Royal Caribbean Cruise Lines 2011 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ROYAL CARIBBEAN CRUISES LTD. 43

FINANCIAL PRESENTATION

DESCRIPTION OF CERTAIN LINE ITEMS

Revenues

Our revenues are comprised of the following:

đƫƫPassenger ticket revenues, which consist of revenue

recognized from the sale of passenger tickets and the

sale of air transportation to and from our ships; and

đƫƫOnboard and other revenues, which consist primarily

of revenues from the sale of goods and/or services

onboard our ships not included in passenger ticket

prices, cancellation fees, sales of vacation protection

insurance, pre- and post-cruise tours, Pullmantur’s

land-based tours and hotel and air packages includ-

ing Pullmantur Air’s charter business to third parties.

Onboard and other revenues also include revenues we

receive from independent third party concessionaires

that pay us a percentage of their revenues in exchange

for the right to provide selected goods and/or services

onboard our ships.

Cruise Operating Expenses

Our cruise operating expenses are comprised of the

following:

đƫƫCommissions, transportation and other expenses,

which consist of those costs directly associated with

passenger ticket revenues, including travel agent

commissions, air and other transportation expenses,

port costs that vary with passenger headcounts and

related credit card fees;

đƫƫOnboard and other expenses, which consist of the

direct costs associated with onboard and other rev-

enues, including the costs of products sold onboard

our ships, vacation protection insurance premiums,

costs associated with pre- and post-cruise tours and

related credit card fees as well as the minimal costs

associated with concession revenues, as the costs

are mostly incurred by third-party concessionaires;

đƫƫPayroll and related expenses, which consist of costs

for shipboard personnel (costs associated with our

shoreside personnel are included in marketing, selling

and administrative expenses);

đƫƫFood expenses, which include food costs for both

guests and crew;

đƫƫFuel expenses, which include fuel and related delivery

and storage costs, including the financial impact of

fuel swap agreements; and

đƫƫOther operating expenses, which consist primarily

of operating costs such as repairs and maintenance,

port costs that do not vary with passenger head-

counts, vessel operating lease costs, costs associated

with Pullmantur’s land-based tours and Pullmantur

Air’s charter business to third parties, vessel related

insurance and entertainment.

We do not allocate payroll and related costs, food

costs, fuel costs or other operating costs to the expense

categories attributable to passenger ticket revenues or

onboard and other revenues since they are incurred

to provide the total cruise vacation experience.

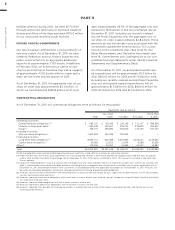

SELECTED OPERATIONAL AND FINANCIAL METRICS

We utilize a variety of operational and financial metrics

which are defined below to evaluate our performance

and financial condition. As discussed in more detail

herein, certain of these metrics are non-GAAP financial

measures which we believe provide useful information

to investors as a supplement to our consolidated

financial statements, which are prepared and presented

in accordance with GAAP. The presentation of non-

GAAP financial information is not intended to be con-

sidered in isolation or as a substitute for, or superior

to, the financial information prepared and presented

in accordance with GAAP.

Available Passenger Cruise Days (“APCD”) is our

measurement of capacity and represents double

occupancy per cabin multiplied by the number of

cruise days for the period. We use this measure to

perform capacity and rate analysis to identify our

main non-capacity drivers that cause our cruise

revenue and expenses to vary.

Gross Cruise Costs represent the sum of total cruise

operating expenses plus marketing, selling and

administrative expenses.

Gross Yields represent total revenues per APCD.

Net Cruise Costs and Net Cruise Costs Excluding Fuel

represent Gross Cruise Costs excluding commissions,

transportation and other expenses and onboard and

other expenses and, in the case of Net Cruise Costs

Excluding Fuel, fuel (each of which is described above

under the Description of Certain Line Items heading).

In measuring our ability to control costs in a manner

that positively impacts net income, we believe changes

in Net Cruise Costs and Net Cruise Costs Excluding

Fuel to be the most relevant indicators of our perfor-

mance. A reconciliation of historical Gross Cruise Costs

to Net Cruise Costs and Net Cruise Costs Excluding

Fuel is provided below under Results of Operations.

We have not provided a quantitative reconciliation of

projected Gross Cruise Costs to projected Net Cruise

Costs and projected Net Cruise Costs Excluding Fuel

due to the significant uncertainty in projecting the costs

deducted to arrive at these measures. Accordingly,