Royal Caribbean Cruise Lines 2014 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

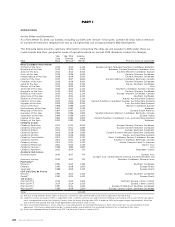

18 Royal Caribbean Cruises Ltd.

PART I

primarily source guests for our global brands from

North America. We also continue to expand our focus

on selling and marketing our cruise brands to guests

in countries outside of North America by tailoring

itineraries and onboard product offerings to the cul-

tural characteristics and preferences of our interna-

tional guests. In addition, we explore opportunities

that may arise to acquire or develop brands tailored

to specific markets.

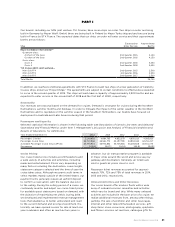

Passenger ticket revenues generated by sales origi-

nating in countries outside of the United States were

approximately 47% of total passenger ticket revenues in

2014 and 48% and 49% in 2013 and 2012, respectively.

International guests have grown from approximately

1.8 million in 2010 to approximately 2.2 million in 2014.

Cost Efficiency, Operating Expenditures and

Adequate Cash and Liquidity

We continue our commitment to identify and imple-

ment cost containment initiatives. Our most recent

initiatives relate to realizing economies of scale and

improving service delivery to our travel partners and

guests by restructuring and consolidating our global

sales, marketing, general and administrative structure.

We also continue our initiatives to reduce energy con-

sumption and, by extension, fuel costs. These include

the design of more fuel-efficient ships as well as the

implementation of more efficient hardware, including

propulsion and cooling systems incorporating energy

efficiencies.

We are focused on maintaining a strong liquidity posi-

tion, reducing our debt and improving our credit met-

rics. In addition, we continue to pursue our long-term

objective of returning our credit ratings to investment

grade. We believe these strategies enhance our ability

to achieve our overall goal of maximizing our return

on invested capital and long-term shareholder value.

Fleet Upgrade, Maintenance and Expansion

We place a strong focus on product innovation, which

we seek to achieve by introducing new concepts

on our new ships and continuously making improve-

ments to our fleet. Several of these innovations have

become signature elements of our brands, such as

the “Royal Promenade” (a boulevard with shopping,

dining and entertainment venues) for the Royal

Caribbean International brand and enhanced design

features found on our Solstice-class ships for the

Celebrity Cruises brand.

Our upgrade and maintenance programs enable us to

incorporate many of our latest signature innovations

throughout the brand fleet and allow us to benefit

from economies of scale by leveraging our suppliers.

Ensuring consistency across our fleet provides us with

the flexibility to redeploy our ships among our brand

portfolio.

We are committed to building state-of-the-art ships

and our brands, excluding our 50% joint venture TUI

Cruises, currently have effective agreements for the

construction of four new ships. These consist of two

Quantum-class ships, which are scheduled to enter

service in the second quarters of 2015 and 2016 and

two Oasis-class ships, which are scheduled to enter

service in the second quarters of 2016 and 2018,

respectively. We also reached conditional agreements

with STX France to build two ships of a new generation

for Celebrity Cruises, which are scheduled to enter

service in the second half of 2018 and the first half

of 2020. The addition of these six ships is expected

to increase our passenger capacity by approximately

25,000 berths by December 31, 2020, or approxi-

mately 25.1%, as compared to our capacity as of

December 31, 2014.

TUI Cruises, our 50% joint venture, currently has

effective agreements for the construction of three

new ships. These ships are scheduled to enter service

in the second quarter of 2015, third quarter of 2016

and second quarter of 2017, with an expected total

capacity of 7,500 berths.

We continuously evaluate opportunities to order new

ships, purchase existing ships or sell ships in our cur-

rent fleet.

Markets and Itineraries

In an effort to penetrate untapped markets, diversify

our consumer base and respond to changing economic

and geopolitical market conditions, we continue to

seek opportunities to optimally deploy ships to new

and stronger markets and itineraries throughout the

world. The portability of our ships allows us to readily

deploy our ships to meet demand within our existing

cruise markets. We make deployment decisions gen-

erally 12 to 18 months in advance, with the goal of

optimizing the overall profitability of our portfolio.

Additionally, the infrastructure investments we have

made to create a flexible global sourcing model has

made our brands relevant in a number of markets

around the world, which allows us to be opportunis-

tic and source the highest yielding guests for our

itineraries.

Our ships offer a wide selection of itineraries that call

on approximately 480 destinations in 113 countries,

spanning all seven continents. We are focused on

obtaining the best possible long-term shareholder

returns by operating in established markets while

growing our presence in developing markets. New

capacity allows us to expand into new markets and

itineraries. Our brands have expanded their mix of

itineraries while strengthening our ability to further

penetrate the Asian, Australian, Caribbean, and Latin

American markets. Additionally, in order to capitalize

on the summer season in the Southern Hemisphere