Royal Caribbean Cruise Lines 2014 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 Royal Caribbean Cruises Ltd.

PART II

under Item 8. Financial Statements and Supplemen-

tary Data for further information.

• As of September 30, 2014, we changed our voyage

proration methodology and recognized passenger

ticket revenues, revenues from onboard and other

goods and services and all associated cruise operat-

ing costs for all of our uncompleted voyages, includ-

ing voyages of ten days or less, on a pro-rata basis.

The effect of this change was an increase to net

income of $53.2 million for the year ended December

31, 2014. Refer to Note 2. Summary of Significant

Accounting Policies to our consolidated financial

statements under Item 8. Financial Statements and

Supplementary Data for further information.

• During the fourth quarter of 2014, Spain adopted

tax reform legislation that, among other things,

amended the net operating loss carryforward rules.

As a result, we reversed a portion of the deferred tax

asset valuation allowance recorded in 2012 which

resulted in a deferred tax benefit of $33.5 million.

Refer to Note 12. Income Taxes to our consolidated

financial statements under Item 8. Financial State-

ments and Supplementary Data for further discus-

sion on the transaction.

Other Items

• On March 31, 2014, Pullmantur sold the majority

of its interest in its non-core businesses. Refer to

Note 16. Restructuring and Related Charges to our

consolidated financial statements under Item 8.

Financial Statements and Supplementary Data for

further discussion on the sales transaction.

• In December 2014, we terminated the leasing of

Brilliance of the Seas under the 25-year operating

lease originally entered into in July 2002, denomi-

nated in British pound sterling. As part of the agree-

ment, we purchased the Brilliance of the Seas for

a net settlement purchase price of approximately

£175.4 million or $275.4 million. Refer to Note 5.

Property and Equipment to our consolidated finan-

cial statements under Item 8. Financial Statements

and Supplementary Data for further discussion on

the transaction.

• During 2014, we entered into an agreement with

STX France S.A. to build the fourth Oasis-class ship

for Royal Caribbean International. Refer to Note 15.

Commitments and Contingencies to our consolidated

financial statements for further information.

• During the fourth quarter of 2014, we repurchased

from A. Wilhelmsen AS, our largest shareholder, 3.5

million shares of our common stock. Refer to Note 8.

Shareholders’ Equity to our consolidated financial

statements for further information.

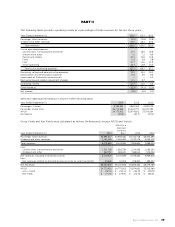

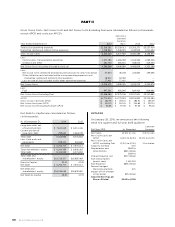

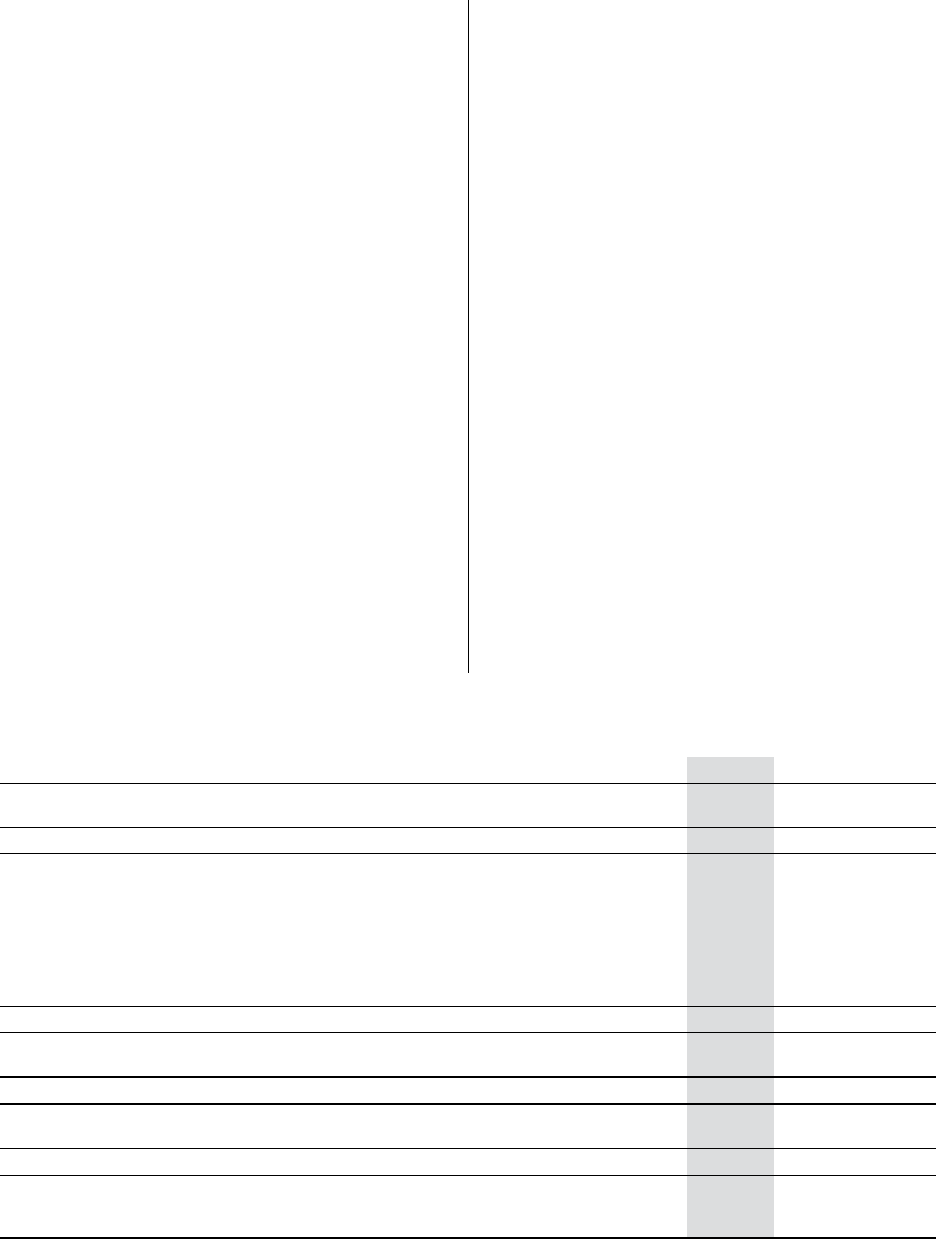

We reported total revenues, operating income, net income, Adjusted Net Income, earnings per share and Adjusted

Earnings per Share as shown in the following table (in thousands, except per share data):

Year Ended December 31,

Adjusted Net Income

Net income

Net Adjustments to Net Income (Decrease) Increase ()

Adjustments to Net Income:

Pullmantur impairment related charges() — —

Restructuring and related impairment charges —

Other initiative costs — —

Estimated impact of divested businesses prior to sales transaction

Loss on sale of ship included within other operating expenses — —

Impact of voyage proration change() () — —

Reversal of a deferred tax valuation allowance () — —

Net Adjustments to Net Income (Decrease) Increase ()

Basic:

Adjusted Earnings per Share

Earnings per Share

Diluted:

Adjusted Earnings per Share

Earnings per Share

Weighted-Average Shares Outstanding:

Basic

Diluted

() Includes $28.5 million in net deferred tax expense related to the Pullmantur impairment.

() Represents the net income amount that would have been recognized in 2013 had we recognized revenues and cruise operating expenses on a pro-

rata basis for all voyages.