Royal Caribbean Cruise Lines 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 93

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

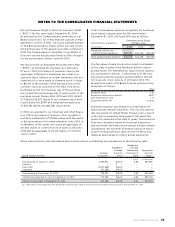

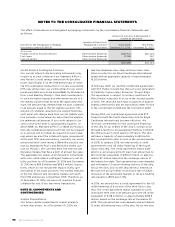

We enter into foreign currency forward contracts, col-

lar options and cross currency swap agreements to

manage portions of the exposure to movements in

foreign currency exchange rates. As of December 31,

2014, the aggregate cost of our ships on order was

approximately $5.0 billion, of which we had deposited

$394.4 million as of such date. Approximately 28.8%

and 36.3% of the aggregate cost of the ships under

construction was exposed to fluctuations in the Euro

exchange rate at December 31, 2014 and 2013, respec-

tively. The majority of our foreign currency forward

contracts, collar options and cross currency swap

agreements are accounted for as cash flow, fair value

or net investment hedges depending on the designa-

tion of the related hedge.

During 2013, we entered into foreign currency for-

ward contracts to hedge €365.0 million of our €745.0

million 5.625% unsecured senior notes due January

2014. These foreign currency forward contracts were

accounted for as cash flow hedges and matured

January 2014.

On a regular basis, we enter into foreign currency

forward contracts and, from time to time, we utilize

cross-currency swap agreements to minimize the vol-

atility resulting from the remeasurement of net mone-

tary assets and liabilities denominated in a currency

other than our functional currency or the functional

currencies of our foreign subsidiaries. During 2014,

we maintained an average of approximately $474.0

million of these foreign currency forward contracts.

These instruments are not designated as hedging

instruments. In 2014, 2013 and 2012 changes in the

fair value of the foreign currency forward contracts

were (losses) gains of approximately $(48.6) million,

$(19.3) million and $7.7 million, respectively, which

offset gains (losses) arising from the remeasurement

of monetary assets and liabilities denominated in for-

eign currencies in those same years of $49.5 million,

$13.4 million and $(11.8) million, respectively. These

changes were recognized in earnings within Other

income (expense) in our consolidated statements

of comprehensive income (loss).

We consider our investments in our foreign operations

to be denominated in relatively stable currencies and

of a long-term nature. In January 2014, we entered into

foreign currency forward contracts and designated

them as hedges of a portion of our net investments

in Pullmantur and TUI Cruises of €415.6 million, or

approximately $502.9 million, based on the exchange

rate at December 31, 2014. These forward currency

contracts mature in April 2016.

The notional amount of outstanding foreign exchange

contracts, including our forward contracts and collar

options, as of December 31, 2014 and 2013 was $3.0

billion and $2.5 billion, respectively.

Non-Derivative Instruments

We also address the exposure of our investments in

foreign operations by denominating a portion of our

debt in our subsidiaries’ and investments’ functional

currencies and designating it as a hedge of these

subsidiaries and investments. We designated debt

as a hedge of our net investments in Pullmantur and

TUI Cruises of approximately €139.4 million and

€544.9 million, or approximately $168.7 million and

$750.8 million, through December 31, 2014 and 2013,

respectively.

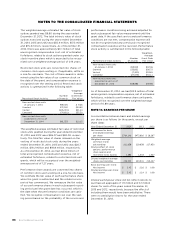

Fuel Price Risk

Our exposure to market risk for changes in fuel prices

relates primarily to the consumption of fuel on our

ships. We use fuel swap agreements and fuel call

options to mitigate the financial impact of fluctuations

in fuel prices.

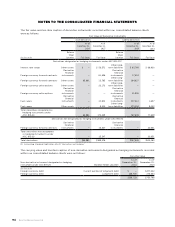

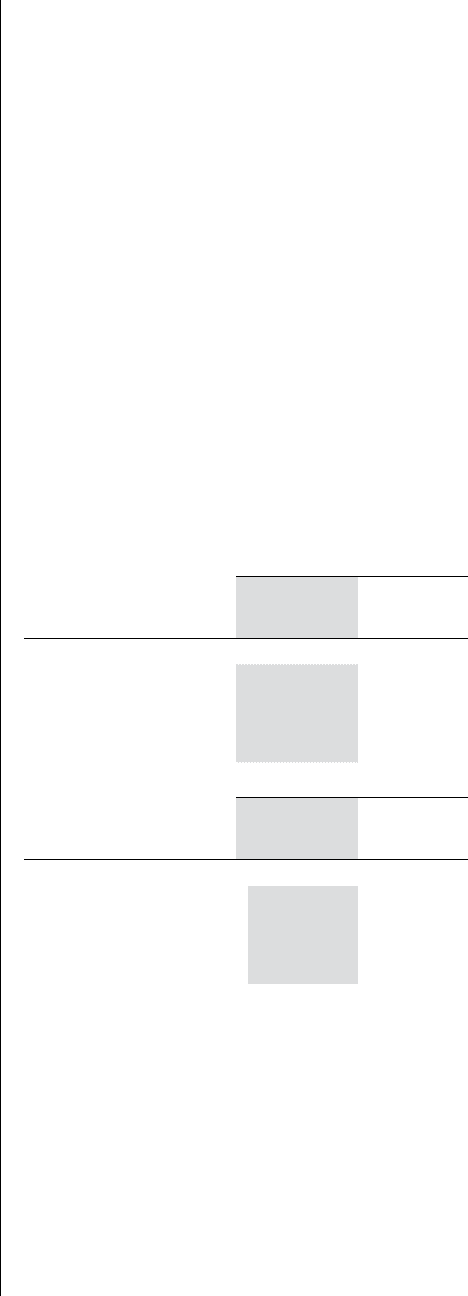

Our fuel swap agreements are accounted for as cash

flow hedges. At December 31, 2014, we have hedged

the variability in future cash flows for certain fore-

casted fuel transactions occurring through 2018. As

of December 31, 2014 and 2013, we had the following

outstanding fuel swap agreements:

Fuel Swap Agreements

Asof

December

Asof

December

(metric tons)

—

—

Fuel Swap Agreements

Projected fuel purchases

for year:

Asof

December

Asof

December

(% hedged)

—

—

At December 31, 2014 and 2013, $(223.1) million and

$9.5 million, respectively, of estimated unrealized

net (loss) gain associated with our cash flow hedges

pertaining to fuel swap agreements were expected to

be reclassified to earnings from Accumulated other

comprehensive (loss) income within the next twelve

months. Reclassification is expected to occur as the

result of fuel consumption associated with our hedged

forecasted fuel purchases.