Royal Caribbean Cruise Lines 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 81

of our second Project Sunshine ship. The credit agree-

ments make available to us for each ship an unsecured

term loan in an amount up to the United States dollar

equivalent corresponding to approximately €595.0

million, with funding of 50% of each facility subject

to syndication prior to delivery. Hermes has agreed

to guarantee to the lender payment of 95% of each

financing. The loans amortize semi-annually and will

mature 12 years following delivery of the applicable

ship. Interest on the loans will accrue at our election

at either a fixed rate of 4.76% or a floating rate at

LIBOR plus a margin of 1.30%.

During 2008, we entered into a credit agreement

providing financing for Celebrity Reflection which is

scheduled for delivery in the fourth quarter of 2012.

The credit agreement provides for an unsecured term

loan for up to 80% of the purchase price of the vessel

which will be 95% guaranteed by Hermes and will be

funded at delivery. The loan will have a 12-year life

with semi-annual amortization, and will bear interest

at our election of either a fixed rate of 4.13% (inclusive

of the applicable margin) or a floating rate at LIBOR

plus a margin of 0.40%.

In February 2012, the credit facility we obtained in

connection with our purchase of Celebrity Solstice

was assigned from Celebrity Solstice Inc., our subsid-

iary which owns the ship, to Royal Caribbean Cruises

Ltd. Similar assignments were simultaneously made

from the ship-owning subsidiary level to Royal

Caribbean Cruises Ltd. for the facilities relating to

Celebrity Equinox, Celebrity Eclipse and Celebrity

Silhouette and for the credit agreement relating to

Celebrity Reflection, expected to be delivered in the

fourth quarter of 2012. Other than the change in bor-

rower, the economic terms of these facilities remain

unchanged. These amended facilities each contain

covenants substantially similar to the covenants, in

our other parent-level ship financing agreements

and our revolving credit facilities.

Certain of our unsecured term loans are guaranteed

by the export credit agency in the respective country

in which the ship is constructed. In consideration for

these guarantees, depending on the financing arrange-

ment, we pay to the applicable export credit agency

fees that range from either (1) 1.13% to 1.96% per annum

based on the outstanding loan balance semi-annually

over the term of the loan (subject to adjustment in

certain of our facilities based upon our credit ratings)

or (2) an upfront fee of approximately 2.3% to 2.37%

of the maximum loan amount. We amortize the fees

that are paid upfront over the life of the loan and those

that are paid semi-annually over the life of the loan

over each respective payment period. We classify

these fees within Debt issuance costs in our consoli-

dated statement of cash flows. During the second

quarter of 2011, we identified errors in the manner

in which we were amortizing fees related to three

outstanding export credit agency guaranteed loans,

and to a much lesser extent, fees associated with

our revolving credit facilities. See Note 1. General—

Revision of Prior Period Financial Statements for

further details.

Under certain of our agreements, the contractual

interest rate, facility fee and/or export credit agency

fee vary with our debt rating.

The unsecured senior notes and senior debentures are

not redeemable prior to maturity, except that certain

series may be redeemed upon the payment of a

make-whole premium.

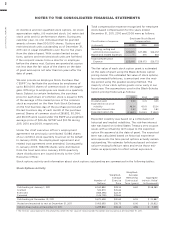

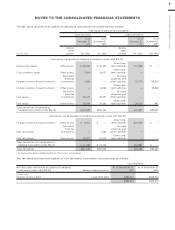

Following is a schedule of annual maturities on long-

term debt including capital leases as of December 31,

2011 for each of the next five years (in thousands):

Year

Thereafter

NOTE 8. SHAREHOLDERS’ EQUITY

In July 2011, our Board of Directors reinstated our

quarterly dividend which had previously been dis-

continued in the fourth quarter of 2008. We declared

and paid a cash dividend on our common stock of

$0.10 per share during the third quarter of 2011 and

declared a cash dividend on our common stock of

$0.10 per share in December 2011, which was paid in

the first quarter of 2012.

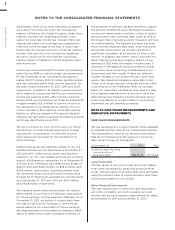

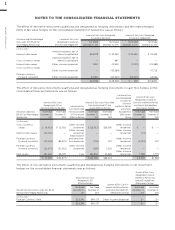

NOTE 9. STOCK-BASED EMPLOYEE

COMPENSATION

We have three stock-based compensation plans, which

provide for awards to our officers, directors and key

employees. The plans consist of a 1995 Incentive

Stock Option Plan, a 2000 Stock Award Plan, and a

2008 Equity Plan. The 1995 Incentive Stock Option

Plan terminated by its terms in February 2005. The

2000 Stock Award Plan, as amended, and the 2008

Equity Plan, as amended, provide for the issuance

of up to 13,000,000 and 11,000,000 shares of our

common stock, respectively, pursuant to grants of