Royal Caribbean Cruise Lines 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 Royal Caribbean Cruises Ltd.

PART II

our current ownership interest in TUI Cruises below

37.5% through 2019.

Some of the contracts that we enter into include

indemnification provisions that obligate us to make

payments to the counterparty if certain events occur.

These contingencies generally relate to changes in

taxes, increased lender capital costs and other similar

costs. The indemnification clauses are often standard

contractual terms and are entered into in the normal

course of business. There are no stated or notional

amounts included in the indemnification clauses and

we are not able to estimate the maximum potential

amount of future payments, if any, under these indem-

nification clauses. We have not been required to make

any payments under such indemnification clauses in

the past and, under current circumstances, we do not

believe an indemnification obligation is probable.

Other than the items described above, we are not

party to any other off-balance sheet arrangements,

including guarantee contracts, retained or contingent

interest, certain derivative instruments and variable

interest entities, that either have, or are reasonably

likely to have, a current or future material effect on

our financial position.

FUNDING NEEDS AND SOURCES

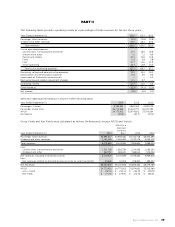

We have significant contractual obligations of which

our debt service obligations and the capital expendi-

tures associated with our ship purchases represent

our largest funding needs. As of December 31, 2014,

we have approximately $2.3 billion in contractual

obligations due through December 31, 2015 of which

approximately $790.9 million relates to debt maturities,

$946.8 million relates to the acquisition of Anthem of

the Seas along with progress payments on our other

ship purchases and $245.2 million relates to interest

on long-term debt. We have historically relied on a

combination of cash flows provided by operations,

drawdowns under our available credit facilities, the

incurrence of additional debt and/or the refinancing

of our existing debt and the issuance of additional

shares of equity securities to fund these obligations.

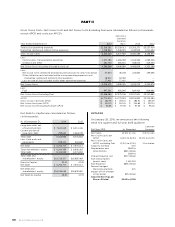

We had a working capital deficit of $3.0 billion as of

December 31, 2014 as compared to a working capital

deficit of $3.3 billion as of December 31, 2013. Included

within our working capital deficit is $799.6 million

and $1.6 billion of current portion of long-term debt,

including capital leases, as of December 31, 2014 and

December 31, 2013, respectively. The decrease in work-

ing capital deficit was primarily due to the decrease in

current maturities of long-term debt. Similar to others

in our industry, we operate with a substantial working

capital deficit. This deficit is mainly attributable to the

fact that, under our business model, a vast majority of

our passenger ticket receipts are collected in advance

of the applicable sailing date. These advance passen-

ger receipts remain a current liability until the sailing

date. The cash generated from these advance receipts

is used interchangeably with cash on hand from other

sources, such as our revolving credit facilities and

other cash from operations. The cash received as

advanced receipts can be used to fund operating

expenses for the applicable future sailing or other-

wise, pay down our revolving credit facilities, invest

in long-term investments or any other use of cash.

In addition, we have a relatively low-level of accounts

receivable and rapid turnover results in a limited

investment in inventories. We generate substantial

cash flows from operations and our business model,

along with our unsecured revolving credit facilities,

has historically allowed us to maintain this working

capital deficit and still meet our operating, investing

and financing needs. We expect that we will continue

to have working capital deficits in the future.

As of December 31, 2014, we have on order two

Quantum-class ships and two Oasis-class ships each

of which has committed unsecured bank financing

arrangements which include sovereign financing

guarantees. Refer to Note 15. Commitments and

Contingencies to our consolidated financial state-

ments under Item 8. Financial Statements and

Supplementary Data for further information.

During 2014, we repaid our €745.0 million 5.625%

unsecured senior notes with proceeds from our

$380.0 million unsecured term loan facility and our

revolving credit facilities and we amended and

restated our €365.0 million unsecured term loan

due July 2017 primarily to reduce the margin on the

facility. Additionally, in March 2014, we amended our

unsecured term loans for Oasis of the Seas and Allure

of the Seas primarily to reduce the margins on those

facilities and eliminate the lenders’ option to exit

those facilities in 2015 and 2017, respectively.

During 2014, we increased the capacity of our unse-

cured revolving credit facility due August 2018 by

$300 million by utilizing the accordion feature, bring-

ing our total capacity under this facility to $1.2 billion

as of December 31, 2014. We purchased the Brilliance

of the Seas for a net settlement purchase price of

approximately £175.4 million or $275.4 million using

proceeds from this facility. Refer to Note 7. Long-Term

Debt to our consolidated financial statements under

Item 8. Financial Statements and Supplementary Data

for further information.

As of December 31, 2014, we had liquidity of $1.0 bil-

lion, consisting of approximately $189.2 million in cash

and cash equivalents and $800.9 million available

under our unsecured credit facilities. We anticipate

that our cash flows from operations and our current

financing arrangements, as described above, will be