Royal Caribbean Cruise Lines 2014 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80 Royal Caribbean Cruises Ltd.

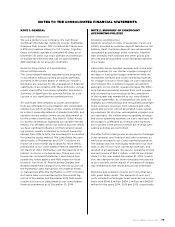

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

record an impairment of Pullmantur’s tradenames and

trademarks for the year ended December 31, 2014 and

December 31, 2013, but for the year ended December

31, 2012, we recorded an impairment of $17.4 million.

During our 2014 annual impairment review, we deter-

mined the fair value of the trademarks and trade names

exceeded its carrying value by approximately 4%

resulting in no impairment to Pullmantur’s trademarks

and tradenames.

As described in Note 3. Goodwill, the persistent eco-

nomic instability in Pullmantur’s markets has created

significant uncertainties in forecasting operating results

and future cash flows used in our impairment analysis.

We continue to monitor economic events in these

markets for their potential impact on Pullmantur’s

business and valuation. Further, the estimation of fair

value utilizing discounted expected future cash flows

includes numerous uncertainties which require our

significant judgment when making assumptions of

expected revenues, operating costs, marketing, selling

and administrative expenses, interest rates, ship addi-

tions and retirements as well as assumptions regarding

the cruise vacation industry’s competitive environment

and general economic and business conditions, among

other factors. If there are changes to the projected

future cash flows used in the impairment analysis,

especially in Net Yields or if certain transfers of ves-

sels from our other cruise brands to the Pullmantur

fleet do not take place, an impairment charge with

respect to the Pullmantur reporting unit’s trademarks

and trade names will likely be required.

Finite-life intangible assets and related accumulated

amortization are immaterial to our 2014, 2013, and

2012 consolidated financial statements.

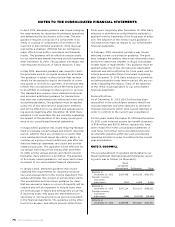

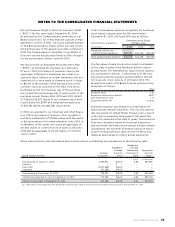

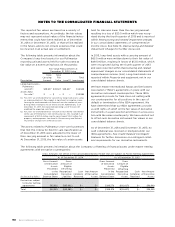

NOTE 5. PROPERTY AND EQUIPMENT

Property and equipment consists of the following

(in thousands):

Ships

Ship improvements

Ships under construction

Land, buildings and improve-

ments, including leasehold

improvements and port

facilities

Computer hardware and soft-

ware, transportation equip-

ment and other

Total property and equipment

Less—accumulated deprecia-

tion and amortization () ()

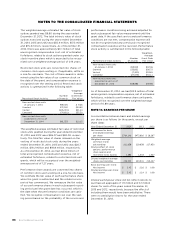

Ships under construction include progress payments

for the construction of new ships as well as planning,

design, interest and other associated costs. We capi-

talized interest costs of $28.8 million, $17.9 million

and $13.3 million for the years 2014, 2013 and 2012,

respectively.

In 2014, our conditional agreement with STX France to

build the fourth Oasis-class ship for Royal Caribbean

International became effective. Refer to Note 15. Com-

mitments and Contingencies for further information.

During 2014, we sold Celebrity Century to a subsidiary

of Skysea Holding International Ltd. (“Skysea Holding”)

for $220.0 million in cash. We agreed to charter the

Celebrity Century from the buyer until April 2015

to fulfill existing passenger commitments. The sale

resulted in a loss of $17.4 million that was recognized

in earnings during the third quarter of 2014 and is

reported within Other operating expenses in our

consolidated statements of comprehensive income

(loss). We subsequently acquired a 35% equity stake

in Skysea Holding in November 2014. See Note 6.

Other Assets for further discussion.

In December 2014, we terminated the leasing of

Brilliance of the Seas under the 25-year operating

lease originally entered into in July 2002, denomi-

nated in British pound sterling. As part of the agree-

ment, we purchased the Brilliance of the Seas for

a net settlement purchase price of approximately

£175.4 million or $275.4 million. At the date of pur-

chase, the total carrying amount of the ship, including

capital improvements previously accounted for as

leasehold improvements, was $330.5 million which

approximated the estimated fair market value of the

ship. We funded the purchase using proceeds from

our $1.2 billion unsecured revolving credit facility.

See Note 7. Long-Term Debt for further information.

During 2013, the fair value of Pullmantur’s aircraft

were determined to be less than their carrying value

and a restructuring related impairment charge of

$13.5 million was recognized in earnings during the

fourth quarter of 2013 and reported within Restruc-

turing and related impairment charges within our con-

solidated statements of comprehensive income (loss).

Furthermore, in 2012, the fair value of Pullmantur’s

aircraft were determined to be less than their carrying

value and an impairment charge of $48.9 million was

recognized in earnings during the fourth quarter of

2012 and reported within Impairment of Pullmantur

related assets within our consolidated statements of

comprehensive income (loss).