Redbox 2007 Annual Report Download - page 52

Download and view the complete annual report

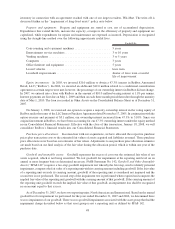

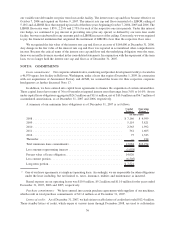

Please find page 52 of the 2007 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.DVD revenues and is recorded in our consolidated income statement under the caption “direct operating expenses.”

The fee arrangements are based on our negotiations and evaluation of certain factors with the retailers such as total

revenue, e-payment capabilities, long-term non-cancelable contracts, installation of our machines in high traffic

and/or urban or rural locations, new product commitments, co-op marketing incentive, or other criteria. We

recognize this expense at the time we recognize the associated revenue from each of our customer transactions. This

expense is recorded on a straight-line basis as a percentage of revenue based on estimated annual volumes. In certain

instances, we prepay amounts to our entertainment services retailers, which are expensed over the contract term.

The expense is included in depreciation and other in the accompanying consolidated statements of operations and

cash flows.

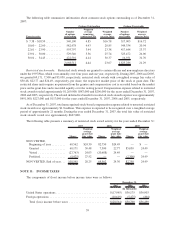

Operating taxes, net: Taxes related to operating our business are recorded in operating taxes, net on the

consolidated statement of operations. Such taxes include property taxes, sales and use taxes, and franchise taxes and

do not include income taxes. During the third quarter of 2007, operating taxes, net included a telecommunication

fee refund in the amount of $11.8 million as a result of an Internal Revenue Service ruling that telecommunication

fees paid during the period of March 1, 2003 through July 31, 2006 were improperly collected by the United States

government. The $11.8 million represents the refund amount as filed on our fiscal year 2006 federal income tax

return. This telecommunication fee refund, along with the $5.5 million amount received by us on behalf of our

equity investment related party and accrued interest totaling $17.6 million is included in accounts receivable, net as

of December 31, 2007. As discussed in Note 17, this related party amount of the receivable resulted in a payable to

the related party. In February 2008, we received the refund in the amount that we estimated.

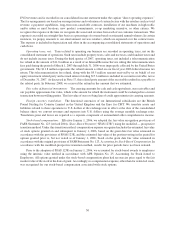

Fair value of financial instruments: The carrying amounts for cash and cash equivalents, our receivables and

our payables approximate fair value, which is the amount for which the instrument could be exchanged in a current

transaction between willing parties. The fair value of our revolving line of credit approximates its carrying amounts.

Foreign currency translation: The functional currencies of our International subsidiaries are the British

Pound Sterling for Coinstar Limited in the United Kingdom and the Euro for CMT. We translate assets and

liabilities related to these operations to U.S. dollars at the exchange rate in effect at the date of the consolidated

balance sheet; we convert revenues and expenses into U.S. dollars using the average monthly exchange rates.

Translation gains and losses are reported as a separate component of accumulated other comprehensive income.

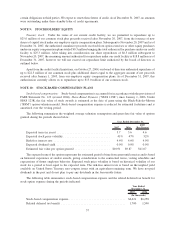

Stock-based compensation: Effective January 1, 2006, we adopted the fair value recognition provisions of

FASB Statement No. 123 (revised 2004), Share-Based Payment (“SFAS 123R”) using the modified — prospective

transition method. Under this transition method, compensation expense recognized includes the estimated fair value

of stock options granted on and subsequent to January 1, 2006, based on the grant date fair value estimated in

accordance with the provisions of SFAS 123R, and the estimated fair value of the portion vesting in the period for

options granted prior to, but not vested as of January 1, 2006, based on the grant date fair value estimated in

accordance with the original provisions of FASB Statement No. 123, Accounting for Stock-Based Compensation.In

accordance with the modified-prospective transition method, results for prior periods have not been restated.

Prior to the adoption of SFAS 123R on January 1, 2006, we accounted for stock-based awards to employees

using the intrinsic value method in accordance with APB Opinion No. 25, Accounting for Stock Issued to

Employees. All options granted under the stock-based compensation plans had an exercise price equal to the fair

market value of the stock at the date of grant. Accordingly, no compensation expense, other than for restricted stock,

was recognized for our stock-based compensation associated with stock options.

50