Royal Caribbean Cruise Lines 2011 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 42

PART II

Pullmantur reporting unit in our goodwill impairment

test. Based on the discounted cash flow model we

determined the fair value of our trademarks and trade

names exceeded their carrying value.

As of December 31, 2011, Pullmantur had deferred tax

assets of €25.9 million, or $33.6 million, resulting from

net operating losses. We regularly review deferred tax

assets for recoverability based on our history of earn-

ings, expectations for future earnings, and tax planning

strategies. We believe it is more-likely-than-not that

we will recover the deferred tax assets based on our

expectation of future earnings and implementation of

tax planning strategies. Realization of deferred tax

assets ultimately depends on the existence of sufficient

taxable income to support the amount of deferred

tax assets. It is possible we may need to establish a

valuation allowance for a portion or all of the deferred

tax asset balance if future earnings do not meet

expectations or we are unable to successfully imple-

ment our tax planning strategies.

Derivative Instruments

We enter into various forward, swap and option con-

tracts to manage our interest rate exposure and to

limit our exposure to fluctuations in foreign currency

exchange rates and fuel prices. These instruments are

recorded on the balance sheet at their fair value and

the vast majority are designated as hedges. We also

have non-derivative financial instruments designated

as hedges of our net investment in our foreign opera-

tions and investments. The fuel options we have

entered into represent economic hedges which are

not designated as hedging instruments for accounting

purposes and thus, changes in their fair value are

immediately recognized in earnings. Our derivative

instruments are not held for trading or speculative

purposes. We account for derivative financial instru-

ments in accordance with authoritative guidance.

Refer to Note 2. Summary of Significant Accounting

Policies and Note 13. Fair Value Measurements and

Derivative Instruments to our consolidated financial

statements for more information on related authorita-

tive guidance, the Company’s hedging programs and

derivative financial instruments.

We enter into foreign currency forward contracts

and interest rate, cross currency and fuel swaps and

options with third-party institutions in over-the-counter

markets. We estimate the fair value of our foreign

currency forward contracts and interest rate and

cross currency swaps using expected future cash flows

based on the instruments’ contract terms and pub-

lished forward curves for foreign currency exchange

and interest rates. We apply present value techniques

and LIBOR-based discount rates to convert the

expected future cash flows to the current fair value

of the instruments.

We estimate the fair value of our fuel swaps using

expected future cash flows based on the swaps’ con-

tract terms and forward prices. We derive forward

prices from forward fuel curves based on pricing inputs

provided by third-party institutions that transact in

the fuel indices we hedge. We validate these pricing

inputs against actual market transactions and pub-

lished price quotes for similar assets. We apply present

value techniques and LIBOR-based discount rates to

convert the expected future cash flows to the current

fair value of the instruments. We also corroborate our

fair value estimates using valuations provided by our

counterparties.

We estimate the fair value for our fuel call options

based on the prevailing market price for the instruments

consisting of published price quotes for similar assets

based on recent transactions in an active market.

We adjust the valuation of our derivative financial

instruments to incorporate credit risk, when applicable.

We believe it is unlikely that materially different esti-

mates for the fair value of our foreign currency for-

ward contracts and interest rate, cross currency and

fuel swaps and options would be derived from other

appropriate valuation models using similar assumptions,

inputs or conditions suggested by actual historical

experience.

Contingencies—Litigation

On an ongoing basis, we assess the potential liabilities

related to any lawsuits or claims brought against us.

While it is typically very difficult to determine the

timing and ultimate outcome of such actions, we use

our best judgment to determine if it is probable that

we will incur an expense related to the settlement or

final adjudication of such matters and whether a rea-

sonable estimation of such probable loss, if any, can

be made. In assessing probable losses, we take into

consideration estimates of the amount of insurance

recoveries, if any. We accrue a liability when we

believe a loss is probable and the amount of loss

can be reasonably estimated. Due to the inherent

uncertainties related to the eventual outcome of liti-

gation and potential insurance recoveries, it is possible

that certain matters may be resolved for amounts

materially different from any provisions or disclosures

that we have previously made.

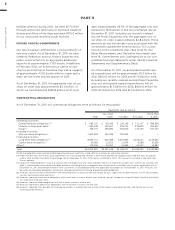

SEASONALITY

Our revenues are seasonal based on demand for

cruises. Demand is strongest for cruises during the

Northern Hemisphere’s summer months and holidays.

In order to mitigate the impact of the winter weather

in the Northern Hemisphere and to capitalize on the

summer season in the Southern Hemisphere, our brands

have increased deployment to South America and

Australia during the Northern Hemisphere winter months.