Royal Caribbean Cruise Lines 2014 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 Royal Caribbean Cruises Ltd.

PART II

Other expense decreased $41.1 million, or 96.0%, to

$1.7 million in 2013 compared to $42.9 million for the

same period in 2012. This change was primarily due to:

• a $29.8 decrease in deferred income tax expense as

a result of a 100% valuation allowance recorded in

connection with Pullmantur’s deferred tax assets in

2012 partially offset by a reduction in Pullmantur’s

deferred tax liability and resulting tax benefit related

to a 2013 impairment of Pullmantur’s long-lived assets

and a 2012 impairment charge of Pullmantur’s trade-

marks and trade names; and

• income of $32.0 million from our equity method

investments in 2013 as compared to income of $23.8

million in 2012.

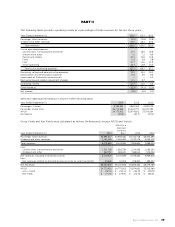

Net Yields

Net Yields increased 2.7% in 2013 compared to

2012 primarily due to an increase in ticket prices,

onboard revenue and Pullmantur’s travel agency

network and air charter business noted above. Net

Yields increased 3.2% in 2013 compared to 2012 on

a Constant Currency basis.

Net Cruise Costs

Net Cruise Costs increased 2.7% in 2013 compared to

2012 primarily due to the increase in crew expenses,

food expenses, indirect operating expenses and

expenses related to Pullmantur’s travel agency net-

work and air charter business, noted above. Net

Cruise Costs per APCD increased 1.9% in 2013 com-

pared to 2012. Net Cruise Costs per APCD on a

Constant Currency basis increased 1.7% in 2013 com-

pared to 2012.

Net Cruise Costs Excluding Fuel

Net Cruise Costs Excluding Fuel per APCD increased

2.1% in 2013 compared to 2012. Net Cruise Costs

Excluding Fuel per APCD on a Constant Currency

basis increased 1.8% in 2013 compared to 2012.

FUTURE APPLICATION OF ACCOUNTING STANDARDS

Refer to Note 2. Summary of Significant Accounting

Policies to our consolidated financial statements under

Item 8. Financial Statements and Supplementary

Data for further information on Recent Accounting

Pronouncements.

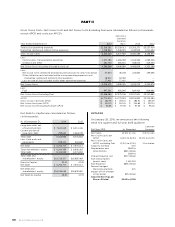

LIQUIDITY AND CAPITAL RESOURCES

Sources and Uses of Cash

Cash flow generated from operations provides us with

a significant source of liquidity. Net cash provided by

operating activities increased $331.7 million to $1.7

billion for 2014 compared to $1.4 billion for 2013. The

increase was primarily due to a decrease in interest

paid in 2014 compared to 2013 and the timing of

proceeds from accounts receivable and payments

to vendors in 2014. Net cash provided by operating

activities in 2013 remained consistent compared

to 2012.

Net cash used in investing activities was $1.8 billion for

2014 compared to $824.5 million for 2013. The increase

was primarily attributable to an increase in capital

expenditures of $1.0 billion in 2014 compared to 2013

primarily due to the delivery of Quantum of the Seas

and the purchase of Brilliance of the Seas in 2014.

Additionally, there was an increase in investments in

and loans to unconsolidated affiliates of $118.0 million

and an increase in cash paid on the settlement of

derivative financial instruments of $50.8 million.

These cash outlays were partially offset by cash

received of $220.0 million in 2014 for the sale of

Celebrity Century which did not occur in 2013 and a

$52.8 million increase in cash received from repay-

ments of a loan to an unconsolidated affiliate in 2014

compared to 2013.

Net cash used in investing activities was $824.5 million

for 2013 compared to $1.3 billion for 2012. The decrease

in 2013 compared to 2012 is primarily due to a decrease

in capital expenditures of $527.7 million attributable

to the delivery of a ship, Celebrity Reflection, in 2012

which did not recur in 2013, partially offset by a higher

level of ships under construction in 2013 compared

to 2012. The decrease in capital expenditures was

partially offset by investments of $70.6 million to

our unconsolidated affiliates during 2013.

Net cash provided by financing activities was $17.5

million for 2014 compared to net cash used in financ-

ing activities of $576.6 million for 2013. This change

was primarily due to a $1.7 billion increase in debt

proceeds and a $40.8 million increase in the proceeds

from the exercise of common stock options, partially

offset by the repurchase of treasury stock of $236.1

million, an increase of $867.7 million in repayments of

debt and an increase of dividends paid of $55.3 mil-

lion. The increase in repayments of debt and proceeds

from issuance of debt was primarily due to proceeds

received from an unsecured term loan of $791.1 million

due to the delivery of Quantum of the Seas in 2014, a

higher level of bond maturities and higher drawings

and repayments on our revolving credit facilities.

Net cash used in financing activities was $576.6 million

for 2013 compared to $179.6 million for 2012. This

change was primarily due to an increase of $295.2

million in repayments of debt and an increase of

$25.9 million paid in dividends, partially offset by a

decrease of $109.0 million in debt proceeds.