Royal Caribbean Cruise Lines 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

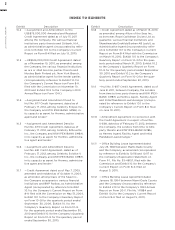

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 71

NOTE 1. GENERAL

Description of Business

We are a global cruise company. We own five cruise

brands, Royal Caribbean International, Celebrity

Cruises, Pullmantur, Azamara Club Cruises, and CDF

Croisières de France with a combined total of 39 ships

in operation at December 31, 2011. Our ships operate

on a selection of worldwide itineraries that call on

approximately 460 destinations. In addition, we have

a 50% investment in a joint venture which operates

the brand TUI Cruises with TUI AG, a German-based

multinational travel and tourism company.

Basis for Preparation of Consolidated

Financial Statements

The consolidated financial statements are prepared

in accordance with accounting principles generally

accepted in the United States of America (“GAAP”).

Estimates are required for the preparation of financial

statements in accordance with these principles. Actual

results could differ from these estimates.

All significant intercompany accounts and transactions

are eliminated in consolidation. We consolidate enti-

ties over which we have control, usually evidenced by

a direct ownership interest of greater than 50%, and

variable interest entities where we are determined to

be the primary beneficiary. See Note 6. Other Assets

for further information regarding our variable interest

entities. For affiliates we do not control but over which

we have significant influence on financial and operat-

ing policies, usually evidenced by a direct ownership

interest from 20% to 50%, the investment is accounted

for using the equity method. We consolidate the

operating results of Pullmantur and its wholly-owned

subsidiary, CDF Croisières de France, on a two-month

lag to allow for more timely preparation of our con-

solidated financial statements. No material events or

transactions affecting Pullmantur or CDF Croisières

de France have occurred during the two-month lag

period of November 2011 and December 2011 that

would require disclosure or adjustment to our consoli-

dated financial statements as of December 31, 2011.

Revision of Prior Period Financial Statements

In connection with the preparation of our consolidated

financial statements for the second quarter of 2011,

we identified and corrected errors in the manner in

which we were amortizing guarantee fees related to

three outstanding export credit agency guaranteed

loans, and to a much lesser extent, fees associated

with our revolving credit facilities. Previously, these

fees were amortized on a straight-line basis over the

life of the respective loan. Following identification of

the errors, in the second quarter of 2011, we corrected

our method of amortizing these guarantee fees based

on the timing of their payment, which payments are

made semi-annually and vary in amount depending

on a number of factors, including the relevant out-

standing loan balance and our credit rating. In accord-

ance with accounting guidance found in ASC 250-10

(SEC Staff Accounting Bulletin No. 99, Materiality),

we assessed the materiality of the errors and con-

cluded that the errors were not material to any of our

previously issued financial statements. In accordance

with accounting guidance found in ASC 250-10 (SEC

Staff Accounting Bulletin No. 108, Considering the

Effects of Prior Year Misstatements when Quantifying

Misstatements in Current Year Financial Statements),

we have revised all affected periods. These non-cash

errors did not impact our operating income or cash

flows for any prior period.

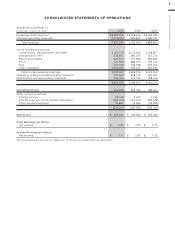

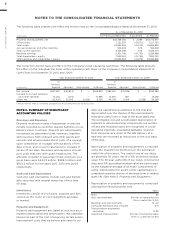

The following table presents the effects of the revision on the Company’s Consolidated Statements of Operations

for the respective annual periods. Please refer to Note 16. Quarterly Selected Financial Data (Unaudited) for the

respective quarterly periods.

Year Ended December 31, 2010 Year Ended December 31, 2009

(in thousands, except per share data)

As

Previously

Reported Adjustment As Revised

As

Previously

Reported Adjustment As Revised

Interest expense, net of interest capitalized () () () () () ()

Total other expense () () () () () ()

Net Income () ()

Earnings per Share:

Basic () ()

Diluted () ()