Royal Caribbean Cruise Lines 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

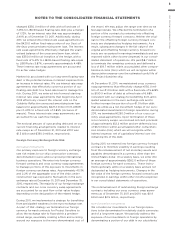

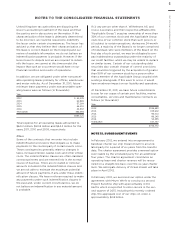

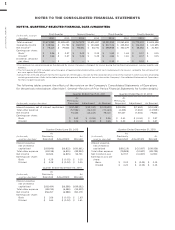

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 87

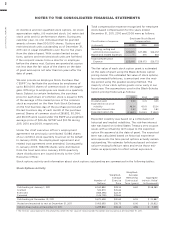

changed $350.0 million of debt with a fixed rate of

7.25% to LIBOR-based floating-rate debt plus a margin

of 1.72%, for an interest rate that was approximately

2.49% as of December 31, 2011. Additionally, during

2011, we entered into interest rate swap agreements on

the $420.0 million fixed-rate portion of our Oasis of

the Seas unsecured amortizing term loan. The interest

rate swap agreements effectively changed the unam-

ortized balance of the unsecured term loan, which

was $350.0 million at inception of the hedge, with a

fixed rate of 5.41% to LIBOR-based floating rate equal

to LIBOR plus 3.87%, currently approximately 4.48%.

These interest rate swap agreements are accounted

for as fair value hedges.

Market risk associated with our long-term floating-rate

debt is the potential increase in interest expense from

an increase in interest rates. We use interest rate swap

agreements that effectively convert a portion of our

floating-rate debt to a fixed-rate basis to manage this

risk. During 2011, we entered into forward-starting

interest rate swap agreements that beginning April

2013 effectively convert the interest rate on the

Celebrity Reflection unsecured amortizing term loan

balance for approximately $627.2 million from LIBOR

plus 0.40% to a fixed rate of 2.85% (inclusive of

margin). These interest rate swap agreements are

accounted for as cash flow hedges.

The notional amount of outstanding debt and on our

current financing arrangements related to interest

rate swaps as of December 31, 2011 and 2010 was

$1.3 billion and $350.0 million, respectively.

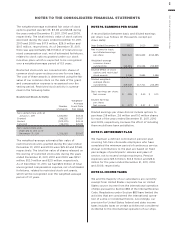

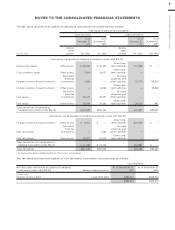

Foreign Currency Exchange Rate Risk

Derivative Instruments

Our primary exposure to foreign currency exchange

rate risk relates to our ship construction contracts

denominated in euros and our growing international

business operations. We enter into foreign currency

forward contracts and cross currency swap agreements

to manage portions of the exposure to movements in

foreign currency exchange rates. Approximately 43.3%

and 2.2% of the aggregate cost of the ships under

construction was exposed to fluctuations in the euro

exchange rate at December 31, 2011 and December 31,

2010, respectively. The majority of our foreign exchange

contracts and our cross currency swap agreements

are accounted for as cash flow or fair value hedges

depending on the designation of the related hedge.

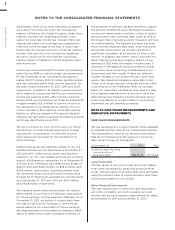

During 2011, we implemented a strategy for benefiting

from anticipated weakness in the euro exchange rate.

As part of that strategy we terminated our foreign

currency forward contracts for Project Sunshine to

allow the exchange rate to float within a predeter-

mined range, essentially creating a floor and a ceiling

around our exposure to the euro-denominated cost of

the vessel. We may adjust the range over time as we

feel appropriate. We effected the termination of a

portion of the contracts by entering into offsetting

foreign currency forward contracts. Neither the origi-

nal nor the offsetting foreign currency forward con-

tracts are designated as hedging instruments. As a

result, subsequent changes in the fair value of the

original and offsetting foreign currency forward con-

tracts are recognized in earnings immediately and are

reported within other income (expense) in our consol-

idated statement of operations. We paid $8.7 million

to terminate the remaining contracts and deferred a

loss of $19.7 million within accumulated other compre-

hensive income (loss) which we will recognize within

depreciation expense over the estimated useful life of

the Project Sunshine ship.

At December 31, 2011, we maintained cross currency

swap agreements that effectively change €150.0 mil-

lion of our €1.0 billion debt with a fixed rate of 5.625%

to $190.9 million of debt at a fixed rate of 6.68%.

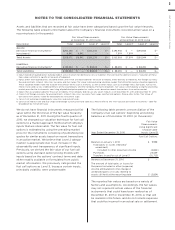

Consistent with our strategy for benefiting from antic-

ipated weakness in the euro exchange rate and to

further increase the portion of our €1.0 billion debt

that we utilize as a net investment hedge of our euro-

denominated investments in foreign operations, during

2011, we terminated €250.0 million of our cross cur-

rency swap agreements. Upon termination of these

cross currency swaps, we received net cash proceeds

of approximately $12.2 million and we deferred a loss

of $3.5 million within accumulated other comprehen-

sive income (loss) which we will recognize within

Interest expense, net of capitalized interest over the

remaining life of the debt.

During 2011, we entered into foreign currency forward

contracts to minimize volatility in earnings resulting

from the remeasurement of net monetary assets and

payables denominated in a currency other than the

United States dollar. On a weekly basis, we enter into

an average of approximately $262.0 million of these

foreign currency forward contracts. These instru-

ments generally settle on a weekly basis and are not

designated as hedging instruments. Changes in the

fair value of the foreign currency forward contracts are

recognized in earnings within other income (expense)

in our consolidated statements of operations.

The notional amount of outstanding foreign exchange

contracts including our cross currency swap agree-

ments as of December 31, 2011 and 2010 was $0.9

billion and $2.5 billion, respectively.

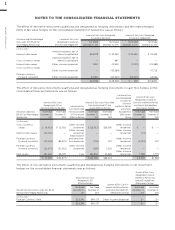

Non-Derivative Instruments

We consider our investments in our foreign opera-

tions to be denominated in relatively stable currencies

and of a long-term nature. We partially address the

exposure of our investments in foreign operations by

denominating a portion of our debt in our subsidiaries’