Royal Caribbean Cruise Lines 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96 Royal Caribbean Cruises Ltd.

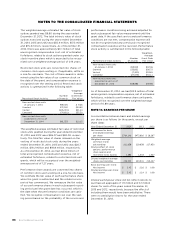

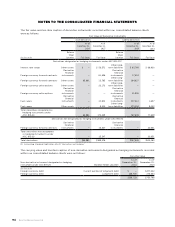

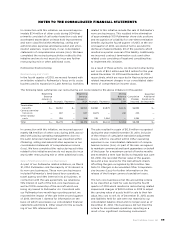

The effect of derivatives not designated as hedging instruments on the consolidated financial statements was

as follows:

Amount of Gain (Loss) Recognized in

Income on Derivative

Derivatives Not Designated as Hedging

Instruments under ASC 815-20

Location of Gain (Loss)

Recognized in Income

on Derivative

YearEnded

December

YearEnded

December

(In thousands)

Foreign currency forward contracts Other income (expense) () ()

Fuel swaps Other income (expense) ()

Fuel call options Other income (expense) — ()

() ()

Credit Related Contingent Features

Our current interest rate derivative instruments may

require us to post collateral if our Standard & Poor’s

and Moody’s credit ratings remain below specified

levels. Specifically, if on the fifth anniversary of enter-

ing into a derivative transaction or on any succeeding

fifth-year anniversary our credit ratings for our senior

unsecured debt were to be below BBB- by Standard &

Poor’s and Baa3 by Moody’s, then each counterparty

to such derivative transaction with whom we are in a

net liability position that exceeds the applicable mini-

mum call amount may demand that we post collateral

in an amount equal to the net liability position. The

amount of collateral required to be posted following

such event will change each time our net liability posi-

tion increases or decreases by more than the applica-

ble minimum call amount. If our credit rating for our

senior unsecured debt is subsequently equal to, or

above BBB- by Standard & Poor’s or Baa3 by Moody’s,

then any collateral posted at such time will be released

to us and we will no longer be required to post collat-

eral unless we meet the collateral trigger requirement

at the next fifth-year anniversary. Currently, our senior

unsecured debt credit rating is BB with a positive out-

look by Standard & Poor’s and Ba1 with a stable out-

look by Moody’s. We currently have five interest rate

derivative hedges that have a term of at least five years.

The aggregate fair values of all derivative instruments

with such credit-related contingent features in net lia-

bility positions as of December 31, 2014 and December

31, 2013 were $65.8 million and $66.9 million, respec-

tively, which do not include the impact of any such

derivatives in net asset positions. The earliest that any

of the five interest rate derivative hedges will reach

their fifth anniversary is November 2016. Therefore, as

of December 31, 2014, we were not required to post

collateral for any of our derivative transactions.

NOTE 15. COMMITMENTS AND

CONTINGENCIES

Capital Expenditures

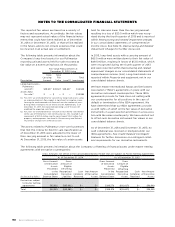

Our future capital commitments consist primarily

of new ship orders. As of December 31, 2014, we

had two Quantum-class ships and two Oasis-class

ships on order for our Royal Caribbean International

brand with an aggregate capacity of approximately

19,200 berths.

In February 2015, we reached conditional agreements

with STX France to build two ships of a new generation

of Celebrity Cruises ships, known as “Project Edge.”

The agreement is subject to certain conditions to

effectiveness expected to occur in the second quarter

of 2015. The ships will each have a capacity of approx-

imately 2,900 berths and are expected to enter service

in the second half of 2018 and the first half of 2020.

During 2014, our conditional agreement with STX

France to build the fourth Oasis-class ship for Royal

Caribbean International became effective. We

received commitments for the unsecured financing

of the ship for up to 80% of the ship’s contract price

through a facility to be guaranteed 100% by COFACE,

the official export credit agency of France. The ship

will have a capacity of approximately 5,450 berths

and is expected to enter service in the second quarter

of 2018. In January 2015, we entered into a credit

agreement for the US dollar financing of the fourth

Oasis-class ship. The credit agreement makes avail-

able to us an unsecured term loan in an amount up to

the US Dollar equivalent of €931.2 million, or approxi-

mately $1.1 billion, based on the exchange rate as of

the transaction date. The loan amortizes semi-annually

and will mature 12 years following delivery of the ship.

At our election, prior to the ship delivery, interest on

the loan will accrue either (1) at a fixed rate of 3.82%

(inclusive of the applicable margin) or (2) at a floating

rate equal to LIBOR plus 1.10%.

In 2014, we entered into a credit agreement for the US

dollar financing of a portion of the third Oasis-class

ship. The credit agreement makes available to us an

unsecured term loan in an amount up to the US dollar

equivalent of €178.4 million, or approximately $215.9

million, based on the exchange rate at December 31,

2014. The loan amortizes semi-annually and will mature

12 years following delivery of the ship. At our election,

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS