Royal Caribbean Cruise Lines 2011 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

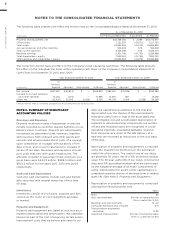

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 75

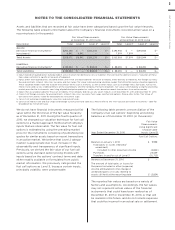

non-performance under derivative instruments, our

revolving credit facilities and new ship progress pay-

ment guarantees, is not considered significant, as we

primarily conduct business with large, well-established

financial institutions, insurance companies and export

credit agencies with which we have long-term rela-

tionships and which have credit risks acceptable to us

or where the credit risk is spread out among a large

number of counterparties. In addition, our exposure

under foreign currency contracts, fuel call options,

interest rate and fuel swap agreements that are in-the-

money, which is approximately $135.5 million as of

December 31, 2011, is limited to the cost of replacing

the contracts in the event of non-performance by

the counterparties to the contract, all of which are

currently our lending banks. We do not anticipate

non-performance by any of our significant counter-

parties. In addition, we have established guidelines

regarding credit ratings and instrument maturities

that we follow to maintain safety and liquidity. We

do not normally require collateral or other security

to support credit relationships; however, in certain

circumstances this option is available to us.

Earnings Per Share

Basic earnings per share is computed by dividing net

income by the weighted-average number of shares of

common stock outstanding during each period. Diluted

earnings per share incorporates the incremental shares

issuable upon the assumed exercise of stock options

and conversion of potentially dilutive securities. (See

Note 10. Earnings Per Share.)

Stock-Based Employee Compensation

We measure and recognize compensation expense at

the fair value of employee stock awards. Compensation

expense for awards and the related tax effects are

recognized as they vest. We use the estimated amount

of expected forfeitures to calculate compensation

costs for all outstanding awards.

Segment Reporting

We operate five wholly-owned cruise brands, Royal

Caribbean International, Celebrity Cruises, Azamara

Club Cruises, Pullmantur and CDF Croisières de France.

In addition, we have a 50% investment in a joint ven-

ture which operates the brand TUI Cruises with TUI AG.

We believe our global brands possess the versatility

to enter multiple cruise market segments within the

cruise vacation industry. Although each of our brands

has its own marketing style as well as ships and crews

of various sizes, the nature of the products sold and

services delivered by our brands share a common

base (i.e., the sale and provision of cruise vacations).

Our brands also have similar itineraries as well as

similar cost and revenue components. In addition,

our brands source passengers from similar markets

around the world and operate in similar economic

environments with a significant degree of commercial

overlap. As a result, our brands (including TUI Cruises)

have been aggregated as a single reportable segment

based on the similarity of their economic characteris-

tics, types of consumers, regulatory environment,

maintenance requirements, supporting systems and

processes as well as products and services provided.

Our Chairman and Chief Executive Officer has been

identified as the chief operating decision-maker and

all significant operating decisions including the alloca-

tion of resources are based upon the analyses of the

Company as a whole.

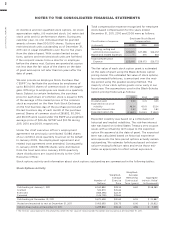

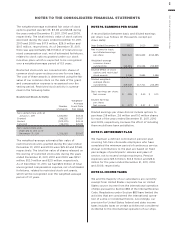

Information by geographic area is shown in the table

below. Passenger ticket revenues are attributed to

geographic areas based on where the reservation

originates.

Passenger ticket revenues:

United States

All other countries

Recently Adopted Accounting Standards

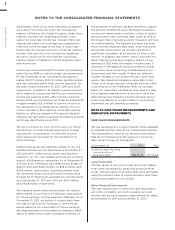

In January 2011, we adopted the remaining provisions

of authoritative guidance issued in 2010 which requires

enhanced disclosures for fair value measurements.

The remaining provisions of this guidance became

effective for our fiscal year 2011 interim and annual

consolidated financial statements and require entities

to present information about purchases, sales, issu-

ances and settlements of financial instruments mea-

sured at fair value within the third level of the fair

value hierarchy on a gross basis. See Note 13. Fair

Value Measurements and Derivative Instruments for

our disclosures required under this guidance.

In January 2011, we also adopted the remaining provi-

sions of authoritative guidance issued in 2010 which

requires enhanced and disaggregated disclosures

about the credit quality of financing receivables and

the allowance for credit losses. The remaining provi-

sions of this guidance became effective for our fiscal

year 2011 interim and annual consolidated financial

statements and require entities to disclose reporting

period activity for financing receivables and the allow-

ance for credit losses. The adoption of this guidance

did not have an impact on our consolidated financial

statements.

In July 2011, we adopted authoritative guidance issued

to clarify when a modification or restructuring of a

receivable constitutes a troubled debt restructuring.

In evaluating whether such a modification or restruc-

turing constitutes a troubled debt restructuring, a

creditor must separately conclude that two conditions

exist: (1) the modification or restructuring constitutes

a concession and (2) the debtor is experiencing finan-

cial difficulties. The guidance became effective for

our interim and annual reporting periods beginning

after June 15, 2011 and was applied retrospectively for