Royal Caribbean Cruise Lines 2011 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 52

PART II

facilities whereas during 2010, we drew $1.7 billion

through unsecured term loans to purchase Celebrity

Eclipse and Allure of the Seas and drew $715.0 million

on our unsecured revolving credit facilities.

FUTURE CAPITAL COMMITMENTS

Our future capital commitments consist primarily of

new ship orders. As of December 31, 2011, we have

Celebrity Reflection and our Project Sunshine ship

under construction for an aggregate additional

capacity of approximately 7,100 berths. In addition,

in February 2012, we exercised our option to con-

struct a second Project Sunshine ship with a capacity

of approximately 4,100 berths which is expected to

enter service in the second quarter of 2015.

As of December 31, 2011, the aggregate cost of our

ships on order was approximately $2.0 billion, of

which we had deposited $185.8 million as of such

date. Approximately 43.3% of the aggregate cost was

exposed to fluctuations in the euro exchange rate at

December 31, 2011. Including our recently ordered

second Project Sunshine ship, the aggregate cost of

our ships on order is approximately $2.8 billion. These

amounts do not include any costs associated with the

construction agreement entered into by TUI Cruises

to build its first newbuild ship. (See Note 13. Fair

Value Measurements and Derivative Instruments and

Note 14. Commitments and Contingencies to our con-

solidated financial statements under Item 8. Financial

Statements and Supplementary Data).

As of December 31, 2011, we anticipated overall capi-

tal expenditures will be approximately $1.2 billion for

2012, $500.0 million for 2013 and $1.1 billion for 2014.

Including our recently ordered second Project Sunshine

ship, our anticipated capital expenditures will be

approximately $1.3 billion for 2012, $600.0 million for

2013, $1.1 billion for 2014 and $1.0 billion for 2015.

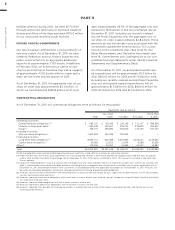

CONTRACTUAL OBLIGATIONS

As of December 31, 2011, our contractual obligations were as follows (in thousands):

Payments due by period

Less than More than

Total 1 year 1–3 years 3–5 years 5 years

Operating Activities:

Operating lease obligations(1)(2)

Interest on long-term debt(3)

Other(4)

Investing Activities:

Ship purchase obligations(5) — —

Financing Activities:

Long-term debt obligations(6)

Capital lease obligations(7)

Other(8)

Total

(1) We are obligated under noncancelable operating leases primarily for a ship, offices, warehouses and motor vehicles.

(2) Under the Brilliance of the Seas lease agreement, we may be required to make a termination payment of approximately £66.8 million, or approxi-

mately $103.8 million based on the exchange rate at December 31, 2011, if the lease is canceled in 2020. This amount is included in the more than

5 years column.

(3) Long-term debt obligations mature at various dates through fiscal year 2027 and bear interest at fixed and variable rates. Interest on variable-rate

debt is calculated based on forecasted debt balances, including interest swapped from a fixed-rate to a variable-rate using the applicable rate at

December 31, 2011. Debt denominated in other currencies is calculated based on the applicable exchange rate at December 31, 2011. Amounts are

based on existing debt obligations and do not consider potential refinancing of expiring debt obligations.

(4) Amounts represent future commitments with remaining terms in excess of one year to pay for our usage of certain port facilities, marine consumables,

services and maintenance contracts.

(5) Amounts represent contractual obligations with initial terms in excess of one year. Amounts do not include our second Project Sunshine ship which

was ordered in February 2012.

(6) Amounts represent debt obligations with initial terms in excess of one year.

(7) Amounts represent capital lease obligations with initial terms in excess of one year.

(8) Amounts represent fees payable to sovereign guarantors in connection with certain of our export credit debt facilities and facility fees on our

revolving credit facilities.