Royal Caribbean Cruise Lines 2011 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 84

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

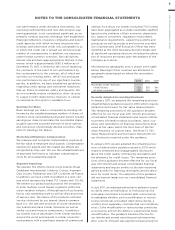

Additionally, some of our ship-operating subsidiaries

are subject to income tax under the tonnage tax

regimes of Malta or the United Kingdom. Under these

regimes, income from qualifying activities is not

subject to corporate income tax. Instead, these sub-

sidiaries are subject to a tonnage tax computed by

reference to the tonnage of the ship or ships regis-

tered under the relevant provisions of the tax regimes.

Income from activities not considered qualifying

activities, which we do not consider significant,

remains subject to Maltese or United Kingdom corpo-

rate income tax.

Income tax (expense) benefit for items not qualifying

under Section 883 or under tonnage tax regimes and

for the remainder of our subsidiaries was approxi-

mately $(20.7) million, $(20.3) million and $5.1 million

and was recorded within other income (expense) for

the years ended December 31, 2011, 2010 and 2009,

respectively. In addition, all interest expense and pen-

alties related to income tax liabilities are classified as

income tax expense within other income (expense).

During 2009, we recorded an out of period adjustment

of approximately $12.3 million to correct an error in

the calculation of our deferred tax liability. This cor-

rection resulted in the reduction of the deferred tax

liability to reflect a change in the enacted Spanish

statutory tax rate used to calculate the liability in 2006

which was identified during 2009.

We do not expect to incur income taxes on future

distributions of undistributed earnings of foreign

subsidiaries. Consequently, no deferred income

taxes have been provided for the distribution of

these earnings.

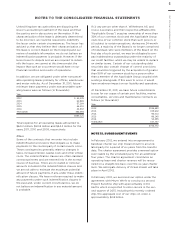

Deferred tax assets and liabilities related to our U.S.

taxable activities are not material as of December 31,

2011 and 2010. Deferred tax assets and liabilities

related to our non-U.S. taxable activities are primarily

a result of Pullmantur’s operations. As of December 31,

2011 and 2010, Pullmantur had deferred tax assets of

€25.9 million and €26.6 million, or $33.6 million and

$35.6 million, respectively, resulting primarily from

net operating losses which will expire in years 2024

through 2027. Total losses available for carryforwards

as of December 31, 2011 and 2010 are $111.4 million

and $118.8 million, respectively.

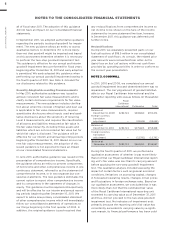

We regularly review deferred tax assets for recover-

ability based on our history of earnings, expectations

for future earnings, and tax planning strategies. As of

December 31, 2011, we believe it is more likely than

not that we will recover Pullmantur’s deferred tax

assets based on our expectation of future earnings

and implementation of tax planning strategies. Reali-

zation of deferred tax assets ultimately depends on

the existence of sufficient taxable income to support

the amount of deferred taxes. European economies

continue to demonstrate instability in light of height-

ened concerns over sovereign debt issues as well as

the impact that proposed austerity measures will have

on certain markets. The Spanish economy has been

more severely impacted than many other economies

around the world where we operate and there is

significant uncertainty as to whether or when it will

recover. In addition, the recent Costa Concordia inci-

dent is having a near-term negative impact on our

earnings in 2012 while the impact in future years is

uncertain. If the Spanish economy weakens further

or recovers more slowly than contemplated in our

discounted cash flow model, if there are relatively

modest changes to our projected future cash flows

used in the impairment analyses, especially in Net

Yields, or if certain transfers of vessels from our other

cruise brands to the Pullmantur fleet do not take

place, it is reasonably possible we may need to estab-

lish a valuation allowance for a portion or all of the

deferred tax asset balance if future earnings do not

meet expectations or we are unable to successfully

implement our tax planning strategies.

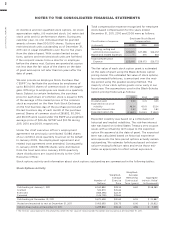

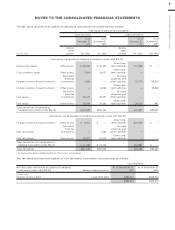

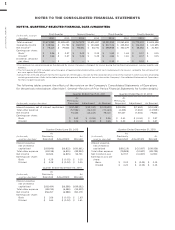

NOTE 13. FAIR VALUE MEASUREMENTS AND

DERIVATIVE INSTRUMENTS

FAIR VALUE MEASUREMENTS

We use quoted prices in active markets when available

to estimate the fair value of our financial instruments.

The estimated fair value of our financial instruments

that are not measured at fair value on a recurring

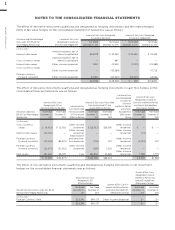

basis are as follows (in thousands):

At December 31,

Long-term debt (including

current portion of

long-term debt)

Long-Term Debt

The fair values of our senior notes and senior deben-

tures were estimated by obtaining quoted market

prices. The fair values of all other debt were estimated

using the present value of expected future cash flows

which incorporates our risk profile.

Other Financial Instruments

The carrying amounts of cash and cash equivalents,

accounts receivable, accounts payable, accrued

interest and accrued expenses approximate fair value

at December 31, 2011 and December 31, 2010.