Royal Caribbean Cruise Lines 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

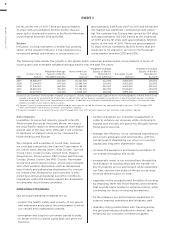

PART I

ROYAL CARIBBEAN CRUISES LTD. 11

facilities, fine dining, spa and wellness, butler service

for suites, as well as interactive entertainment venues.

Azamara Club Cruises also includes as part of the

base price of the cruise certain complimentary

onboard services, amenities and activities which are

not normally included in the base price of other cruise

lines including wine with lunch and dinner, bottled

water, soda, premium coffees and teas, gratuities for

housekeeping and dining/bar staff, self-service laun-

dry and shuttle buses for certain ports.

Pullmantur

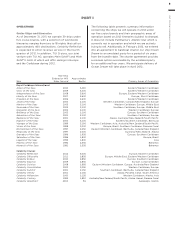

As of December 31, 2011, we operated five ships with

an aggregate capacity of approximately 7,650 berths

under our Pullmantur brand, offering cruise itineraries

that range from four to 12 nights. In February 2012, we

entered into an agreement to bareboat charter our

ship Ocean Dream to an unrelated party for a period

of six years from the transfer date. The charter agree-

ment provides a renewal option exercisable by the

unrelated party for an additional four years. We antic-

ipate delivery of Ocean Dream will take place in April

2012. In addition, in March 2012, Horizon will be rede-

ployed from Pullmantur to CDF Croisières de France

to replace Bleu de France which was sold in November

2010. Pullmantur serves the contemporary segment

of the Spanish, Portuguese and Latin American cruise

markets. Pullmantur also has land-based tour opera-

tions and owns a 49% interest in an air business that

operates four Boeing 747 aircrafts in support of its

cruise and tour operations.

Pullmantur’s strategy is to attract cruise guests by

providing a variety of cruising options and land-based

travel packages. Pullmantur offers a range of cruise

itineraries to Brazil, the Caribbean, Europe and the

Middle East. Pullmantur offers a wide array of onboard

activities and services to guests, including exercise

facilities, swimming pools, beauty salons, gaming

facilities, shopping, dining, certain complimentary

beverages, and entertainment venues. Pullmantur’s

tour operations sell land-based travel packages to

Spanish guests, including hotels and flights primarily

to Caribbean resorts, and land-based tour packages

to Europe aimed at Latin American guests.

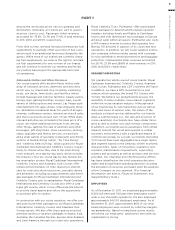

CDF Croisières de France

CDF Croisières de France is designed to serve the

contemporary segment of the French cruise market

by providing a brand custom tailored for French cruise

guests. CDF Croisières de France offers seasonal itin-

eraries to the Mediterranean and a variety of onboard

services, amenities and activities, including entertain-

ment venues, exercise and spa facilities, fine dining,

and gaming facilities.

Starting in the second quarter of 2012, CDF Croisières

de France will begin operating the 1,350-berth Horizon.

This ship is currently operated by Pullmantur and will

be redeployed to CDF Croisières de France in March

2012, following a revitalization to incorporate signature

brand elements. Until November 2011, CDF Croisières

de France operated Bleu de France under a one-year

charter agreement following the sale of the ship from

CDF Croisières de France to an unrelated third party

in November 2010.

TUI Cruises

We also have a joint venture that operates TUI Cruises,

which is designed to serve the contemporary and

premium segments of the German cruise market by

offering a custom-tailored product for German guests.

All onboard activities, services, shore excursions and

menu offerings are designed to suit the preferences

of this target market. TUI Cruises operates two ships,

Mein Schiff I and Mein Schiff II, with an aggregate

capacity of approximately 3,800 berths. In 2011, TUI

Cruises entered into a construction agreement to

build its first newbuild ship, scheduled for delivery in

the second quarter of 2014. TUI Cruises has an option

to construct a second ship of the same class, which

will expire on October 31, 2012. Our joint venture

partner is TUI AG, a German tourism and shipping

company that also owns 51% of TUI Travel.

INDUSTRY

Cruising is considered a well established vacation sec-

tor in the North American market, a growing sector in

the European market and a developing but promising

sector in several other emerging markets. Industry data

indicates that a significant portion of cruise guests

carried are first-time cruisers. We believe this presents

an opportunity for long-term growth and a potential

for increased profitability.

We estimate that the global cruise industry carried

20.2 million cruise guests in 2011 compared to

18.8 million cruise guests carried in 2010. We estimate

that the global cruise fleet was served by approxi-

mately 417,000 berths on approximately 285 ships

at the end of 2011. There are approximately 20 ships

with an estimated 62,000 berths that are expected

to be placed in service in the global cruise market

between 2012 and 2016, although it is also possible

that ships could be taken out of service during these

periods. The majority of cruise guests have historically

been sourced from North America and Europe.

North America

Although the North American cruise market has histor-

ically experienced significant growth, the compound

annual growth rate in cruise guests for this market

was approximately 3.2% from 2007 to 2011. This more

limited growth is attributable in large part to the recent

international expansion within the cruise industry. We

estimate that North America was served by 138 ships

with approximately 201,000 berths at the beginning

of 2007 and by 143 ships with approximately 248,000