Royal Caribbean Cruise Lines 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 85

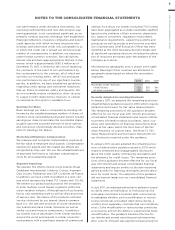

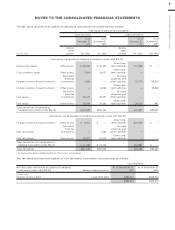

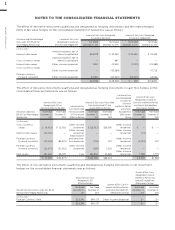

Assets and liabilities that are recorded at fair value have been categorized based upon the fair value hierarchy.

The following table presents information about the Company’s financial instruments recorded at fair value on a

recurring basis (in thousands):

Fair Value Measurements Fair Value Measurements

at December 31, 2011 Using at December 31, 2010 Using

Description Total Level 11Level 22Level 33Total Level 11Level 22Level 33

Assets:

Derivative financial instruments4 — — — —

Investments5 — — — —

Total Assets — —

Liabilities:

Derivative financial instruments6 — — — —

Total Liabilities — — — —

Inputs based on quoted prices (unadjusted) in active markets for identical assets or liabilities that we have the ability to access. Valuation of these

items does not entail a significant amount of judgment.

2. Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly. For foreign currency

forward contracts, interest rate, cross currency and fuel swaps, fair value is derived using valuation models that utilize the income valuation approach.

These valuation models take into account the contract terms such as maturity, as well as other inputs such as exchange rates, fuel types, fuel curves,

interest rate yield curves, creditworthiness of the counterparty and the Company. For fuel call options, fair value is estimated by using the prevailing

market price for the instruments consisting of published price quotes for similar assets based on recent transactions in an active market.

3. Inputs that are unobservable for the asset or liability. The Company did not use any Level 3 inputs as of December 31, 2011 and December 31, 2010.

4. Consists of foreign currency forward contracts, interest rate, cross currency, fuel swaps and fuel call options. Please refer to the “Fair Value of

Derivative Instruments” table for breakdown by instrument type.

5. Consists of exchange-traded equity securities and mutual funds.

6. Consists of interest rate and fuel swaps and foreign currency forward contracts. Please refer to the “Fair Value of Derivative Instruments” table for

breakdown by instrument type.

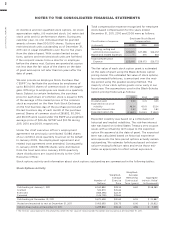

We do not have financial instruments measured at fair

value within the third level of the fair value hierarchy

as of December 31, 2011. During the fourth quarter of

2010, we changed our valuation technique for fuel call

options to a market approach method which employs

inputs that are observable. The fair value for fuel call

options is estimated by using the prevailing market

price for the instruments consisting of published price

quotes for similar assets based on recent transactions

in an active market. We believe that Level 2 catego-

rization is appropriate due to an increase in the

observability and transparency of significant inputs.

Previously, we derived the fair value of our fuel call

options using standard option pricing models with

inputs based on the options’ contract terms and data

either readily available or formulated from public

market information. We previously categorized the

fuel call options as Level 3, because certain inputs,

principally volatility, were unobservable.

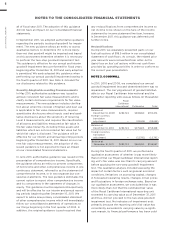

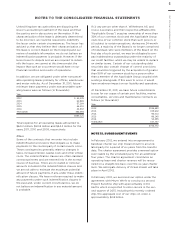

The following table presents a reconciliation of the

Company’s fuel call options’ beginning and ending

balances as of December 31, 2010 (in thousands):

Fair Value

Measurements

Using Significant

Unobservable

Year Ended December 31, 2010 Inputs (Level 3)

Fuel Call Options

Balance at January 1, 2010

Total gains or losses (realized/

unrealized)

Included in other (expense) income ()

Purchases

Transfers in and/or out of Level 3 ()

Balance at December 31, 2010 —

The amount of total gains or losses for

the period included in other (expense)

income attributable to the change in

unrealized gains or losses relating to

assets still held at the reporting date ()

The reported fair values are based on a variety of

factors and assumptions. Accordingly, the fair values

may not represent actual values of the financial

instruments that could have been realized as of

December 31, 2011 or December 31, 2010, or that will

be realized in the future, and do not include expenses

that could be incurred in an actual sale or settlement.