Royal Caribbean Cruise Lines 2014 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2014 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Royal Caribbean Cruises Ltd. 83

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

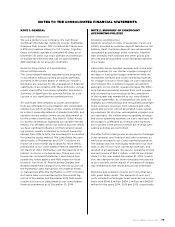

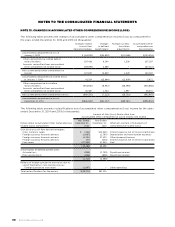

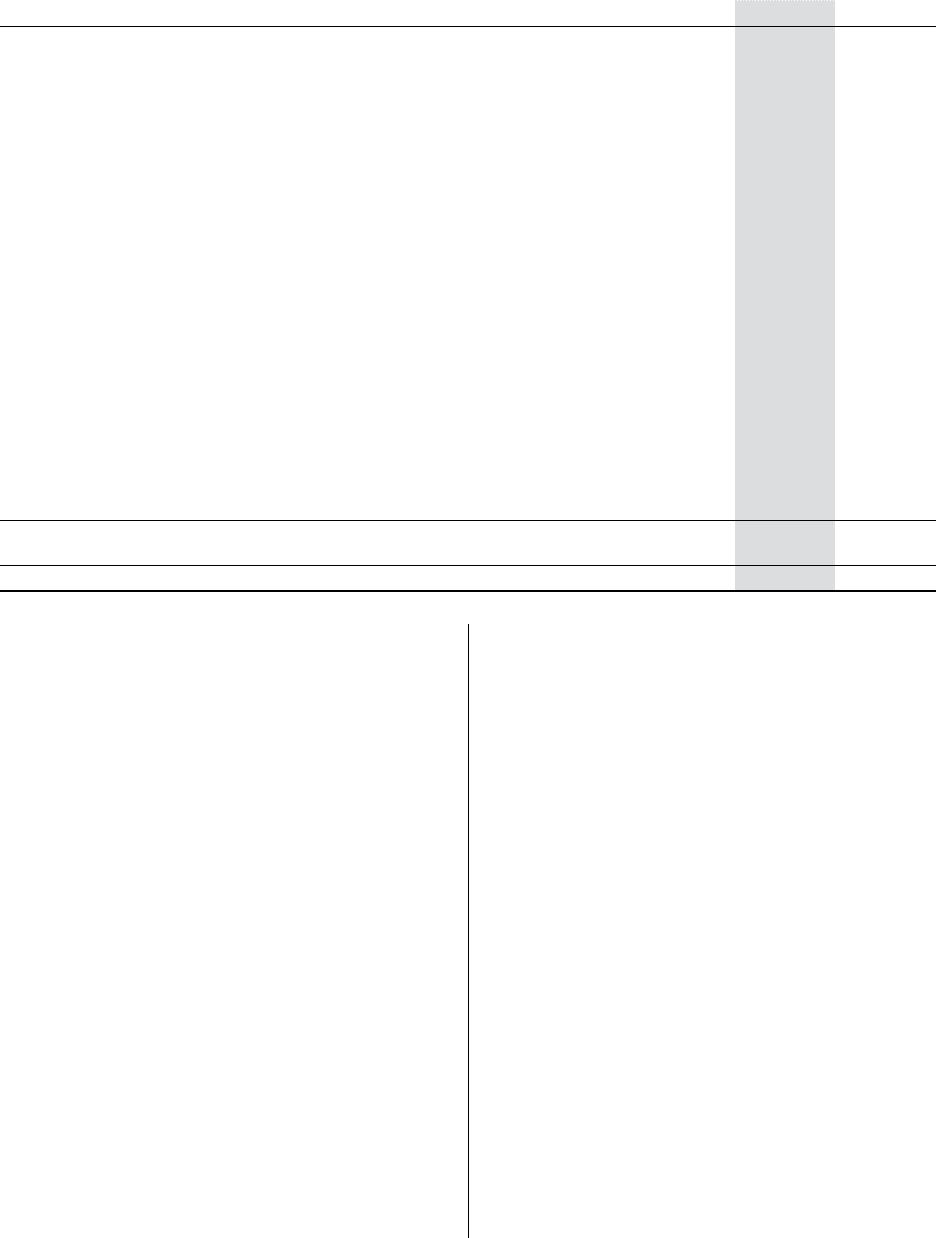

NOTE 7. LONG-TERM DEBT

Long-term debt consists of the following (in thousands):

$1.1 billion unsecured revolving credit facility, LIBOR plus 1.75%, currently 1.92% and

a facility fee of 0.37%, due 2016

$1.2 billion unsecured revolving credit facility, LIBOR plus 1.75%, currently 1.91% and

a facility fee of 0.37%, due 2018

Unsecured senior notes and senior debentures, 5.25% to 11.88%, due 2015, 2016,

2018, 2022 and 2027

€745 million unsecured senior notes, 5.63%, due 2014 —

$589 million unsecured term loan, 4.47%, due through 2014 —

$530 million unsecured term loan, LIBOR plus 0.51%, currently 0.83%, due through 2015

$519 million unsecured term loan, LIBOR plus 0.45%, currently 0.77%, due through 2020

$420 million unsecured term loan, 5.41%, due through 2021

$420 million unsecured term loan, LIBOR plus 1.85%, currently 2.17%, due through 2021

€159.4 million unsecured term loan, EURIBOR plus 1.58%, currently 1.77%, due through 2021

$524.5 million unsecured term loan, LIBOR plus 0.50%, currently 0.83%, due through 2021

$566.1 million unsecured term loan, LIBOR plus 0.37%, currently 0.69%, due through 2022

$1.1 billion unsecured term loan, LIBOR plus 1.85%, currently 2.17%, due through 2022

$632.0 million unsecured term loan, LIBOR plus 0.40%, currently 0.73%, due through 2023

$673.5 million unsecured term loan, LIBOR plus 0.40%, currently 0.73%, due through 2024

$65.0 million unsecured term loan, LIBOR plus 2.12%, currently 2.29%, due through 2019 —

$1.0 million unsecured term loan, 3.00%, due through 2015 —

$380.0 million unsecured term loan, LIBOR plus 2.12%, currently 2.29%, due through 2018 —

$791.1 million unsecured term loan, LIBOR plus 1.30%, currently 1.62%, due through 2026 —

$290.0 million unsecured term loan, LIBOR plus 2.5%, currently 2.67%, due 2016

€365 million unsecured term loan, EURIBOR plus 2.30%, currently 2.32%, due 2017

$7.3 million unsecured term loan, LIBOR plus 2.5%, currently 2.82%, due through 2023

$30.3 million unsecured term loan, LIBOR plus 3.75%, currently 3.99%, due through 2021

Capital lease obligations

Less—current portion () ()

Long-term portion

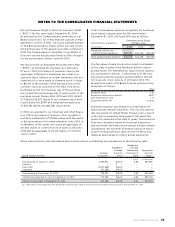

In January 2014, we borrowed $380.0 million under

a previously committed unsecured term loan facility.

The loan is due and payable at maturity in August

2018. Interest on the loan accrues at a floating rate

based on LIBOR plus the applicable margin. The

applicable margin varies with our debt rating and

was 2.12% as of December 31, 2014. The proceeds

of this loan were used to repay our €745.0 million

5.625% unsecured senior notes due January 2014.

In January 2014, we amended and restated our €365.0

million unsecured term loan due July 2017. Interest on

the amended facility accrues at a floating rate based

on EURIBOR plus a margin which varies with our credit

rating. The amendment reduced the margin, which at

our current credit rating resulted in a decrease from

3.00% to 2.30%. The amendment did not result in the

extinguishment of debt.

In March 2014, we amended our unsecured term loans

for Oasis of the Seas and Allure of the Seas primarily

to reduce the margins on those facilities and eliminate

the lenders option to exit those facilities in 2015 and

2017, respectively. The interest rate on the $420.0 mil-

lion floating rate tranche of the Oasis of the Seas term

loan was reduced from LIBOR plus 2.10% to LIBOR

plus 1.85%. The interest rate on the entire $1.1 billion

Allure of the Seas term loan was reduced from LIBOR

plus 2.10% to LIBOR plus 1.85%. These amendments

did not result in the extinguishment of debt.

During 2014, we took delivery of Quantum of the

Seas. To finance the purchase, we borrowed $791.1

million under a previously committed unsecured term

loan which is 95% guaranteed by Hermes. The loan

amortizes semi-annually over 12 years and bears inter-

est at LIBOR plus a margin of 1.30%, currently 1.62%.

In addition, during 2012, we entered into forward-

starting interest rate swap agreements which effec-

tively converted the floating rate available to us per

the credit agreement to a fixed rate, including the

applicable margin, of 3.74% effective October 2014

through the remaining term of the loan. See Note 14.

Fair Value Measurements and Derivative Instruments

for further information regarding these agreements.

During 2014, we increased the capacity of our unse-

cured revolving credit facility due August 2018 by

$300 million by utilizing the accordion feature, bring-

ing our total capacity under this facility to $1.2 billion

as of December 31, 2014. We also have a revolving

credit facility due July 2016 with capacity of $1.1 bil-

lion as of December 31, 2014, giving us an aggregate

revolving borrowing capacity of $2.3 billion.