Royal Caribbean Cruise Lines 2011 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 12

PART I

berths at the end of 2011. There are approximately

10 ships with an estimated 34,000 berths that are

expected to be placed in service in the North American

cruise market between 2012 and 2016.

Europe

In Europe, cruising represents a smaller but growing

sector of the vacation industry. It has experienced a

compound annual growth rate in cruise guests of

approximately 9.6% from 2007 to 2011 and we believe

this market has significant continued growth poten-

tial. We estimate that Europe was served by 104 ships

with approximately 100,000 berths at the beginning

of 2007 and by 121 ships with approximately 155,000

berths at the end of 2011. There are approximately

10 ships with an estimated 28,000 berths that are

expected to be placed in service in the European

cruise market between 2012 and 2016.

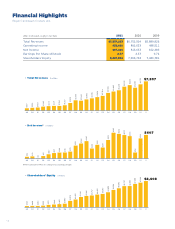

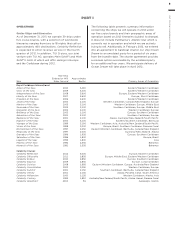

The following table details the growth in the global, North American and European cruise markets in terms of

cruise guests and estimated weighted-average berths over the past five years:

Year

Global Cruise

Guests(1)

Weighted-Average

Supply of Berths

Marketed Globally(1)

North American

Cruise

Guests(2)

Weighted-Average

Supply of Berths

Marketed in

North America(1)

European Cruise

Guests(3)

Weighted-Average

Supply of Berths

Marketed in

Europe(1)

(1) Source: Our estimates of the number of global cruise guests, and the weighted-average supply of berths marketed globally, in North America and

Europe are based on a combination of data that we obtain from various publicly available cruise industry trade information sources including

Seatrade Insider and Cruise Line International Association. In addition, our estimates incorporate our own statistical analysis utilizing the same

publicly available cruise industry data as a base.

(2) Source: Cruise Line International Association based on cruise guests carried for at least two consecutive nights for years 2007 through 2010.

Year 2011 amounts represent our estimates (see number 1 above).

(3) Source: European Cruise Council for years 2007 through 2010. Year 2011 amounts represent our estimates (see number 1 above).

Other Markets

In addition to expected industry growth in North

America and Europe as discussed above, we expect

the Asia/Pacific region to demonstrate an even higher

growth rate in the near term, although it will continue

to represent a relatively small sector compared to

North America and Europe.

We compete with a number of cruise lines; however,

our principal competitors are Carnival Corporation &

plc, which owns, among others, Aida Cruises, Carnival

Cruise Lines, Costa Cruises, Cunard Line, Holland

America Line, Iberocruceros, P&O Cruises and Princess

Cruises; Disney Cruise Line; MSC Cruises; Norwegian

Cruise Line and Oceania Cruises. Cruise lines compete

with other vacation alternatives such as land-based

resort hotels and sightseeing destinations for consum-

ers’ leisure time. Demand for such activities is influ-

enced by political and general economic conditions.

Companies within the vacation market are dependent

on consumer discretionary spending.

OPERATING STRATEGIES

Our principal operating strategies are to:

đƫƫ,.+0!0ƫ0$!ƫ$!(0$Čƫ/"!05ƫ* ƫ/!1.%05ƫ+"ƫ+1.ƫ#1!/0/ƫ

and employees and protect the environment in which

our vessels and organization operate,

đƫƫ/0.!*#0$!*ƫ* ƫ/1,,+.0ƫ+1.ƫ$1)*ƫ,%0(ƫ%*ƫ+. !.ƫ

to better serve our global guest base and grow our

business,

đƫƫ"1.0$!.ƫ/0.!*#0$!*ƫ+1.ƫ+*/1)!.ƫ!*##!)!*0ƫ%*ƫ

order to enhance our revenues while continuing to

expand and diversify our guest mix through interna-

tional guest sourcing,

đƫƫ)*#!ƫ0$!ƫ!""%%!*5ƫ+"ƫ+1.ƫ+,!.0%*#ƫ!4,!* %01.!/ƫ

and ensure adequate cash and liquidity, with the

overall goal of maximizing our return on invested

capital and long-term shareholder value,

đƫƫ%*.!/!ƫ0$!ƫ3.!*!//ƫ* ƫ).'!0ƫ,!*!0.0%+*ƫ+"ƫ

our brands throughout the world,

đƫƫ/0.0!#%((5ƫ%*2!/0ƫ%*ƫ+1.ƫ!4%/0%*#ƫ"(!!0ƫ0$.+1#$ƫ0$!ƫ

revitalization of existing ships and the transfer of

key innovations across each brand, while expanding

our fleet with the new state-of-the-art cruise ships

recently delivered and on order,

đƫƫ,%0(%6!ƫ+*ƫ0$!ƫ,+.0%(%05ƫ* ƫ"(!4%%(%05ƫ+"ƫ+1.ƫ/$%,/ƫ

by deploying them into those markets and itineraries

that provide opportunities to optimize returns, while

continuing our focus on existing key markets,

đƫƫ"1.0$!.ƫ!*$*!ƫ+1.ƫ0!$*+(+#%(ƫ,%(%0%!/ƫ0+ƫ

support ongoing operations and initiatives, and

đƫƫ)%*0%*ƫ/0.+*#ƫ.!(0%+*/$%,/ƫ3%0$ƫ0.2!(ƫ#!*%!/Čƫ

the principal industry distribution channel, while

enhancing our consumer outreach programs.