Royal Caribbean Cruise Lines 2011 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 46

PART II

đƫƫ!ƫ!*0!.! ƫ%*0+ƫ#.!!)!*0/ƫ3%0$ƫ!5!.ƫ!."0ƫ

to build two ships of a new generation of Royal

Caribbean International cruise ships, known as

“Project Sunshine.” The ships will each have a

capacity of approximately 4,100 berths and are

expected to enter service in the third quarter of 2014

and in the second quarter of 2015, respectively. To

finance the ships, we entered into credit agreements

for each ship which make available to us 12-year

unsecured amortizing term loans in an amount up

to the United States dollar equivalent corresponding

to approximately €595.0 million, which are 95%

guaranteed by Hermes.

đƫƫ$!ƫ+),*5ƫ".+)ƫ3$%$ƫ3!ƫ(!/!ƫBrilliance of the

Seas advised us that it will not exercise its right to

cancel the lease in 2012 and we subsequently made

a determination that we will not exercise our right to

cancel the lease. Thus, the lease will continue until at

least 2020 when both parties again have the right to

cancel the lease. Refer to our lease discussion under

the heading Off-Balance Sheet Arrangements below

and Note 14. Commitments and Contingencies to

our consolidated financial statements under Item 8.

Financial Statements and Supplementary Data for

further information.

đƫƫ1.ƫ+. ƫ+"ƫ%.!0+./ƫ.!%*/00! ƫ+1.ƫ-1.0!.(5ƫ

dividend which had been discontinued in the fourth

quarter of 2008. We declared and paid a cash

dividend on our common stock of $0.10 per share

during the third quarter of 2011 and declared a cash

dividend on our common stock of $0.10 per share in

December 2011, which was paid in the first quarter

of 2012.

đƫƫ!ƫ)!* ! ƫ0$!ƫ1*/!1.! ƫ.! %0ƫ"%(%0%!/ƫ+0%*! ƫ

in connection with our financings of the Oasis of the

Seas and Allure of the Seas to reduce certain of the

interest rate costs. See Note 7. Long-Term Debt to

our consolidated financial statements under Item 8.

Financial Statements and Supplementary Data for

further information.

đƫƫƫ.1%/!/ƫ!*0!.! ƫ%*0+ƫ*ƫ#.!!)!*0ƫ3%0$ƫƫ

Finland to build its first newbuild ship, scheduled

for delivery in the second quarter of 2014. TUI

Cruises has entered into a credit agreement provid-

ing financing for up to 80% of the contract price of

the ship. TUI Cruises has an option to construct a

second ship of the same class, which will expire on

October 31, 2012.

Other Items:

đƫƫ*ƫ!.1.5ƫĂĀāĂČƫ3!ƫ!*0!.! ƫ%*0+ƫ*ƫ#.!!)!*0ƫ0+ƫ

bareboat charter our ship Ocean Dream to an unre-

lated party for a period of six years from the transfer

date. The charter agreement provides a renewal

option exercisable by the unrelated party for an

additional four years. We anticipate delivery of

Ocean Dream will take place in April 2012.

đƫƫ*ƫ!.1.5ƫĂĀāĂČƫ0$!ƫ.! %0ƫ"%(%05ƫ3!ƫ+0%*! ƫ%*ƫ

connection with our purchase of Celebrity Solstice

was assigned from Celebrity Solstice Inc., our sub-

sidiary which owns the ship, to Royal Caribbean

Cruises Ltd. Similar assignments were simultaneously

made from the ship-owning subsidiary level to Royal

Caribbean Cruises Ltd. for the facilities relating to

Celebrity Equinox, Celebrity Eclipse and Celebrity

Silhouette and for the credit agreement relating to

Celebrity Reflection, expected to be delivered in

the fourth quarter of 2012. Other than the change

in borrower, the economic terms of these facilities

remain unchanged. These amended facilities each

contain covenants substantially similar to the cove-

nants, in our other parent-level ship financing agree-

ments and our revolving credit facilities.

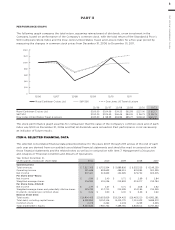

We reported historical total revenues, operating income,

net income and earnings per share as shown in the

following table (in thousands, except per share data):

Year Ended

December 31,

Total revenues

Operating income

Net income

Basic earnings

per share:

Net income

Diluted earnings

per share:

Net income