Royal Caribbean Cruise Lines 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ROYAL CARIBBEAN CRUISES LTD. 45

in Southern Europe in order to target guests in key

source markets in the region and increase capacity

in Northern Europe. In addition, Celebrity Cruises will

have additional product offerings in Australia and Asia.

During 2012, we plan to further strengthen our con-

sumer engagement by strategically investing in a

number of potential revenue enhancing projects

including further developing our customer loyalty

programs, expanding our international distribution

system, continuing with our vessel revitalization pro-

gram, introducing new onboard revenue initiatives

and implementing various information technology

infrastructure investments. We believe these invest-

ments will provide opportunities for increased ticket

and onboard revenues with the ultimate goal of maxi-

mizing our return on invested capital and long-term

shareholder value. In October 2012, Celebrity Cruises

will introduce Celebrity Reflection, the fifth Solstice-

class ship which will offer sailings in Europe and the

Caribbean. We also have two Project Sunshine vessels

on order for Royal Caribbean International which are

expected to enter service in the third quarter of 2014

and in the second quarter of 2015, respectively.

Our liquidity position at the end of 2011 remained

strong and our credit metrics have improved. We

continue to be focused on our goal of returning to an

investment grade credit rating. In 2011, we amended

our $1.225 billion unsecured revolving credit facility

which was due to expire in June 2012. We have

extended the termination date through July 2016 and

reduced the facility amount to $875.0 million. This

facility, combined with our $525.0 million unsecured

revolving credit facility that matures in November

2014, provides us with access to $1.4 billion in revolv-

ing credit capacity. As a result of our strong liquidity

position, in July 2011, our Board of Directors reinstated

our quarterly dividend at a rate of $0.10 per share. We

anticipate funding our 2012 scheduled maturities and

other obligations in 2012 through operating cash flows,

our current available revolving credit facilities and our

current financing arrangements, although we may

opportunistically access the credit and capital markets.

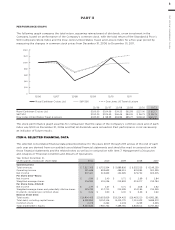

RESULTS OF OPERATIONS

Summary

YEAR ENDED DECEMBER 31, 2011

Total revenues increased 11.6% to $7.5 billion in 2011

from total revenues of $6.8 billion in 2010, primarily

due to a 7.5% increase in capacity (measured by APCD

for such period) and a 4.1% increase in Net Yields. The

increase in Net Yields was primarily due to an increase

in ticket prices and the favorable effect on our reve-

nues of changes in foreign currency exchange rates.

These increases were partially offset by the impact of

geopolitical events including the political unrest in the

Eastern Mediterranean and Northern Africa and the

earthquake and related events in Japan. These events

resulted in deployment changes to avoid calling on

ports in those areas and pricing reductions to stimulate

demand in other areas. The increase in total revenues

was partially offset by higher operating expenses pri-

marily due to the increase in capacity, an increase in

fuel expenses and, to a lesser extent, the unfavorable

effect of changes in foreign currency exchange rates.

Our results for 2011 were also positively impacted

by income from our investments in unconsolidated

subsidiaries of $22.2 million in 2011 as compared to

income of $0.2 million in 2010, and a gain on our fuel

call options of $18.9 million in 2011 as compared to a

loss of $2.8 million in 2010. We also recorded a one-

time gain during 2010 of approximately $89.0 million,

net of costs and payments to insurers, related to a liti-

gation settlement that did not recur in 2011. As a

result, our net income was $607.4 million or $2.77 per

share on a diluted basis for 2011 compared to $515.7

million or $2.37 per share on a diluted basis for 2010.

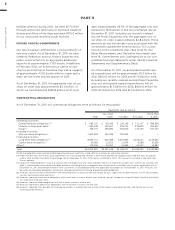

Significant items for 2011 include:

đƫƫ1.ƫ!0ƫ!0ġ0+ġ,%0(ƫ.0%+ƫ !.!/! ƫ0+ƫąĊċĆŌƫ

in 2011 from 52.5% in 2010. Similarly, our Debt-to-

Capital ratio decreased to 50.3% in 2011 from 53.7%

in 2010.

đƫƫ!ƫ/+( ƫCelebrity Mercury to TUI Cruises for €234.3

million. We executed certain forward contracts to

lock in the sales price at approximately $290.0 million.

The sale resulted in a gain of $24.2 million which,

due to the related party nature of the transaction,

is being recognized primarily over the remaining life

of the ship, estimated to be 17 years.

đƫƫ/ƫ+"ƫ!!)!.ƫăāČƫĂĀāāČƫ+1.ƫ(%-1% %05ƫ3/ƫĸāċāƫ%(-

lion, including cash and the undrawn portion of our

unsecured revolving credit facilities. During 2011, we

amended and restated our $1.225 billion unsecured

revolving credit facility which was due to expire in

June 2012. We have extended the termination date

through July 2016 and reduced the facility amount

to $875.0 million. See Note 7. Long-Term Debt to

our consolidated financial statements under Item 8.

Financial Statements and Supplementary Data for

further information.

đƫƫ!ƫ0++'ƫ !(%2!.5ƫ+"ƫCelebrity Silhouette, the fourth

Solstice-class ship for Celebrity Cruises. To finance

the purchase, we borrowed $632.0 million under a

12-year unsecured term loan which is 95% guaranteed

by Euler Hermes Kreditversicherungs AG (“Hermes”),

the official export credit agency of Germany. See

Note 7. Long-Term Debt to our consolidated financial

statements under Item 8. Financial Statements and

Supplementary Data for further information.