Royal Caribbean Cruise Lines 2011 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ROYAL CARIBBEAN CRUISES LTD. 57

We partially address the exposure of our investments

in foreign operations by denominating a portion of

our debt in our subsidiaries’ and investments’ func-

tional currencies. Specifically, we have assigned debt

of €665.0 million, or approximately $863.2 million as

a hedge of our net investment in foreign operations.

Accordingly, we have included approximately $13.2

million of foreign-currency transaction gains in the

foreign-currency translation adjustment component

of accumulated other comprehensive income (loss)

at December 31, 2011. A hypothetical 10% increase or

decrease in the December 31, 2011 foreign currency

exchange rate would increase or decrease the fair

value of our assigned debt by $92.1 million, which

would be offset by a corresponding decrease or

increase in the United States dollar value of our net

investment.

Lastly, during 2011, we entered into foreign currency

forward contracts to minimize volatility in earnings

resulting from the remeasurement of net monetary

assets and payables denominated in a currency other

than the United States dollar. On a weekly basis, we

enter into an average of approximately $262.0 million

of these foreign currency forward contracts. These

instruments generally settle on a weekly basis and are

not designated as hedging instruments. Changes in

the fair value of the foreign currency forward con-

tracts are recognized in earnings within other income

(expense) in our consolidated statements of operations.

Fuel Price Risk

Our exposure to market risk for changes in fuel

prices primarily relates to the consumption of fuel

on our ships. Fuel cost (net of the financial impact of

fuel swap agreements), as a percentage of our total

revenues, was approximately 10.1% in 2011, 9.6% in

2010 and 10.2% in 2009. We use a range of instru-

ments including fuel swap agreements and fuel call

options to mitigate the financial impact of fluctuations

in fuel prices. During 2011, we terminated 100% of our

fuel call options maturing in 2011 and 2012 in order to

monetize previously recorded gains pertaining to the

fuel call options’ fair value prior to their expiration.

Upon termination of these options, we recognized a

gain of approximately $7.3 million and received net

cash proceeds of approximately $34.3 million.

As of December 31, 2011, we had fuel swap agreements

to pay fixed prices for fuel with an aggregate notional

amount of approximately $1.1 billion, maturing through

2015. The fuel swap agreements represent 55% of our

projected 2012 fuel requirements, 47% of our projected

2013 fuel requirements, 30% of our projected 2014

fuel requirements and 20% of our projected 2015 fuel

requirements. The estimated fair value of these con-

tracts at December 31, 2011 was estimated to be an

asset of $79.8 million. As of December 31, 2011, we

had fuel call options on a total of 1.0 million barrels

which mature in 2013. The fuel call options represent

9% of our projected 2013 fuel requirements. The esti-

mated fair value of these contracts at December 31,

2011 was an asset of approximately $16.4 million.

We estimate that a hypothetical 10% increase in our

weighted-average fuel price from that experienced

during the year ended December 31, 2011 would

increase our 2012 fuel cost by approximately $42.0

million, net of the impact of fuel swap agreements.

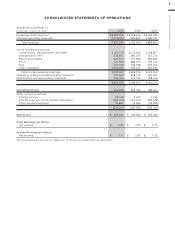

ITEM 8. FINANCIAL STATEMENTS AND

SUPPLEME NTARY DATA

Our Consolidated Financial Statements and Quarterly

Selected Financial Data are included beginning on

page 65 of this report.

ITEM 9. CHANGES IN AND DISAGREEMENTS

WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ITEM 9A. CONTROLS AND PROCEDURES

EVALUATION OF DISCLOSURE CONTROLS

AND PROCEDURES

Our management, with the participation of our

Chairman and Chief Executive Officer and Executive

Vice President and Chief Financial Officer, conducted

an evaluation of the effectiveness of our disclosure

controls and procedures, as such term is defined in

Exchange Act Rule 13a-15(e), as of the end of the

period covered by this report. Based upon such evalu-

ation, our Chairman and Chief Executive Officer and

Executive Vice President and Chief Financial Officer

concluded that those controls and procedures are

effective to provide reasonable assurance that informa-

tion required to be disclosed by us in the reports that

we file or submit under the Exchange Act is accumu-

lated and communicated to management, including

our Chairman and Chief Executive Officer and our

Executive Vice President and Chief Financial Officer,

as appropriate, to allow timely decisions regarding

required disclosure and are effective to provide rea-

sonable assurance that such information is recorded,

processed, summarized and reported within the time

periods specified by the SEC’s rules and forms.