Royal Caribbean Cruise Lines 2014 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78 Royal Caribbean Cruises Ltd.

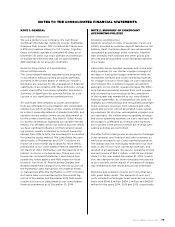

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

In April 2014, amended guidance was issued changing

the requirements for reporting discontinued operations

and enhancing the disclosures in this area. The new

guidance requires a disposal of a component of an

entity or a group of components of an entity to be

reported in discontinued operations if the disposal

represents a strategic shift that has (or will have) a

major effect on an entity’s operations and financial

results. The guidance will be effective prospectively

for our interim and annual reporting periods beginning

after December 15, 2014. The guidance will impact the

reporting and disclosures of future disposals, if any.

In May 2014, amended guidance was issued to clarify

the principles used to recognize revenue for all entities.

The guidance is based on the principle that revenue

should be recognized to depict the transfer of prom-

ised goods or services to customers in an amount that

reflects the consideration to which the entity expects

to be entitled in exchange for those goods or services.

The standard also requires more detailed disclosures

and provides additional guidance for transactions

that were not comprehensively addressed in the prior

accounting guidance. This guidance must be applied

using one of two retrospective application methods

and will be effective for our interim and annual report-

ing periods beginning after December 15, 2016. Early

adoption is not permitted. We are currently evaluating

the impact of the adoption of this newly issued guid-

ance to our consolidated financial statements.

In August 2014, guidance was issued requiring manage-

ment to evaluate, at each annual and interim reporting

period, whether there are conditions or events that

raise substantial doubt about the entity’s ability to

continue as a going concern within one year after the

date the financial statements are issued and provide

related disclosures. This guidance will be effective for

our annual reporting period ending after December

15, 2016, and for annual periods and interim periods

thereafter. Early adoption is permitted. The adoption

of this newly issued guidance is not expected to have

an impact to our consolidated financial statements.

In January 2015, amended guidance was issued

changing the requirements for reporting extraordi-

nary and unusual items in the income statement. The

update eliminates the concept of extraordinary items.

The presentation and disclosure guidance for items

that are unusual in nature or occur infrequently will be

retained and will be expanded to include items that

are both unusual in nature and infrequently occurring.

A reporting entity may apply the amendments pro-

spectively or retrospectively to all periods presented

in the financial statements. The guidance will be effec-

tive for fiscal years, and interim periods within those

fiscal years, beginning after December 15, 2015. Early

adoption is permitted provided that the guidance is

applied from the beginning of the fiscal year of adop-

tion. The adoption of this newly issued guidance is

not expected to have an impact to our consolidated

financial statements.

In February 2015, amended guidance was issued

affecting current consolidation guidance. The guid-

ance changes the analysis that a reporting entity must

perform to determine whether it should consolidate

certain types of legal entities. This guidance must be

applied using one of two retrospective application

methods and will be effective for fiscal years, and for

interim periods within those fiscal years, beginning

after December 15, 2015. Early adoption is permitted,

including adoption in any interim period. We are cur-

rently evaluating the impact, if any, of the adoption

of this newly issued guidance to our consolidated

financial statements.

Reclassifications

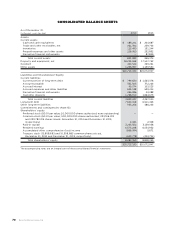

As of December 31, 2013, $24.3 million has been

reclassified in the consolidated balance sheet from

Accrued expenses and other liabilities to Derivative

financial instruments within Total current liabilities in

order to conform to the current year presentation.

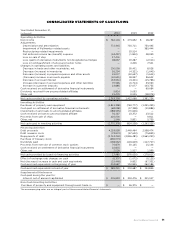

For the years ended December 31, 2013 and December

31, 2012, a net deferred income tax benefit (expense)

of $1.8 million and $(0.5) million, respectively, have

been reclassified in the consolidated statements of

cash flows from Other, net to Net deferred income

tax (benefit) expense within Net cash provided by

operating activities in order to conform to the current

year presentation.

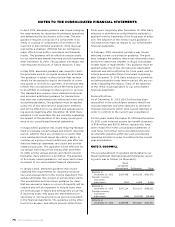

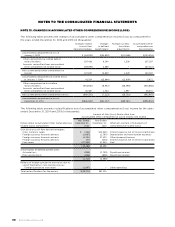

NOTE 3. GOODWILL

The carrying amount of goodwill attributable to our

Royal Caribbean International and Pullmantur report-

ing units was as follows (in thousands):

Royal

Caribbean

International Pullmantur Total

Balance at

December 31, 2012

Foreign currency

translation

adjustment ()

Balance at

December 31, 2013

Foreign currency

translation

adjustment () () ()

Balance at

December 31, 2014