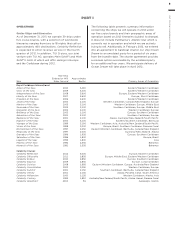

Royal Caribbean Cruise Lines 2011 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 26

PART I

States source shipping income and income from

activities incidental thereto.

We believe that most of our income and the income

of our ship-owning subsidiaries is derived from or

incidental to the international operation of a ship or

ships and, therefore, is exempt from taxation under

Section 883. Additionally, income earned through a

partnership will qualify as income derived from or

incidental to the international operation of a ship or

ships to the same extent as the income would so

qualify if earned directly by the partners. Thus, we

believe that United States source income derived from

or incidental to the international operation of a ship

or ships earned by the United Kingdom tonnage tax

company will qualify for exemption under Section 883

to the same extent as if it were earned directly by the

owners of the United Kingdom tonnage tax company.

Regulations under Section 883 list activities that are

not considered by the Internal Revenue Service to be

incidental to the international operation of ships

including income from the sale of air and land trans-

portation, shore excursions and pre- and post-cruise

tours. To the extent the income from these activities

is earned from sources within the United States, that

income will be subject to United States taxation.

Taxation in the Absence of an Exemption under

Section 883 of the Internal Revenue Code

If we, Celebrity Cruises, Inc. or our ship-owning subsid-

iaries were to fail to meet the requirements of Section

883 of the Internal Revenue Code, or if the provision

was repealed, then, as explained below, such compa-

nies would be subject to United States income taxation

on a portion of their income derived from or inciden-

tal to the international operation of our ships.

Because we and Celebrity Cruises, Inc. conduct a trade

or business in the United States, we and Celebrity

Cruises, Inc. would be taxable at regular corporate

rates on our separate company taxable income (i.e.,

without regard to the income of our ship-owning sub-

sidiaries) from United States sources. In addition, if

any of our earnings and profits effectively connected

with our United States trade or business were with-

drawn, or were deemed to have been withdrawn, from

our United States trade or business, those withdrawn

amounts would be subject to a “branch profits” tax at

the rate of 30%. We and Celebrity Cruises, Inc. would

also be potentially subject to tax on portions of certain

interest paid by us at rates of up to 30%.

If Section 883 were not available to our ship-owning

subsidiaries, each such subsidiary would be subject

to a special 4% tax on its United States source gross

transportation income, if any, each year because it does

not have a fixed place of business in the United States

and its income is derived from the leasing of a ship.

Other United States Taxation

Our primary domestic United States operation, the

Alaska land-tour operation, is subject to United States

federal income tax. Additionally, we and Celebrity

Cruises, Inc. earn United States source income from

activities not considered incidental to international

shipping. The tax on such income is not material to

our results of operation for all years presented.

State Taxation

We, Celebrity Cruises, Inc. and certain of our subsid-

iaries are subject to various United States state income

taxes which are generally imposed on each state’s

portion of the United States source income subject to

federal income taxes. Additionally, the state of Alaska

subjects an allocated portion of the total income of

companies doing business in Alaska and certain other

affiliated companies to Alaska corporate state income

taxes and also imposes a 33% tax on adjusted gross

income from onboard gambling activities conducted

in Alaska waters. This did not have a material impact

to our results of operations for all years presented.

MALTESE, SPANISH AND FRENCH INCOME TAX

Our Pullmantur ship owner-operator subsidiaries,

which include the owner-operator of CDF Croisieres

de France’s ship, qualify as licensed shipping organi-

zations in Malta. No Maltese income tax is charged

on the income derived from shipping activities of a

licensed shipping organization. Instead, a licensed

shipping organization is liable to pay a tonnage tax

based on the net tonnage of the ship or ships regis-

tered under the relevant provisions of the Merchant

Shipping Act. A company qualifies as a shipping orga-

nization if it engages in qualifying activities and it

obtains a license from the Registrar-General to enable

it to carry on such activities. Qualifying activities

include, but are not limited to, the ownership, opera-

tion (under charter or otherwise), administration and

management of a ship or ships registered as a Maltese

ship in terms of the Merchant Shipping Act and the

carrying on of all ancillary financial, security and com-

mercial activities in connection therewith.

Our Maltese operations that do not qualify as licensed

shipping organizations, which are not considered sig-

nificant, remain subject to normal Maltese corporate

income tax.

Pullmantur has sales and marketing functions, land-

based tour operations and air business in Spain. These

activities are subject to Spanish taxation. The tax from

these operations is not considered significant to our

operations. CDF Croisieres de France’s French opera-

tions are minimal and therefore, its French income

taxes are minimal.