Royal Caribbean Cruise Lines 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

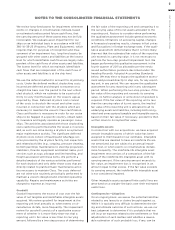

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

ROYAL CARIBBEAN CRUISES LTD. 77

in the face of mixed economic environments and fore-

casts of operating results generated by the reporting

unit appear sufficient to support its carrying value.

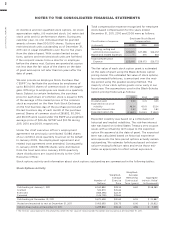

In addition, during the fourth quarter of 2011, we per-

formed our annual impairment review of goodwill for

Pullmantur’s reporting unit. We did not perform a

qualitative assessment but instead proceeded directly

to the two-step goodwill impairment test. We estimated

the fair value of the Pullmantur reporting unit using

a probability-weighted discounted cash flow model.

The principal assumptions used in the discounted

cash flow model are projected operating results,

weighted-

average cost of capital, and terminal value.

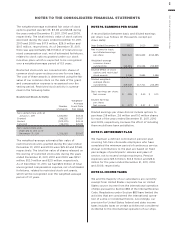

Significantly

impacting these assumptions are the

transfer of vessels from our other cruise brands to

Pullmantur. Cash flows were calculated using our 2012

projected operating results as a base. To that base

we added future years’ cash flows assuming multiple

revenue and expense scenarios that reflect the impact

on Pullmantur’s reporting unit of different global

economic environments beyond 2012. We assigned

a probability to each revenue and expense scenario.

We discounted the projected cash flows using rates

specific to Pullmantur’s reporting unit based on its

weighted-average cost of capital. Based on the

probability-weighted discounted cash flows, we deter-

mined the fair value of the Pullmantur reporting unit

exceeded its carrying value. Therefore, we did not

proceed to step two of the impairment analysis and

we do not consider goodwill to be impaired.

The estimation of fair value utilizing discounted

expected future cash flows includes numerous uncer-

tainties which require our significant judgment when

making assumptions of expected revenues, operating

costs, marketing, selling and administrative expenses,

interest rates, ship additions and retirements as well

as assumptions regarding the cruise vacation industry’s

competitive environment and general economic and

business conditions, among other factors. Pullmantur

is a brand targeted primarily at the Spanish, Portuguese

and Latin American markets. European economies

continue to demonstrate instability in light of height-

ened concerns over sovereign debt issues as well as

the impact that proposed austerity measures will have

on certain markets. The Spanish economy has been

more severely impacted than many other economies

around the world where we operate and there is signif-

icant uncertainty as to whether or when it will recover.

In addition, the recent Costa Concordia incident is

having a near-term negative impact on our earnings

in 2012 while the impact in future years is uncertain.

If the Spanish economy weakens further or recovers

more slowly than contemplated in our discounted

cash flow model, if there are relatively modest changes

to our projected future cash flows used in the impair-

ment analyses, especially in Net Yields, or if certain

transfers of vessels from our other cruise brands to

the Pullmantur fleet do not take place, it is reasonably

possible that an impairment charge of Pullmantur’s

reporting unit’s goodwill may be required.

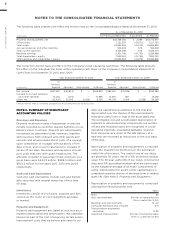

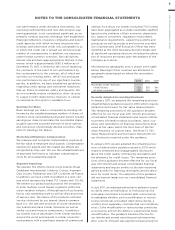

NOTE 4. INTANGIBLE ASSETS

Intangible assets consist of the following (in thousands):

Indefinite-life intangible asset—

Pullmantur trademarks and

trade names

Foreign currency translation

adjustment () ()

Total

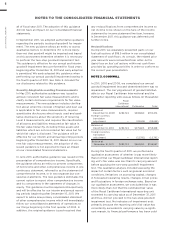

We performed the annual impairment review of our

trademarks and trade names during the fourth quarter

of 2011 using a discounted cash flow model and the

relief-from-royalty method. The royalty rate used is

based on comparable royalty agreements in the tour-

ism and hospitality industry. Since these trademarks

and trade names relates to Pullmantur, we have used

the same discount rate used in valuing the Pullmantur

reporting unit in our goodwill impairment test. Based

on the discounted cash flow model, we determined

the fair value of our trademarks and trade names

exceeded their carrying value. However, European

economies continue to demonstrate instability in light

of heightened concerns over sovereign debt issues as

well as the impact that proposed austerity measures

will have on certain markets. The Spanish economy

has been more severely impacted than many other

economies around the world where we operate and

there is significant uncertainty as to whether or when

it will recover. In addition, the recent Costa Concordia

incident is having a near-term negative impact on our

earnings in 2012 while the impact in future years is

uncertain. If the Spanish economy weakens further

or recovers more slowly than contemplated in our

discounted cash flow model, if there are relatively

modest changes to our projected future cash flows

used in the impairment analyses, especially in Net

Yields, or if certain transfers of vessels from our other

cruise brands to the Pullmantur fleet do not take

place, it is reasonably possible that an impairment

charge of Pullmantur’s trademark and trade names

may be required.

Finite-life intangible assets and related accumulated

amortization are immaterial to our 2011, 2010, and

2009 consolidated financial statements.