Royal Caribbean Cruise Lines 2011 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 48

PART II

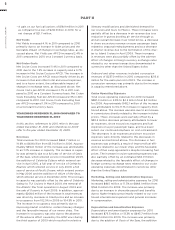

Net Debt-to-Capital was calculated as follows

(in thousands):

As of December 31,

Long-term debt, net of

current portion

Current portion of

long-term debt

Total debt

Less: Cash and cash

equivalents

Net Debt

Total shareholders’ equity

Total debt

Total debt and

shareholders’ equity

Debt-to-Capital

Net Debt

Net Debt and

shareholders’ equity

Net Debt-to-Capital

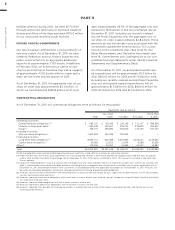

OUTLOOK

On February 2, 2012, we announced the following

initial first quarter and full year 2012 guidance:

Full Year 2012

As Reported

Constant

Currency

Net Yields Flat to 4% 1% to 5%

Net Cruise Costs per APCD 5% to 6% 6% to 7%

Net Cruise Costs per

APCD, excluding Fuel 3% to 4% 4% to 5%

Capacity Increase 2.1%

Depreciation and

Amortization $730 to $750 million

Interest Expense, net $360 to $380 million

Fuel Consumption

(metric tons) 1,354,000

Fuel Expenses $889 million

Percent Hedged

(fwd consumption) 55%

Impact of 10% change in

fuel prices $42 million

EPS $1.90 to $2.30

First Quarter 2012

As Reported

Constant

Currency

Net Yields 4% to 6% 5% to 7%

Net Cruise Costs per APCD Approx. 10% 10% to 11%

Net Cruise Costs per

APCD, excluding Fuel 5% to 6% 6% to 7%

Capacity Increase 2.5%

Depreciation and

Amortization $175 to $185 million

Interest Expense, net $82 to $92 million

Fuel Consumption

(metric tons) 341,000

Fuel Expenses $224 million

Percent Hedged

(fwd consumption) 53%

Impact of 10% change

in fuel prices $11 million

EPS $0.10 to $0.20

In providing the above guidance, we noted that prior

to the Costa Concordia incident, bookings had been

running approximately 5% higher than the same time

last year and at higher prices. Immediately after the

incident, we experienced a significant decline in new

booking activity, but cancellation activity remained at

normal levels. We believe the decline in new bookings

was driven by the extensive media coverage of the

incident and the curtailment of marketing activities by

most cruise lines and travel agencies. We also noted

that the impact on bookings was the greatest for the

first three quarters of 2012, while longer term book-

ings remained healthy.

Over the last several weeks, media coverage has

subsided and normal marketing activity has resumed.

During this period, we have continued to experience a

slow improvement in year-over-year revenue build but

the pace of bookings is still lower than at the same

time last year and lower when compared to the rate

of revenue build we were experiencing prior to the

tragedy. While booking patterns have not yet stabi-

lized and a high degree of uncertainty remains, our

total booked load factors as of the date of this filing

are at approximately the same level as at this same

time last year and at modestly higher prices.

As is always the case when evaluating booking activity

and expectations over diverse itineraries and markets,

it is difficult to reduce the volumes of data to a simple

pattern. Nevertheless, the general direction and tone

of the market so far are consistent with our earlier

expectations as indicated in our February 2, 2012

guidance, and our outlook for Net Yields and Net

Cruise Costs excluding fuel is essentially unchanged for

the first quarter and for the full year of 2012. Further-

more, we continue to believe that the tragedy will not

have a significant long-term impact on our business.

In addition, we noted the following changes since our

February 2, 2012 announcement:

Fuel Prices Fuel prices have increased since our previ-

ous guidance. While we do not forecast fuel prices,

based on current at the pump prices net of hedging,

our fuel costs for the first quarter and full year of 2012

are estimated to be $229 million and $921 million,

respectively.

Currency Impacts The United States dollar has weak-

ened relative to other currencies in which we transact

business. A weaker United States dollar tends to

improve revenues and, to a lesser extent, increase

expenses. The weakening United States dollar thus

has had a net positive impact of approximately $0.04

which has offset some of the increased fuel expense.