Royal Caribbean Cruise Lines 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Royal Caribbean Cruise Lines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2011 ANNUAL REPORT 78

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

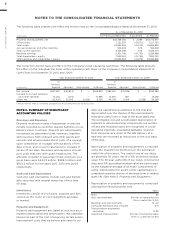

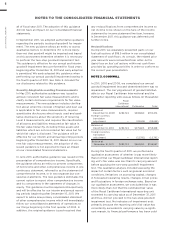

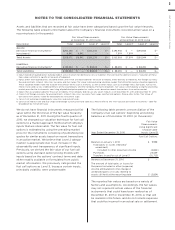

NOTE 5. PROPERTY AND EQUIPMENT

Property and equipment consists of the following

(in thousands):

Ships

Ship improvements

Ships under construction

Land, buildings and

improvements, including

leasehold improvements

and port facilities

Computer hardware and

software, transportation

equipment and other

Total property and equipment

Less—accumulated depreciation

and amortization () ()

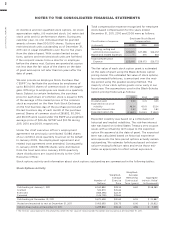

Ships under construction include progress payments

for the construction of new ships as well as planning,

design, interest, commitment fees and other associated

costs. We capitalized interest costs of $14.0 million,

$28.1 million and $41.5 million for the years 2011, 2010

and 2009, respectively.

In November 2010, we sold Bleu de France to an unre-

lated party for $55.0 million. The sale was recorded

in the first quarter of 2011, as we consolidate the

operating results of CDF Croisières de France on a

two-month lag. (See Note 1. General.) As part of the

sale agreement, we chartered the Bleu de France from

the buyer for a period of one year from the sale date

to fulfill existing passenger commitments. The sale

resulted in an immaterial gain that was recognized

over the charter period.

In February 2011, we sold Celebrity Mercury to TUI

Cruises for €234.3 million. We executed certain for-

ward exchange contracts to lock in the sales price at

approximately $290.0 million. The sale resulted in a

gain of $24.2 million which, due to the related party

nature of the transaction, is being recognized primar-

ily over the remaining life of the ship, estimated to

be 17 years.

Atlantic Star is currently not in operation. During 2009,

we classified the ship as held for sale within other

assets in our consolidated balance sheets and recog-

nized a charge of $7.1 million to reduce the carrying

value of the ship to its fair value less cost to sell. This

amount was recorded within other operating expenses

in our consolidated statements of operations. Manage-

ment continues to actively pursue the sale of the ship.

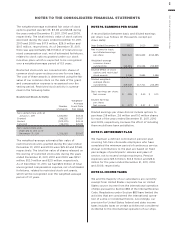

NOTE 6. OTHER ASSETS

Variable Interest Entities

Variable Interest Entities (“VIEs”), are entities in which

the equity investors have not provided enough equity

to finance its activities or the equity investors (1) can-

not directly or indirectly make decisions about the

entity’s activities through their voting rights or similar

rights; (2) do not have the obligation to absorb the

expected losses of the entity; (3) do not have the

right to receive the expected residual returns of the

entity; or (4) have voting rights that are not propor-

tionate to their economic interests and the entity’s

activities involve or are conducted on behalf of an

investor with a disproportionately small voting interest.

We have determined that our 40% noncontrolling

interest in Grand Bahama Shipyard Ltd. (“Grand

Bahama”), a ship repair and maintenance facility in

which we initially invested in 2001, is a VIE. The facility

serves cruise and cargo ships, oil and gas tankers, and

offshore units. We utilize this facility, among other

ship repair facilities, for our regularly scheduled dry-

docks and certain emergency repairs as may be

required. We have determined we are not the primary

beneficiary of this facility, as we do not have the power

to direct the activities that most significantly impact

the facility’s economic performance. Accordingly, we

do not consolidate this entity and we account for this

investment under the equity method of accounting.

As of December 31, 2011 and December 31, 2010, the

net book value of our investment in Grand Bahama,

including equity and loans, was approximately $61.4

million and $64.1 million, respectively, which is also

our maximum exposure to loss as we are not contrac-

tually required to provide any financial or other sup-

port to the facility. The majority of our loans to Grand

Bahama are in non-accrual status. During 2011, we

received approximately $10.8 million in principal and

interest payments from Grand Bahama and recorded

income associated with our investment in Grand

Bahama. We monitor credit risk associated with these

loans through our participation on the facility’s board

of directors along with our review of the facility’s

financial statements and projected cash flows. Based

on this review, we believe the risk of loss associated

with these loans is remote as of December 31, 2011.

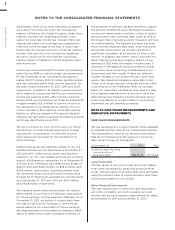

In conjunction with our acquisition of Pullmantur in

2006, we obtained a 49% noncontrolling interest

in Pullmantur Air, S.A. (“Pullmantur Air”), a small

air business that operates four aircrafts in support

of Pullmantur’s operations. We have determined

Pullmantur Air is a VIE for which we are the primary