Royal Caribbean Cruise Lines 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90 Royal Caribbean Cruises Ltd.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

The reported fair values are based on a variety of

factors and assumptions. Accordingly, the fair values

may not represent actual values of the financial instru-

ments that could have been realized as of December

31, 2014 or December 31, 2013, or that will be realized

in the future, and do not include expenses that could

be incurred in an actual sale or settlement.

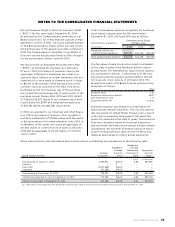

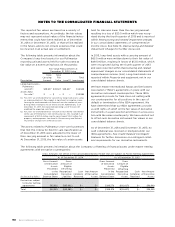

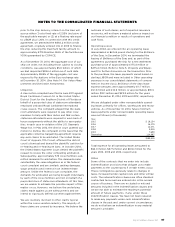

The following table presents information about the

Company’s long-lived assets for our Pullmantur

reporting unit and assets held for sale recorded at

fair value on a nonrecurring basis (in thousands):

Fair Value Measurements at

December 31, 2013 Using

Description

Total

Carrying

Amount

Total

Fair

Value Level 3

Total

Impairment

Long-lived assets—

Pullmantur

aircraft()

Assets held

for sale() — — —

() For 2013, we estimated the fair value of our long-lived assets using

an undiscounted cash flow model. A significant assumption in per-

forming the undiscounted cash flow test was the number of years

during which we expect to use these aircraft. Additionally, as of

December 31, 2013, the expected operating use of the aircraft

modified the expected cash flows.

() For 2013, we estimated the fair value of assets held for sale related

to the sale of Pullmantur’s non-core businesses. This resulted in an

impairment of $20.0 million mostly consisting of $18.2 million for

property and equipment. See Note 16. Restructuring and Related

Impairment Charges for further discussion.

The assets related to Pullmantur’s non-core businesses

that met the criteria for held for sale classification as

of December 31, 2013 were adjusted to the lower of

their carrying amount or fair value less cost to sell.

At December 31, 2013, the fair value of certain assets

held for sale was lower than the carrying amount,

resulting in a loss of $20.0 million which was recog-

nized during the fourth quarter of 2013 and is reported

within Restructuring and related impairment charges

in our consolidated statements of comprehensive

income (loss). See Note 16. Restructuring and Related

Impairment Charges for further discussion.

In 2013, long-lived assets with a carrying amount of

$63.0 million were written down to their fair value of

$49.5 million, resulting in losses of $13.5 million, which

were recognized during the fourth quarter of 2013

and were reported within Restructuring and related

impairment charges in our consolidated statements of

comprehensive income (loss). Long-lived assets are

reported within Property and equipment, net in our

consolidated balance sheets.

We have master International Swaps and Derivatives

Association (“ISDA”) agreements in place with our

derivative instrument counterparties. These ISDA

agreements provide for final close out netting with

our counterparties for all positions in the case of

default or termination of the ISDA agreement. We

have determined that our ISDA agreements provide

us with rights of setoff on the fair value of derivative

instruments in a gain position and those in a loss posi-

tion with the same counterparty. We have elected not

to offset such derivative instrument fair values in our

consolidated balance sheets.

As of December 31, 2014 and December 31, 2013, no

cash collateral was received or pledged under our

ISDA agreements. See Credit Related Contingent

Features for further discussion on contingent collat-

eral requirements for our derivative instruments.

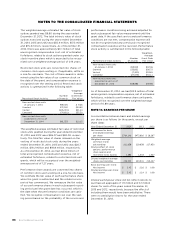

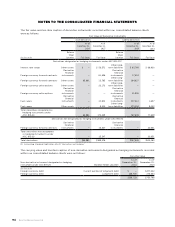

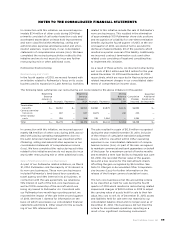

The following table presents information about the Company’s offsetting of financial assets under master netting

agreements with derivative counterparties:

Gross Amounts not Offset in the Consolidated Balance Sheet that are Subject to Master Netting Agreements

As of December 31, 2014 As of December 31, 2013

(In thousands of dollars)

Gross Amount

of Derivative

Assets

Presented

in the

Consolidated

Balance Sheet

Gross

Amount of

Eligible

Offsetting

Recognized

Derivative

Liabilities

Cash

Collateral

Received

Net Amount

of Derivative

Assets

Gross Amount

of Derivative

Assets

Presented

in the

Consolidated

Balance Sheet

Gross

Amount of

Eligible

Offsetting

Recognized

Derivative

Assets

Cash

Collateral

Received

Net Amount

of Derivative

Assets

Derivatives subject

to master netting

agreements () — — () —

Total () — — () —