Royal Caribbean Cruise Lines 2014 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 Royal Caribbean Cruises Ltd.

PART II

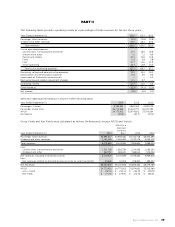

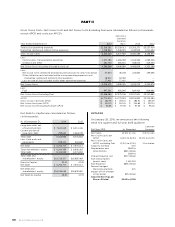

capital structure. A reconciliation of historical Debt-

to-Capital to Net Debt-to-Capital is provided below

under Results of Operations.

Net Revenues represent total revenues less commis-

sions, transportation and other expenses and onboard

and other expenses (each of which is described above

under the Description of Certain Line Items heading).

For the periods prior to the sale of the Pullmantur non-

core businesses, we have presented Net Revenues

excluding the estimated impact of these divested

businesses in the financial tables under Results of

Operations.

Net Yields represent Net Revenues per APCD. We

utilize Net Revenues and Net Yields to manage our

business on a day-to-day basis as we believe that it is

the most relevant measure of our pricing performance

because it reflects the cruise revenues earned by us

net of our most significant variable costs, which are

commissions, transportation and other expenses and

onboard and other expenses. A reconciliation of his-

torical Gross Yields to Net Yields is provided below

under Results of Operations. We have not provided a

quantitative reconciliation of projected Gross Yields

to projected Net Yields due to the significant uncer-

tainty in projecting the costs deducted to arrive at

this measure. Accordingly, we do not believe that rec-

onciling information for such projected figures would

be meaningful. For the periods prior to the sale of the

Pullmantur non-core businesses, Net Yields excludes

the estimated impact of these divested businesses.

Occupancy, in accordance with cruise vacation

industry practice, is calculated by dividing Passenger

Cruise Days by APCD. A percentage in excess of 100%

indicates that three or more passengers occupied

some cabins.

Passenger Cruise Days represent the number of

passengers carried for the period multiplied by the

number of days of their respective cruises.

We believe Net Yields, Net Cruise Costs and Net Cruise

Costs Excluding Fuel are our most relevant non-GAAP

financial measures. However, a significant portion of

our revenue and expenses are denominated in curren-

cies other than the United States dollar. Because our

reporting currency is the United States dollar, the value

of these revenues and expenses can be affected by

changes in currency exchange rates. Although such

changes in local currency prices is just one of many

elements impacting our revenues and expenses, it

can be an important element. For this reason, we also

monitor Net Yields, Net Cruise Costs and Net Cruise

Costs Excluding Fuel as if the current periods’ cur-

rency exchange rates had remained constant with the

comparable prior periods’ rates, or on a “Constant

Currency” basis.

It should be emphasized that Constant Currency is

primarily used for comparing short-term changes

and/or projections. Over the longer term, changes in

guest sourcing and shifting the amount of purchases

between currencies can significantly change the impact

of the purely currency-based fluctuations.

The use of certain significant non-GAAP measures,

such as Net Yields, Net Cruise Costs and Net Cruise

Costs Excluding Fuel, allows us to perform capacity

and rate analysis to separate the impact of known

capacity changes from other less predictable changes

which affect our business. We believe these non-GAAP

measures provide expanded insight to measure reve-

nue and cost performance in addition to the standard

United States GAAP based financial measures. There

are no specific rules or regulations for determining

non-GAAP and Constant Currency measures, and as

such, there exists the possibility that they may not be

comparable to other companies within the industry.

EXECUTIVE OVERVIEW

Midway through 2014, we announced our Double-

Double program, which called for increasing the

Company’s Return on Invested Capital (“ROIC”) to

double digits and doubling our 2014 Adjusted Earn-

ings per Share, both by 2017. Our aim, through this

program, is to provide shareholders with increased

visibility into our long-term financial goals by means

of a formalized and measured framework. To achieve

these goals, we maintain our focus on three key

objectives: growing revenue yields, maintaining cost

consciousness and pursuing moderate capacity growth.

Our 2014 results were in line with our Double-Double

program. Based on our results, we remain confident

that we are on the right path for realizing these objec-

tives. We finished 2014 with net income of $764.1 mil-

lion, or $3.43 per diluted share, compared to $473.7

million, or $2.14 per diluted share, in 2013. Adjusted

Net Income was $755.7 million, or $3.39 per share,

compared to $539.2 million, or $2.44 per share, in

2013. Adjusted Earnings per Share of $3.39 per share

represented approximately a 40% increase in year-

over-year EPS growth and established a new record

for our Company.

Caribbean capacity for the industry grew by 13% in

2014 and comprised 49% of our total capacity. This

considerable growth led to increased levels of promo-

tional activity throughout the industry and depressed

our pricing power. Helping offset the Caribbean was

the double-digit yield improvement in Europe and

China. The European season was the strongest we

have seen in several years and China’s ability to absorb

our capacity growth while driving higher yields con-

tinues to impress.