Royal Caribbean Cruise Lines 2011 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 82

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(i) incentive and non-qualified stock options, (ii) stock

appreciation rights, (iii) restricted stock, (iv) restricted

stock units and (v) performance shares. During any

calendar year, no one individual shall be granted

awards of more than 500,000 shares. Options and

restricted stock units outstanding as of December 31,

2011 vest in equal installments over four to five years

from the date of grant. With certain limited excep-

tions, options and restricted stock units are forfeited

if the recipient ceases to be a director or employee

before the shares vest. Options are granted at a price

not less than the fair value of the shares on the date

of grant and expire not later than ten years after the

date of grant.

We also provide an Employee Stock Purchase Plan

(“ESPP”) to facilitate the purchase by employees of

up to 800,000 shares of common stock in the aggre-

gate. Offerings to employees are made on a quarterly

basis. Subject to certain limitations, the purchase

price for each share of common stock is equal to 90%

of the average of the market prices of the common

stock as reported on the New York Stock Exchange

on the first business day of the purchase period and

the last business day of each month of the purchase

period. Shares of common stock of 28,802, 30,054,

and 65,005 were issued under the ESPP at a weighted-

average price of $29.46, $27.87 and $12.78 during

2011, 2010 and 2009, respectively.

Under the chief executive officer’s employment

agree ment we previously contributed 10,086 shares

of our common stock quarterly to a trust on his behalf.

In January 2009, the employment agreement and

related trust agreement were amended. Consequently,

in January 2009, 768,018 shares were distributed

from the trust and since January 2009 quarterly

share distributions are issued directly to the Chief

Executive Officer.

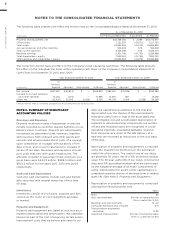

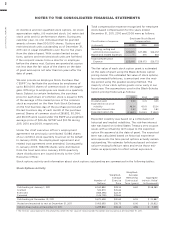

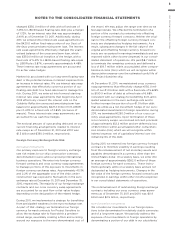

Total compensation expense recognized for employee

stock-based compensation for the years ended

December 31, 2011, 2010 and 2009 were as follows:

Classification of expense

Employee Stock-Based

Compensation

(in thousands)

Marketing, selling and

administrative expenses

Payroll and related expenses —

Total Compensation

Expense

The fair value of each stock option grant is estimated

on the date of grant using the Black-Scholes option

pricing model. The estimated fair value of stock options,

less estimated forfeitures, is amortized over the vest-

ing period using the graded-vesting method. The

majority of our stock option grants occur early in our

fiscal year. The assumptions used in the Black-Scholes

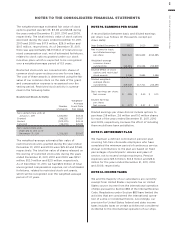

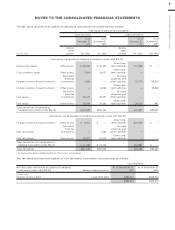

option-pricing model are as follows:

Dividend yield

Expected stock price

volatility

Risk-free interest rate

Expected option life 6 years 6 years 5 years

Expected volatility was based on a combination of

historical and implied volatilities. The risk-free interest

rate was based on United States Treasury zero coupon

issues with a remaining term equal to the expected

option life assumed at the date of grant. The expected

term was calculated based on historical experience

and represents the time period options actually remain

outstanding. We estimate forfeitures based on histori-

cal pre-vesting forfeiture rates and revise those esti-

mates as appropriate to reflect actual experience.

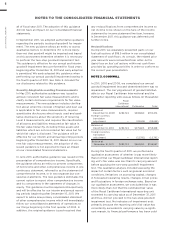

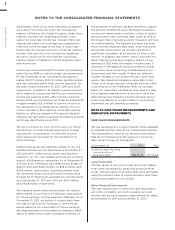

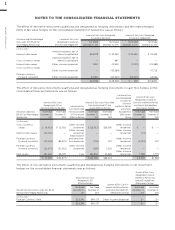

Stock options activity and information about stock options outstanding are summarized in the following tables:

Stock Options Activity

Weighted-

Weighted- Average

Average Remaining Aggregate

Number of Exercise Contractual Intrinsic Value1

Options Price Term (years) (in thousands)

Outstanding at January 1, 2011

Granted

Exercised ()

Canceled ()

Outstanding at December 31, 2011

Vested and expected to vest at December 31, 2011

Options Exercisable at December 31, 2011

1 The intrinsic value represents the amount by which the fair value of stock exceeds the option exercise price as of December 31, 2011.