Royal Caribbean Cruise Lines 2014 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 55

PART II

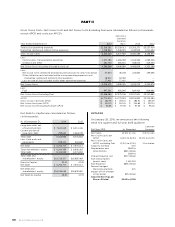

FUTURE CAPITAL COMMITMENTS

Our future capital commitments consist primarily of

new ship orders. As of December 31, 2014, we had

two Quantum-class ships and two Oasis-class ships

on order for our Royal Caribbean International brand

with an aggregate capacity of approximately 19,200

berths. Additionally, we have two “Project Edge”

ships on order for our Celebrity Cruises brand with an

aggregate capacity of approximately 5,800 berths,

which are expected to become effective in the second

quarter of 2015.

As of December 31, 2014, the aggregate cost of

our ships on order, not including the “Project Edge”

ships, was approximately $5.0 billion, of which we had

deposited $394.4 million as of such date. Approximately

28.8% of the aggregate cost was exposed to fluctua-

tions in the Euro exchange rate at December 31, 2014.

(See Note 14. Fair Value Measurements and Derivative

Instruments and Note 15. Commitments and Contingen-

cies to our consolidated financial statements under

Item 8. Financial Statements and Supplementary Data).

As of December 31, 2014, anticipated overall capital

expenditures, based on our existing ships on order,

are approximately $1.6 billion for 2015, $2.3 billion for

2016, $0.4 billion for 2017 and $2.2 billion for 2018.

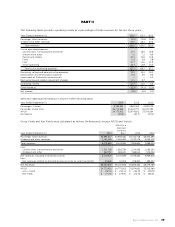

CONTRACTUAL OBLIGATIONS

As of December 31, 2014, our contractual obligations were as follows (in thousands):

Paymentsduebyperiod

Total

Lessthan

year –years –years

Morethan

years

Operating Activities:

Operating lease obligations()

Interest on long-term debt()

Other()

Investing Activities:

Ship purchase obligations() —

Other() — — —

Financing Activities:

Long-term debt obligations()

Capital lease obligations()

Other()

Total

() We are obligated under noncancelable operating leases primarily for offices, warehouses and motor vehicles. Amounts represent contractual

obligations with initial terms in excess of one year.

() Long-term debt obligations mature at various dates through fiscal year 2027 and bear interest at fixed and variable rates. Interest on variable-rate

debt is calculated based on forecasted debt balances, including interest swapped using the applicable rate at December 31, 2014. Debt denomi-

nated in other currencies is calculated based on the applicable exchange rate at December 31, 2014.

() Amounts primarily represent future commitments with remaining terms in excess of one year to pay for our usage of certain port facilities, marine

consumables, services and maintenance contracts.

() Amounts do not include potential obligations which remain subject to cancellation at our sole discretion.

() Amount represents unused commitment on loan to unconsolidated affiliate.

() Amounts represent debt obligations with initial terms in excess of one year.

() Amounts represent capital lease obligations with initial terms in excess of one year.

() Amounts represent fees payable to sovereign guarantors in connection with certain of our export credit debt facilities and facility fees on our

revolving credit facilities.

Please refer to Funding Needs and Sources for discus-

sion on the planned funding of the above contractual

obligations.

As a normal part of our business, depending on mar-

ket conditions, pricing and our overall growth strat-

egy, we continuously consider opportunities to enter

into contracts for the building of additional ships. We

may also consider the sale of ships or the purchase

of existing ships. We continuously consider potential

acquisitions and strategic alliances. If any of these

were to occur, they would be financed through the

incurrence of additional indebtedness, the issuance

of additional shares of equity securities or through

cash flows from operations.

OFF-BALANCE SHEET ARRANGEMENTS

In connection with the sale of Celebrity Mercury in

February 2011, we and TUI AG each guaranteed repay-

ment of 50% of a €180.0 million amortizing bank loan

provided to TUI Cruises which is due 2016. As of

December 31, 2014, €117.0 million, or approximately

$141.6 million based on the exchange rate at December

31, 2014, remains outstanding. Based on current facts

and circumstances, we do not believe potential obli-

gations under this guarantee are probable.

TUI Cruises has entered into construction agreements

with Meyer Turku shipyard that includes certain restric-

tions on each of our and TUI AG’s ability to reduce