Royal Caribbean Cruise Lines 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 83

The weighted-average estimated fair value of stock

options granted was $21.39, $11.69 and $3.68 during

the years ended December 31, 2011, 2010 and 2009,

respectively. The total intrinsic value of stock options

exercised during the years ended December 31, 2011,

2010 and 2009 was $17.3 million, $26.9 million and

$0.5 million, respectively. As of December 31, 2011,

there was approximately $6.9 million of total unrecog-

nized compensation cost, net of estimated forfeitures,

related to stock options granted under our stock

incentive plans which is expected to be recognized

over a weighted-average period of 0.9 years.

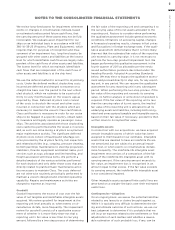

Restricted stock units are converted into shares of

common stock upon vesting on a one-for-one basis.

The cost of these awards is determined using the fair

value of our common stock on the date of the grant,

and compensation expense is recognized over the

vesting period. Restricted stock activity is summa-

rized in the following table:

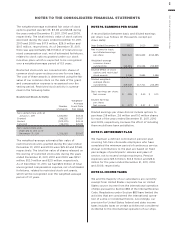

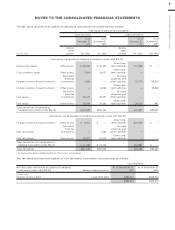

Restricted Stock Activity

Weighted-

Average

Number Grant Date

of Awards Fair Value

Non-vested share units at

January 1, 2011

Granted

Vested ()

Canceled ()

Non-vested share units

expected to vest as of

December 31, 2011

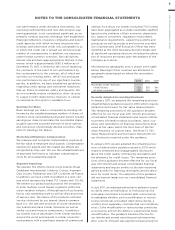

The weighted-average estimated fair value of

restricted stock units granted during the year ended

December 31, 2010 and 2009 were $25.32 and $7.68,

respectively. The total fair value of shares released on

the vesting of restricted stock units during the years

ended December 31, 2011, 2010 and 2009 was $25.1

million, $12.0 million and $2.5 million, respectively.

As of December 31, 2011, we had $8.5 million of total

unrecognized compensation expense, net of estimated

forfeitures, related to restricted stock unit grants,

which will be recognized over the weighted-average

period of 1.0 years.

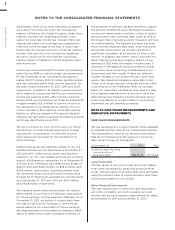

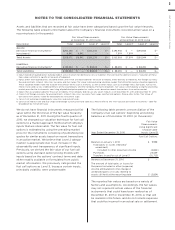

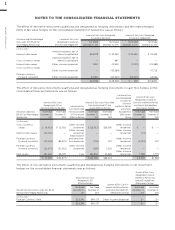

NOTE 10. EARNINGS PER SHARE

A reconciliation between basic and diluted earnings

per share is as follows (in thousands, except per

share data):

Year Ended December 31,

Net income for basic

and diluted earnings

pe r sh are

Weighted-average

common shares

outstanding

Dilutive effect of stock

options and restricted

stock awards

Diluted weighted-

average shares

outstanding

Basic earnings per share:

Net income

Diluted earnings

per share:

Net income

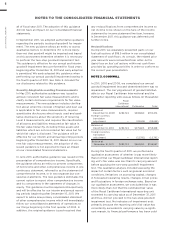

Diluted earnings per share did not include options to

purchase 2.8 million, 2.6 million and 5.0 million shares

for each of the years ended December 31, 2011, 2010

and 2009, respectively, because the effect of including

them would have been antidilutive.

NOTE 11. RETIREMENT PLAN

We maintain a defined contribution pension plan

covering full-time shoreside employees who have

completed the minimum period of continuous service.

Annual contributions to the plan are based on fixed

percentages of participants’ salaries and years of

service, not to exceed certain maximums. Pension

expenses were $15.3 million, $13.3 million and $13.6

million for the years ended December 31, 2011, 2010

and 2009, respectively.

NOTE 12. INCOME TAXES

We and the majority of our subsidiaries are currently

exempt from United States corporate tax on United

States source income from the international operation

of ships pursuant to Section 883 of the Internal Revenue

Code. Regulations under Section 883 have limited the

activities that are considered the international opera-

tion of a ship or incidental thereto. Accordingly, our

provision for United States federal and state income

taxes includes taxes on certain activities not considered

incidental to the international operation of our ships.