Redbox 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

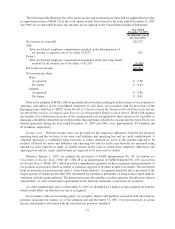

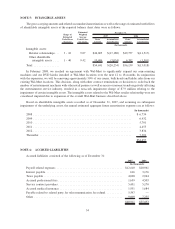

The components of income tax (benefit) expense were as follows:

2007 2006 2005

December 31,

(In thousands)

Current:

United States federal.................................. $1,216 $ 826 $ 506

State and local ...................................... 1,692 617 37

Foreign ........................................... (77) 447 (631)

Total current ...................................... 2,831 1,890 (88)

Deferred:

United States federal.................................. $(6,707) $ 9,519 $11,899

State and local ...................................... (1,461) 2,079 2,059

Foreign ........................................... (974) (1,415) 357

Total deferred ..................................... (9,142) 10,183 14,315

Total tax (benefit) expense ............................... $(6,311) $12,073 $14,227

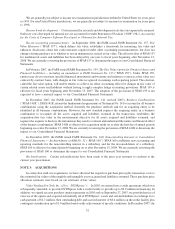

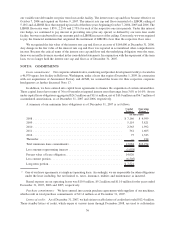

The income tax (benefit) expense differs from the amount that would result by applying the U.S. statutory rate

to (loss) income before income taxes. A reconciliation of the difference follows:

2007 2006 2005

December 31,

U.S. federal tax expense (benefit) at the statutory rate ........................ ⫺35.0% 35.0% 35.0%

State income taxes, net of federal impact . . . .............................. ⫺1.9% 4.8% 3.7%

Incentive stock options ............................................... 1.9% 2.1% —

Impact of meeting the indefinite reversal criteria for unremitted foreign earnings .... — ⫺4.8% —

State net operating loss carryforward adjustment ............................ 2.6% 3.7% —

R&D credit ....................................................... ⫺0.2% ⫺3.4% —

Change in valuation allowance for deferred tax asset ......................... 7.0% 1.2% —

Foreign rate differential .............................................. 1.9% — —

Other ............................................................ 1.6% 0.7% 0.3%

⫺22.1% 39.3% 39.0%

Deferred income tax assets and liabilities reflect the net tax effects of temporary differences between the

carrying amounts of assets and liabilities for financial reporting purposes and the carrying amounts used for income

tax purposes. Future tax benefits for net operating loss and tax credit carryforwards are also recognized to the extent

that realization of such benefits is more likely than not.

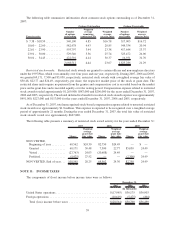

In determining our fiscal 2007, 2006 and 2005 tax provisions under SFAS 109, management determined the

deferred tax assets and liabilities for each separate tax entity and considered a number of factors including the

positive and negative evidence regarding the realization of our deferred tax assets to determine whether a valuation

allowance should be recognized with respect to our deferred tax assets. The consolidated tax valuation allowance

was $2.5 million as of December 31, 2007. A valuation allowance has been recorded against foreign net operating

losses as the negative evidence outweighs the positive evidence that those deferred tax assets will more likely than

not be realized. The net change in the valuation allowance during the years ended December 31, 2007 and 2006 was

$1.6 million and $0.9 million, respectively. During the year ended December 31, 2005, there was a zero net change

in the valuation allowance. The net change in 2007 was comprised of $2.0 million recorded for foreign net operating

losses net of a $0.4 million reclassification required upon the adoption of FIN 48.

60