Royal Caribbean Cruise Lines 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 92

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

A class action complaint was filed in June 2011 against

Royal Caribbean Cruises Ltd. in the United States

District Court for the Southern District of Florida on

behalf of a purported class of stateroom attendants

employed onboard Royal Caribbean International

cruise vessels alleging that they were required to

pay other crew members to help with their duties in

violation of the U.S. Seaman’s Wage Act. The lawsuit

also alleges that certain stateroom attendants were

required to work back of house assignments without

the ability to earn gratuities in violation of the U.S.

Seaman’s Wage Act. Plaintiffs seek judgment for

damages, wage penalties and interest in an indetermi-

nate amount. We have filed a Motion to Dismiss the

Complaint on the basis that the applicable collective

bargaining agreement requires any such claims to be

arbitrated. We believe we have meritorious defenses

to the lawsuit which we intend to vigorously pursue.

We commenced an action in June 2010 in the United

States District Court for Puerto Rico seeking a declar-

atory judgment that Puerto Rico’s distributorship laws

do not apply to our relationship with an international

representative located in Puerto Rico. In September

2010, that international representative filed a number

of counterclaims against Royal Caribbean Cruises Ltd.

and Celebrity Cruises, Inc. alleging violations of Puerto

Rico’s distributorship laws, bad faith breach of con-

tract, tortious interference with contract, violations of

various federal and state antitrust and unfair competi-

tion laws. The international representative is seeking

in excess of $40.0 million on each of these counter-

claims together with treble damages in the amount of

$120.0 million on several of the counterclaims as well

as injunctive relief and declaratory judgment. We

believe that the claims made against us are without

merit and we intend to vigorously defend ourselves

against them.

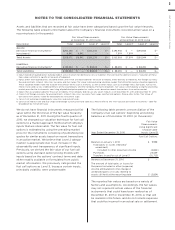

In January 2010, we reached a settlement with Rolls

Royce in our lawsuit that was pending in the Circuit

Court for Miami-Dade County, Florida against Rolls

Royce for the recurring Mermaid pod failures. As part

of the settlement, each party dismissed the lawsuit

with prejudice and released the other from all claims

and counterclaims made by each party against the

other. Under the terms of the settlement, we received

a payment in the first quarter of 2010 of approxi-

mately $68.0 million, net of costs and payments to

insurers, and will receive an additional $20.0 million

that will be payable within five years. We recorded a

one-time gain of approximately $85.6 million in the

first quarter of 2010 in connection with this settle-

ment, comprised of the $68.0 million payment and

the net present value of the $20.0 million receivable

or $17.6 million. This amount was recognized within

other income (expense) in our consolidated financial

statements.

We are routinely involved in other claims typical

within the cruise vacation industry. The majority of

these claims are covered by insurance. We believe the

outcome of such claims, net of expected insurance

recoveries, will not have a material adverse impact on

our financial condition or results of operations and

cash flows.

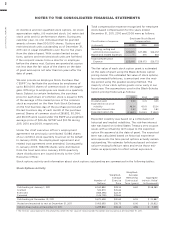

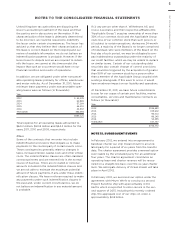

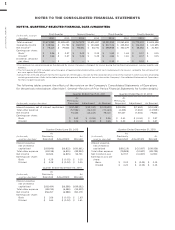

Operating Leases

In July 2002, we entered into an operating lease

denominated in British pound sterling for the Brilliance

of the Seas. The lease payments vary based on ster-

ling LIBOR. The lease has a contractual life of 25 years;

however, both the lessor and we have certain rights

to cancel the lease at years 10 (i.e., 2012) and 18 (i.e.,

2020) upon advance notice given approximately one

year prior to cancellation. Accordingly, at the incep-

tion of the lease, the lease term for accounting pur-

poses was established to be 10 years. In June 2011,

the lessor advised us that it would not exercise its

right to cancel the lease in 2012 and we subsequently

made a determination that we will not exercise our

right to cancel the lease in 2012. As a result, we per-

formed a lease classification analysis and concluded

that the lease should continue to be classified as an

operating lease. In the event of early termination at

year 18, we have the option to cause the sale of the

vessel at its fair value and to use the proceeds towards

the applicable termination payment. Alterna tively,

we could opt at such time to make a termination

payment of approximately £66.8 million, or approxi-

mately $103.8 million based on the exchange rate at

December 31, 2011 and relinquish our right to cause

the sale of the vessel. This is analogous to a guaran-

teed residual value. This termination amount, which

is our maximum exposure, has been included in the

table below for noncancelable operating leases.

Under current circumstances we do not believe early

termination of this lease is probable.

Under the Brilliance of the Seas operating lease, we

have agreed to indemnify the lessor to the extent its

after-tax return is negatively impacted by unfavorable

changes in corporate tax rates, capital allowance

deductions and certain unfavorable determinations

which may be made by United Kingdom tax authori-

ties. These indemnifications could result in an increase

in our lease payments. We are unable to estimate the

maximum potential increase in our lease payments

due to the various circumstances, timing or a combi-

nation of events that could trigger such indemnifica-

tions. We have been advised by the lessor that the