Royal Caribbean Cruise Lines 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 45

• Fuel expenses, which include fuel and related deliv-

ery and storage costs, including the financial impact

of fuel swap agreements; and

• Other operating expenses, which consist primarily

of operating costs such as repairs and maintenance,

port costs that do not vary with passenger head

counts, vessel related insurance and entertainment.

Additionally, costs associated with Pullmantur’s

travel agency network, land-based tours and air

charter business to third parties are included in

other operating expenses through the date of the

sale of Pullmantur’s non-core businesses further

discussed below.

We do not allocate payroll and related expenses, food

expenses, fuel expenses or other operating expenses

to the expense categories attributable to passenger

ticket revenues or onboard and other revenues since

they are incurred to provide the total cruise vacation

experience.

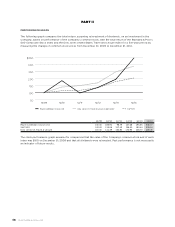

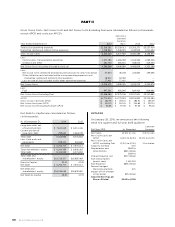

SELECTED OPERATIONAL AND FINANCIAL METRICS

We utilize a variety of operational and financial metrics

which are defined below to evaluate our performance

and financial condition. As discussed in more detail

herein, certain of these metrics are non-GAAP financial

measures, which we believe provide useful informa-

tion to investors as a supplement to our consolidated

financial statements, which are prepared and pre-

sented in accordance with GAAP. The presentation

of non-GAAP financial information is not intended to

be considered in isolation or as a substitute for, or

superior to, the financial information prepared and

presented in accordance with GAAP.

Adjusted Earnings per Share represents Adjusted Net

Income divided by weighted average shares outstand-

ing or by diluted weighted average shares outstanding,

as applicable. We believe that this non-GAAP measure

is meaningful when assessing our performance on a

comparative basis.

Adjusted Net Income represents net income excluding

certain items that we believe adjusting for is meaning-

ful when assessing our performance on a comparative

basis. For the periods presented, these items included

restructuring and related impairment charges, other

costs related to our profitability initiatives, the esti-

mated impact of the divested Pullmantur non-core

businesses, impairment of Pullmantur related assets,

the loss recognized on the sale of Celebrity Century,

the impact of the change in our voyage proration

methodology and the reversal of a deferred tax asset

valuation allowance due to Spanish tax reform. The

estimated impact of the divested Pullmantur non-

core businesses was arrived at by adjusting the net

income (loss) of these businesses for the ownership

percentage we retained as well as for intercompany

transactions that are no longer eliminated in our con-

solidated statements of comprehensive income (loss)

subsequent to the sales transaction. For the full year

2014, the impact of the voyage proration change rep-

resents net income that would have been recognized

in 2013 had we recognized revenues and cruise oper-

ating expenses on a pro-rata basis for all voyages.

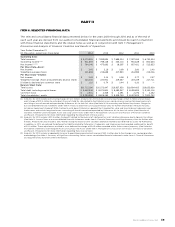

Available Passenger Cruise Days (“APCD”) is our

measurement of capacity and represents double

occupancy per cabin multiplied by the number of

cruise days for the period. We use this measure to

perform capacity and rate analysis to identify our

main non-capacity drivers that cause our cruise

revenue and expenses to vary.

Gross Cruise Costs represent the sum of total cruise

operating expenses plus marketing, selling and admin-

istrative expenses.

Gross Yields represent total revenues per APCD.

Net Cruise Costs and Net Cruise Costs Excluding Fuel

represent Gross Cruise Costs excluding commissions,

transportation and other expenses and onboard

and other expenses and, in the case of Net Cruise

Costs Excluding Fuel, fuel expenses (each of which is

described above under the Description of Certain Line

Items heading). In measuring our ability to control

costs in a manner that positively impacts net income,

we believe changes in Net Cruise Costs and Net Cruise

Costs Excluding Fuel to be the most relevant indica-

tors of our performance. A reconciliation of historical

Gross Cruise Costs to Net Cruise Costs and Net Cruise

Costs Excluding Fuel is provided below under Results

of Operations. We have not provided a quantitative

reconciliation of projected Gross Cruise Costs to pro-

jected Net Cruise Costs and projected Net Cruise

Costs Excluding Fuel due to the significant uncer-

tainty in projecting the costs deducted to arrive at

these measures. Accordingly, we do not believe that

reconciling information for such projected figures

would be meaningful. For the periods prior to the sale

of the Pullmantur non-core businesses, Net Cruise

Costs excludes the estimated impact of these divested

businesses. Net Cruise Costs also excludes initiative

costs reported within Marketing, selling and admin-

istrative expenses, as well as the loss recognized on

the sale of Celebrity Century included within Other

operating expenses.

Net Debt-to-Capital is a ratio which represents total

long-term debt, including the current portion of

long-term debt, less cash and cash equivalents (“Net

Debt”) divided by the sum of Net Debt and total

shareholders’ equity. We believe Net Debt and Net

Debt-to-Capital, along with total long-term debt

and shareholders’ equity are useful measures of our

PART II