Royal Caribbean Cruise Lines 2014 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 51

PART II

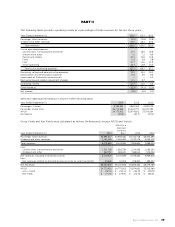

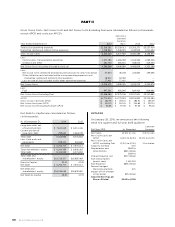

First Quarter 2015 AsReported

Constant

Currency

Net Yields Approx() ()to()

Net Cruise Costs per

APCD ()to() Approx()

Net Cruise Costs per

APCD, excluding Fuel Flattoup to

Capacity Increase

Depreciation and

Amortization

to

million

Interest Expense, net

to

million

Fuel Consumption

(metric tons)

Fuel Expenses million

Percent Hedged

(fwd consumption)

Impact of 10% change

in fuel prices million

Adjusted Earnings per

Share—Diluted to

Since our earnings release on January 29, 2015, book-

ings have remained encouraging and consistent with

our previous expectations. Accordingly, our forecast

has remained essentially unchanged.

YEAR ENDED DECEMBER 31, 2014 COMPARED TO

YEAR ENDED DECEMBER 31, 2013

In this section, references to 2014 refer to the year

ended December 31, 2014 and references to 2013

refer to the year ended December 31, 2013.

Revenues

Total revenues for 2014 increased $114.0 million, or

1.4%, to $8.1 billion from $8.0 billion in 2013.

Passenger ticket revenues comprised 73.0% of our

2014 total revenues. Passenger ticket revenues

increased by $171.1 million, or 3.0%, to $5.9 billion in

2014 from $5.7 billion in 2013. The increase was pri-

marily due to:

• a 2.4% increase in capacity, which increased Passen-

ger ticket revenues by $134.6 million. The increase in

capacity was primarily due to the addition of Quantum

of the Seas which entered service in October 2014

and the transfer of Monarch of the Seas to Pullmantur

in April 2013 reducing capacity in 2013 due to the

two-month lag further discussed in Note 1. General

to our consolidated financial statements. Passenger

ticket revenues also includes the impact of the change

in our voyage proration methodology; and

• an increase in ticket prices driven by greater demand

for close-in European and Asian sailings, which was

partially offset by a decrease in ticket prices for

Caribbean sailings, all of which contributed to a

$99.1 million increase in Passenger ticket revenues.

The increase in passenger ticket revenues was par-

tially offset by the unfavorable effect of changes in

foreign currency exchange rates related to our revenue

transactions denominated in currencies other than the

United States dollar of approximately $62.5 million.

The remaining 27.0% of 2014 total revenues was com-

prised of onboard and other revenues, which decreased

$57.2 million, or 2.6%. The decrease in onboard and

other revenues was primarily due to a $177.2 million

decrease in revenues related to Pullmantur’s non-core

businesses that were sold in 2014 as noted above. The

decrease was partially offset by:

• a $45.5 million increase in onboard revenue attribut-

able to higher spending on a per passenger basis

primarily due to our ship upgrade programs and

other revenue enhancing initiatives, including vari-

ous beverage initiatives, the addition and promotion

of specialty restaurants, the increased revenue asso-

ciated with internet and other telecommunication

services and other onboard activities;

• a $46.0 million increase attributable to the 2.4%

increase in capacity noted above, which includes the

impact of the change in our voyage proration; and

• a $28.7 million increase in other revenue of which

the largest driver is attributable to an out-of-period

adjustment of approximately $13.9 million that was

recorded in 2013 to correct the calculation of our

liability for our credit card rewards program.

Onboard and other revenues included concession

revenues of $324.3 million in 2014 and $316.3 million

in 2013.

Cruise Operating Expenses

Total cruise operating expenses for 2014 increased

$1.0 million. The increase was primarily due to:

• a $119.4 million increase attributable to the 2.4%

increase in capacity noted above, which includes

the impact of the change in our voyage proration

methodology;

• a $37.8 million increase in head taxes mainly attrib-

utable to itinerary changes;

• the loss recognized on the sale of Celebrity Century

of $17.4 million; and

• a $12.5 million increase primarily attributable to

vessel maintenance due to the timing of scheduled

drydocks.