Redbox 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.recognized $2.7 million of income from equity investments, or 49% of the $5.5 million payable, related to our

equity interest in the third party. We received this refund in the amount estimated in February 2008.

In the second quarter of 2007, we entered into a loan agreement with Redbox in the amount of $10.0 million

and is recorded in Other Assets on the Consolidated Balance Sheet as of December 31, 2007. The principal amount

is due on May 1, 2010 at which time any accrued and unpaid interest is due. The note accrues interest at 11% per

annum. Interest payments are first due on May 1, 2009 and then on each three month period thereafter through

May 1, 2010.

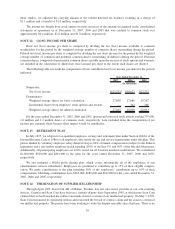

NOTE 18: SUBSEQUENT EVENTS

On January 1, 2008, we exercised our option to acquire a majority ownership interest in the voting equity of

Redbox under the terms of the LLC Interest Purchase Agreement dated November 17, 2005. In conjunction with the

option exercise and payment of $5.1 million, our ownership interest increased from 47.3% to 51.0%. Since our

original investment in Redbox, we have been accounting for our 47.3% ownership interest under the equity method

in our Consolidated Financial Statements. Effective with the close of this transaction, January 18, 2008, we will

consolidate Redbox’s financial results into our Consolidated Financial Statements. We are currently in the process

of completing the purchase accounting for this acquisition.

Effective January 1, 2008, we completed the acquisition of GroupEx Financial Corporation, JRJ Express Inc.

and Kimeco, LLC (collectively, “GroupEx”), for an aggregate purchase price of up to $70.0 million. The purchase

price included a $60.0 million cash payment (subject to a customary working capital adjustment) at closing. Of the

$60.0 million paid at closing, $6.0 million is being held in escrow as partial security for the indemnification

obligations of the sellers under the agreement until the earlier of (1) the date eighteen months following the closing

and (2) the date thirty days after completion in calendar year 2009 of the 2008 calendar year audit. An additional

$34.0 million of the $60.0 million paid at closing is being held in escrow as partial security for the indemnification

obligations of the sellers under the agreement with respect to a lawsuit against GroupEx and one of the sellers,

which will be held until a final court order or written settlement agreement resolving such lawsuit has been

obtained. In addition, there is a contingent payment of up to $10.0 million should certain performance conditions be

met in the fifteen months following the closing. We are currently in the process of completing the purchase

accounting for this acquisition.

65