale of Pullmantur Non-core Businesses

As part of our Pullmantur related initiatives, on March

31, 2014, Pullmantur sold the majority of its interest in

its non-core businesses. These non-core businesses

included Pullmantur’s land-based tour operations,

travel agency and 49% interest in its air business. In

connection with the sale agreement, we retained a

19% interest in each of the non-core businesses as

well as 100% ownership of the aircraft which are

being dry leased to Pullmantur Air. Consistent with

our Pullmantur two-month lag reporting period, we

reported the impact of the sale in the second quarter

of 2014. See Note 1. General for information on the

basis on which we prepare our consolidated financial

statements and Note 6. Other Assets for the account-

ing of our 19% retained interest.

The sale resulted in a gain of $0.6 million recognized

during the year ended December 31, 2014, inclusive

of the release of cumulative translation adjustment

losses, which is classified within Other operating

expenses in our consolidated statements of compre-

hensive income (loss). As part of the sale, we agreed

to maintain commercial and bank guarantees on behalf

of the buyer for a maximum period of twelve months

and extended a term loan facility to Nautalia due June

30, 2016. We recorded the fair value of the guaran-

tees and a loss reserve for the loan amount drawn,

offsetting the gain recognized by $5.5 million. See

Note 13. Changes in Accumulated Other Comprehen-

sive Income (Loss) for further information on the

release of the foreign currency translation losses.

The non-core businesses met the accounting criteria

to be classified as held for sale during the fourth

quarter of 2013 which resulted in restructuring related

impairment charges of $20.0 million in 2013 to adjust

the carrying value of assets held for sale to their fair

value, less cost to sell. As of December 31, 2013, assets

and liabilities held for sale were not material to our

consolidated balance sheet and no longer exist as of

December 31, 2014. The businesses did not meet the

criteria for discontinued operations reporting as a

result of our significant continuing involvement.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS