Royal Caribbean Cruise Lines 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

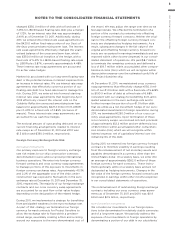

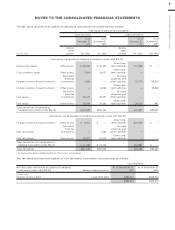

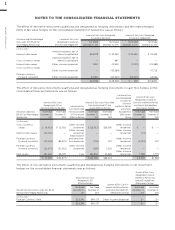

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 91

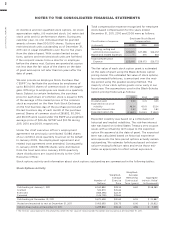

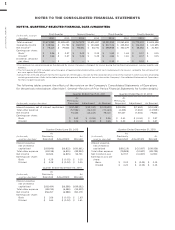

The effect of derivatives not designated as hedging instruments on the consolidated financial statements was

as follows:

Amount of Gain (Loss) Recognized

in Income on Derivative

Derivatives Not Designated as Hedging

Instruments under ASC 815-20

Location of Gain (Loss)

Recognized in Income on

Derivative

Year Ended

December 31, 2011

Year Ended

December 31, 2010

(in thousands)

Foreign exchange contracts Other income (expense) ()

Fuel call options Other income (expense) ()

()

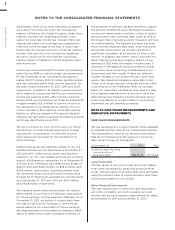

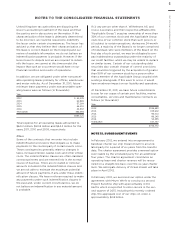

Credit Related Contingent Features

Our current interest rate derivative instruments may

require us to post collateral if our Standard & Poor’s

and Moody’s credit ratings remain below specified

levels. Specifically, if on the fifth anniversary of enter-

ing into a derivative transaction and on all succeeding

fifth-year anniversaries our credit ratings for our senior

unsecured debt were to be below BBB- by Standard &

Poor’s and Baa3 by Moody’s, then each counterparty

to such derivative transaction with whom we are in a

net liability position that exceeds the applicable mini-

mum call amount may demand that we post collateral

in an amount equal to the net liability position. The

amount of collateral required to be posted following

such event will change each time our net liability posi-

tion increases or decreases by more than the applica-

ble minimum call amount. If our credit rating for our

senior debt is subsequently equal to, or above BBB-

by Standard & Poor’s or Baa3 by Moody’s, then any

collateral posted at such time will be released to us

and we will no longer be required to post collateral

unless we meet the collateral trigger requirement at

the next fifth-year anniversary. Currently, our senior

unsecured debt credit rating is BB with a stable out-

look by Standard & Poor’s and Ba2 with a stable out-

look by Moody’s. We currently have three interest rate

derivative transactions that have a term of at least

five years. One of these transactions will reach its fifth

anniversary in July 2012. All of the instruments relat-

ing to this transaction are in a net asset position as

of December 31, 2011. Therefore, as of December 31,

2011, we are not required to post collateral for any of

our derivative instruments.

NOTE 14. COMMITMENTS AND

CONTINGENCIES

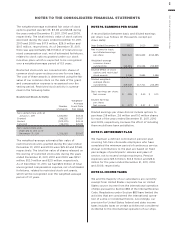

Capital Expenditures

Our future capital commitments consist primarily of

new ship orders. As of December 31, 2011, we had

Celebrity Reflection and one Project Sunshine ship

under construction for an aggregate additional capac-

ity of approximately 7,100 berths.

As of December 31, 2011, the aggregate cost of the

two ships currently under construction including

amounts due to the shipyard and other ship related

costs was approximately $2.0 billion, of which we had

deposited $185.8 million as of such date. Approxi-

mately 43.3% of the aggregate cost of these two ships

was exposed to fluctuations in the euro exchange rate

at December 31, 2011. These amounts do not include

any costs associated with the construction agreement

entered into by TUI Cruises to build its first newbuild

ship. (See Note 13. Fair Value Measurements and

Derivative Instruments.)

We have committed bank financing arrangements

for Celebrity Reflection and our two Project Sunshine

ships, each of which include sovereign financing

guarantees.

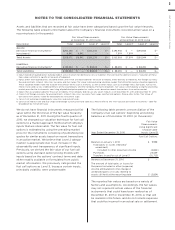

Litigation

Between August 1, 2011 and September 8, 2011, three

similar purported class action lawsuits were filed

against us and certain of our officers in the U.S. District

Court of the Southern District of Florida. The cases

have since been consolidated and a consolidated

amended complaint was filed on February 17, 2012.

The consolidated amended complaint was filed on

behalf of a purported class of purchasers of our

common stock during the period from October 26,

2010 through July 27, 2011 and names the Company,

our Chairman and CEO, our CFO and the Presidents

and CEOs of our Royal Caribbean International and

Celebrity Cruises brands as defendants. The con-

solidated amended complaint alleges violations of

Section 10(b) of the Securities Exchange Act of 1934

and SEC Rule 10b-5 as well as, in the case of the indi-

vidual defendants, the control person provisions of

the Securities Exchange Act. The complaint principally

alleges that the defendants knowingly made incorrect

statements concerning the Company’s outlook for 2011

by not taking into proper account lagging European

and Mediterranean bookings. The consolidated

amended complaint seeks unspecified damages,

interest, and attorneys’ fees. We believe the claims

are without merit and we intend to vigorously defend

ourselves against them.