Royal Caribbean Cruise Lines 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 72

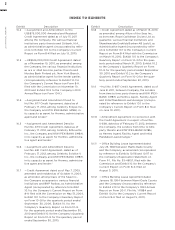

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

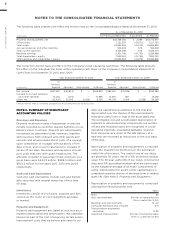

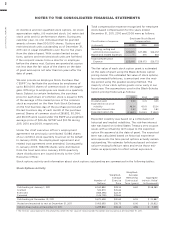

The following table presents the effect the revision had on the Consolidated Balance Sheet at December 31, 2010:

As of December 31, 2010

(in thousands) As Previously Reported Adjustment As Revised

Property and equipment, net

Other assets ()

Total assets ()

Accrued expenses and other liabilities

Total current liabilities

Retained earnings ()

Total shareholders’ equity ()

Total liabilities and shareholders’ equity ()

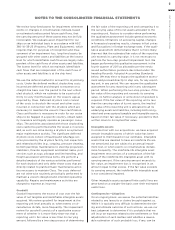

The correction did not have an effect on the Company’s total operating cash flows. The following table presents

the effect on the individual line items within operating cash flows on the Company’s Consolidated Statement of

Cash Flows for December 31, 2010 and 2009:

Year Ended December 31, 2010 Year Ended December 31, 2009

(in thousands)

As

Previously

Reported Adjustment Reclassification

1

As Revised

As

Previously

Reported Adjustment Reclassification

1

As Revised

Net Income () — () —

Increase in accrued expenses

and other liabilities () — —

Other, net () () ()

1 Please refer to Note 2. Summary of Significant Accounting Policies for discussion.

NOTE 2. SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

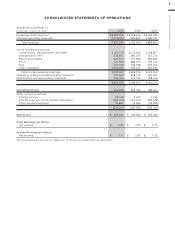

Revenues and Expenses

Deposits received on sales of passenger cruises are

initially recorded as customer deposit liabilities on our

balance sheet. Customer deposits are subsequently

recognized as passenger ticket revenues, together

with revenues from onboard and other goods and

services and all associated direct costs of a voyage,

upon completion of voyages with durations of ten

days or less, and on a pro rata basis for voyages in

excess of ten days. Revenues and expenses include

port costs that vary with guest headcounts. The

amounts included in passenger ticket revenues on a

gross basis were $442.9 million, $398.0 million and

$303.2 million for the years 2011, 2010 and 2009,

respectively.

Cash and Cash Equivalents

Cash and cash equivalents include cash and market-

able securities with original maturities of less than

90 days.

Inventories

Inventories consist of provisions, supplies and fuel

carried at the lower of cost (weighted-average)

or market.

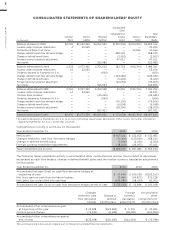

Property and Equipment

Property and equipment are stated at cost less accu-

mulated depreciation and amortization. We capitalize

interest as part of the cost of acquiring certain assets.

Improvement costs that we believe add value to our

ships are capitalized as additions to the ship and

depreciated over the shorter of the improvements’

estimated useful lives or that of the associated ship.

The estimated cost and accumulated depreciation of

replaced or refurbished ship components are written-

off and any resulting losses are recognized in cruise

operating expenses. Liquidated damages received

from shipyards as a result of the late delivery of a

new ship are recorded as reductions to the cost basis

of the ship.

Depreciation of property and equipment is computed

using the straight-line method over the estimated

useful life of the asset. The useful lives of our ships

are generally 30 years, net of a 15% projected residual

value. The 30-year useful life of our newly constructed

ships and 15% associated residual value are both based

on the weighted-average of all major components of

a ship. Depreciation for assets under capital leases is

computed using the shorter of the lease term or related

asset life. (See Note 5. Property and Equipment.)

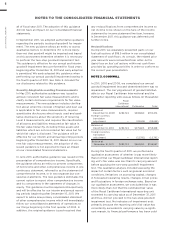

Depreciation of property and equipment is computed

utilizing the following useful lives:

Years

Ships 30

Ship improvements Shorter of remaining ship

life or useful life (3–20)

Buildings and improvements 10–40

Computer hardware and software 3–5

Transportation equipment

and other 3–30

Leasehold improvements Shorter of remaining lease

term or useful life (3–30)